Over the past week, Ripple’s (XRP) price has hovered around the $0.43 price level with a seven-day net change of less than 1%. As the market sentiment hangs in the balance, long-term XRP investors appear to have stopped selling. Will this validate a bullish XRP price prediction for the coming days?

Ripple XRP price, along with other Layer-1 coins, has delivered a sideways performance in the past week. Critical on-chain data suggests that XRP could soon enter a prolonged price rally.

Here’s how the recent uptrend in network traction and renewed confidence among long-term XRP holders could trigger a bullish price action.

The Ripple Network is Gaining Traction

Despite the gloomy market sentiment surrounding the top 10 ranked cryptocurrencies, XRP ledger network has witnessed a considerable increase in network traction.

Notably, the number seven-day average of Daily Active Addresses (DAA) on the XRP network has been increasing since the start of May. Specifically, between May 3 and May 15, the DAA increased by 15% from 64,723 to 74,393 active users.

The DAA (7D) metric takes a seven-day average of the total unique wallet addresses interacting on a blockchain network.

And when network activity increases during a price correction, as seen above, it signals that the underlying coin is attracting demand which could propel it into the next price rally.

If XRP network participants continue on this trajectory, it would significantly reduce the chances of further price reversal.

Long-term Investors are Growing Confident

As Ripple (XRP) price dropped 9% between May 5 and May 11, long-term investors also exacerbated the retracement with some sell action.

However, on-chain data now shows that the long-term holders appear to be positioned for future price gains.

Since May 9, Mean Coin Age across the Ripple network has increased on seven consecutive days. Notably, between May 9 and May 15, the XRP Mean Coin Age surged 11% from 33.03 to 36.77.

Mean Coin Age evaluates the average days that all coins in circulation have stayed in their current wallet addresses.

When it rises persistently, as seen above, it indicates that most long-term investors across the network are holding firm.

In summary, the bullish XRP price prediction will likely be validated if stakeholders continue to increase the level of network activity and investors HODL longer.

XRP Price Prediction: $0.50 is Still Within Reach

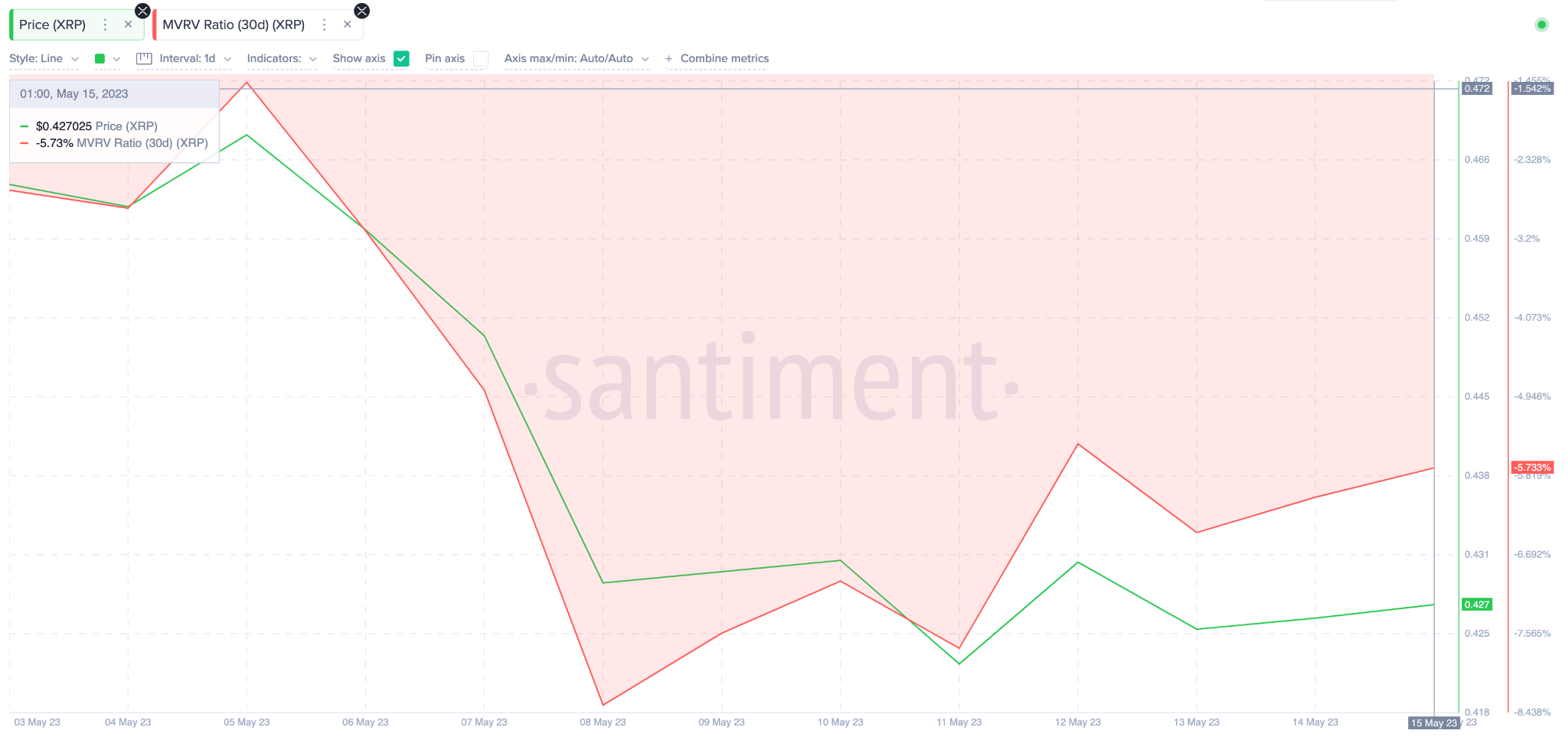

And according to Santiment’s Market-Value to Realized-Value (MVRV) data, most crypto investors that bought XRP within the past month are sitting on unrealized losses of about 6%.

Historical trading patterns suggest they are unlikely to sell until the price surges by until they break even around $0.45.

And If XRP can break beyond that $0.45 resistance level, it could rise by another 7% toward the $0.50 zone before they begin to book profits.

Conversely, the bears could still flip the narrative if XRP price drops below $0.40. Nevertheless, investors will likely offer bullish support at this level as they look to avoid losses of more than 10%

Otherwise, XRP could drop much lower toward the next significant support level at $0.35.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.