The price of Ripple’s XRP cleared an important resistance line and reached a new monthly high on May 30.

However, despite this breakout, the price action and wave count suggest that a local top may be in place, hence predicting a future price decrease. Additionally, the release of 500 million XRP tokens from an escrow could create additional selling pressure.

Ripple Price Clears Crucial Resistance

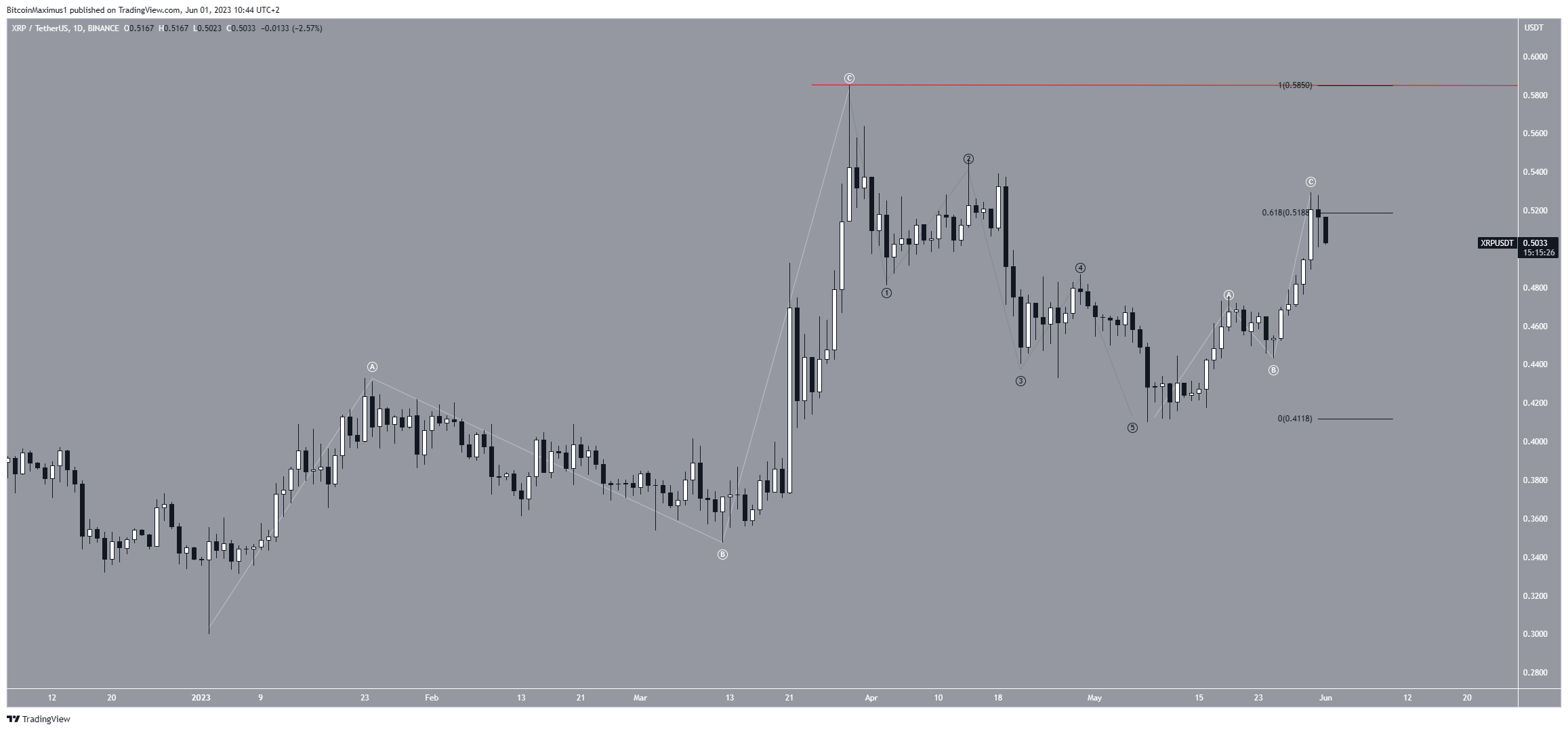

The price of XRP has decreased below a descending resistance line since March 28. This indicates that the price is in a short-term correction.

However, the price broke out from the line on May 26, confirming that the correction is complete. The breakout led to a high of $0.53 on May 30.

Despite the breakout, the price was rejected by the 0.618 Fib retracement resistance level at $0.52 (red icon). It has fallen since.

According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction.

The Relative Strength Index (RSI) indicator supports the legitimacy of the breakout. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true.

However, while the indicator is above 50 and still increasing, it reached overbought territory. This is an area where local tops are often reached.

XRP Price Prediction: Has the Price Topped?

Based on a technical analysis within a short-term four-hour time frame, the ongoing rebound in XRP is merely a temporary rally and will be followed by another decline. This analysis suggests a bearish forecast for XRP’s price, which has possibly reached its local top.

The primary justification for this outlook is the wave count, which strengthens the notion of a downward trend. Technical analysts employ the Elliott Wave theory to determine the direction of trends by examining recurring long-term price patterns and investor psychology.

According to the wave count, the price of XRP has concluded a five-wave decline (indicated in black). This confirms a bearish trend. Furthermore, the decline followed an upward corrective labeled as A-B-C, further supporting this possibility.

If this long-term count is correct, the breakout from the descending resistance line is only part of another A-B-C correction. The 0.618 Fib retracement level rejecting the price supports this possibility.

So, the count suggests that a local top is in and a decrease to $0.34 will follow.

The release of 500 million XRP tokens today supports this possibility. A release of this magnitude could create massive selling pressure, in turn causing a sharp downward movement.

Despite this bearish XRP price prediction, an increase above the yearly high of $0.58 will mean the trend is still bullish. In that case, the XRP price could increase to the next resistance at $0.90.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.