Bitcoin miners have seen some relief recently, as indicated by the recent movement of the Puell Multiple. After 191 days of struggling, this on-chain metric has finally seen a much-needed rally, bringing positive news for the crypto mining industry.

The Puell Multiple is a key metric used to assess the state of the Bitcoin mining industry. It measures the daily average Bitcoin mining revenue divided by the daily average electrical cost of mining. A value of 1 or higher indicates that the mining industry is generating enough revenue to cover its costs, while a value lower than 1 suggests that miners are operating at a loss.

Bitcoin Miners Have Some Relief

The recent rally in the Puell Multiple shows that the revenue generated by Bitcoin mining has increased, allowing miners to cover their costs and potentially even make a profit. This is a much-needed boost for the industry, which has faced significant challenges over the past 191 days, according to technical analyst Peter Swift.

During this time, the Puell Multiple remained in the capitulation zone, indicating that the mining industry was struggling to cover its costs and operating at a significant loss. This situation likely led to increased sell pressure, as miners sought to offload their Bitcoin holdings in order to mitigate their losses.

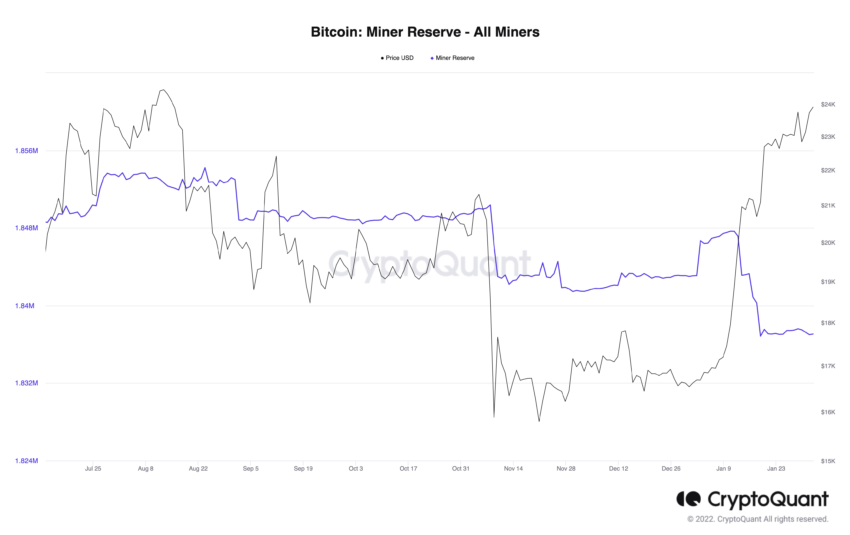

Indeed, on-chain data from CryptoQuant shows the total Bitcoin miner reserves have dropped by approximately 16,917 BTC since July 2022. This decrease in reserves highlights a shift in the market, with miners potentially selling off their holdings or using them to cover operational costs.

The drop in miner reserves raised questions about the overall stability of the mining industry and its impact on the broader crypto market. Still, with the recent rally in the Puell Multiple, it appears like Bitcoin miners are now able to breathe a sigh of relief as increased revenue should help to reduce their selling pressure.

This is positive news for Bitcoin and the crypto market as a whole, as it suggests that supply-side pressures may ease, leading to potentially higher prices.

Bitcoin has enjoyed an impressive upward price action, posting year-to-date gains of more than 45%. The pioneer cryptocurrency entered 2023 trading at a low of $16,540 and on Wednesday it hit a high of $24,280, outperforming Ethereum. The upswing followed a statement from Federal Reserve Chair Jerome Powell, hinting that the disinflationary trend in the economy has commenced.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.