The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

With the price of bitcoin hovering near $50,000, momentum has returned to the market and strong hands have accumulated more bitcoin than ever. A 2013-style double bubble is in the cards.

The 2013 cycle saw the price of bitcoin draw down 75% from the highs before rallying a staggering 1,750% in less than six months. We aren’t suggesting that the rally will occur again with the same performance, but rather an explosive “double bubble” within the traditional four-year boom-and-bust cycle.

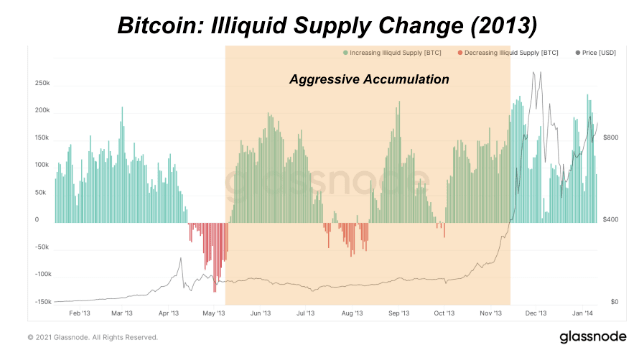

The market has gone through quite a similar cycle compared to 2013 as well, with an initial parabolic run up, a large amount of coins becoming liquid before an aggressive reaccumulation and parabolic run up.

If bitcoin continues to transfer to strong hands at the current pace, a parabolic run-up will commence that most in the world cannot fathom. Bitcoin, at nearly a $1 trillion asset today, can elevate to a $5 trillion asset in 2022 with relative ease.

After all, $1 of capital that flows into bitcoin adds far more than just $1 of market cap to the asset, and during a bull market when most market participants are holding, the market value to realized value of bitcoin explodes upwards. If 1% of capital flows out of global debt funds into bitcoin as a safe haven, as the global economy experiences massive supply chain disruptions causing rising prices across the board.