For the first time since January, Bitcoin dropped below the $20k mark during the early hours of Friday, Mar. 10. Over the past 24 hours, the king coin has lost more than 8% of its value, with other assets following in its footsteps. At press time, Ethereum’s daily depreciation stood at 8.5%. Other altcoins like Shiba Inu and MATIC also noted similar 7–8% corrections.

Due to the latest flash crash, billions of dollars have been eroded from the market. As a result, the number was nowhere close to the psychological $1 trillion mark. At press time, the total cryptocurrency market cap stood at $925.22 billion, down by a whopping 7.2% over the past day.

Also Read: Silicon Valley Bank Plunges 60%: A Banking Crisis Ahead?

What are whales upto?

A recent analysis by Santiment revealed that MATIC was “the most notable asset” that has been making a big splash on the volume front. The report highlighted that a 58,885,143 MATIC transaction (worth $62.1 million) was made today. Nevertheless, there’s not much to rejoice about. Explaining why, the report noted,

“Unfortunately, this appears to have been an exchange address moving coins to another exchange address, which generally isn’t indicative of any positive price movement coming up.”

However, it also went on to add,

“But it is possible. Usually, this kind of transfer reflects a whale selloff at worst, or a routine move to another exchange address at best.”

Also Read: Bitcoin Dips Below $20K Halting Its Hotstreak

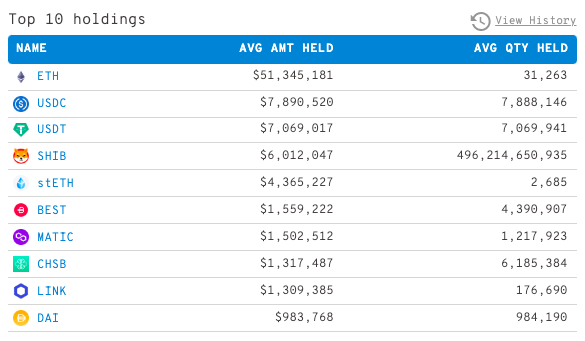

The top Ethereum whales also did not seem to be engaging in a lot of altcoin-centric transactions. Among the top-sold assets, the 100 largest Ether whales dumped tokens like Uniswap, Synthetix, and MATIC. Alongside stablecoins and wrapped tokens, Lido Finance’s native crypto, LDO, managed to make it to the top purchased list.

Nevertheless, their top holdings featured Ethereum, MATIC, Shiba Inu, and Chainlink.

Additionally, Shiba Inu was also a part of the most used smart contracts by the top 100 Ethereum whales over the past 24 hours. The list also had a bunch of other prominent DeFi names, including Synthetix, Aave, and Curve Finance.

Thus, looking at the above data, it can be said that whales have not yet started accumulating altcoins in mass. However, as analyzed in an article recently, the current condition is a disguised opportunity for buyers to accumulate altcoins, given their undervaluation.

Also Read: Shiba Inu, Cardano, Ethereum: Is It Finally Time To Buy Altcoins?