Recent data from Crypto Quant reveals a decline in sell-side liquidity across various digital assets, including Bitcoin and Ethereum with an even sharper drop in buy-side liquidity. The repercussions of these liquidity changes have prompted discussions about their interpretation, especially in light of Bitcoin’s price going up due to increased institutional interest.

Liquidity Plummets In Crypto Market

According to statistics, Bitcoin’s exchange reserve has dwindled by 20% over the past year, amounting to 2.092 million. This reduction in available Bitcoin holdings on exchanges suggests a decreased willingness among investors to sell or trade their Bitcoin.

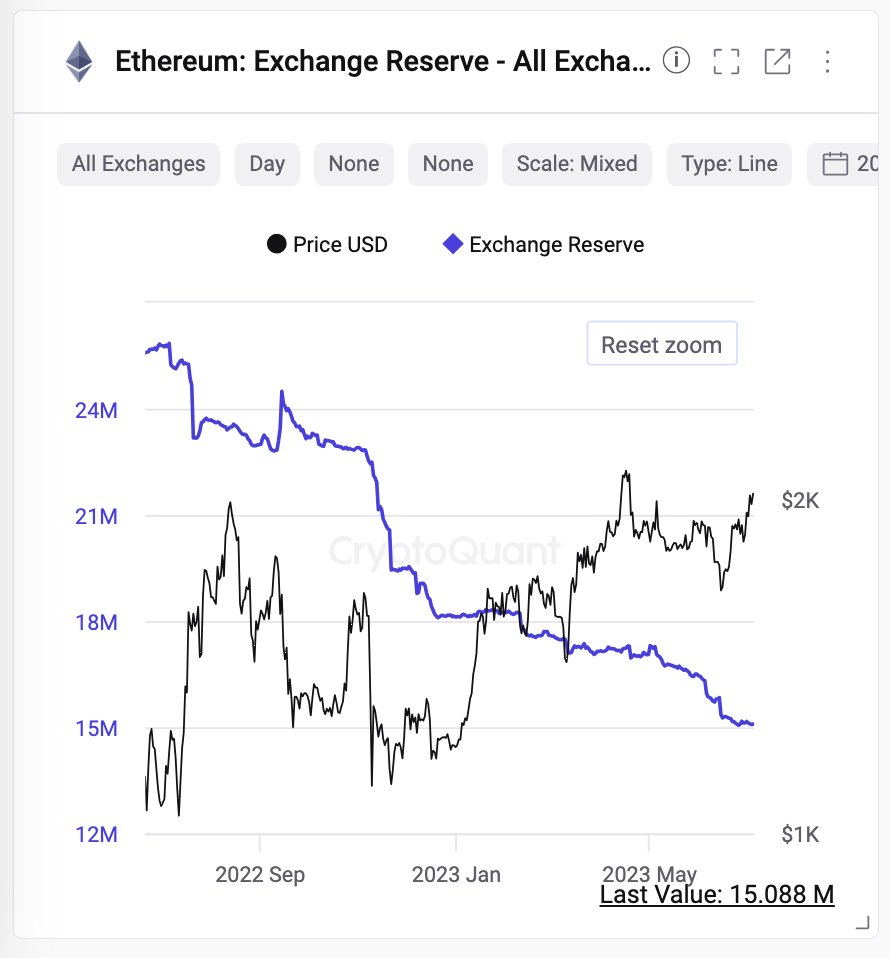

In a similar vein, Ethereum’s exchange reserves have experienced an even steeper decline, plummeting by 40% to reach 16 million.

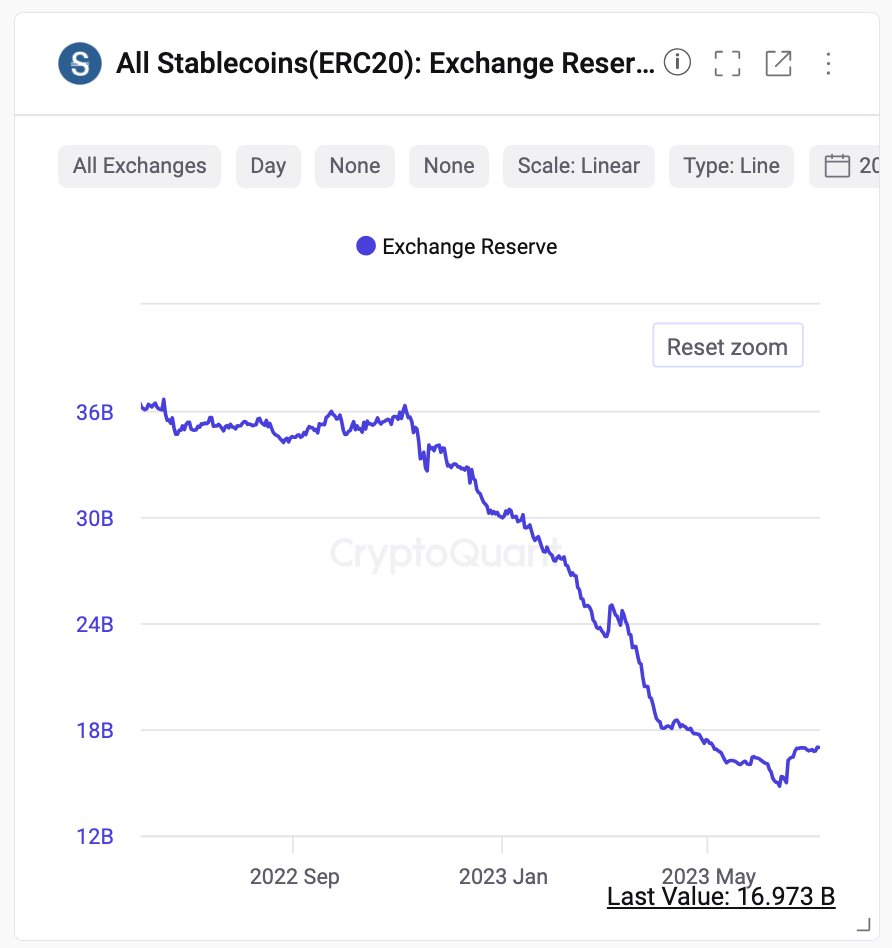

Another key aspect affected by this liquidity shift is the stablecoin market. Stablecoins, which aim to maintain a stable value by being pegged to a fiat currency, have encountered a sharp decline in reserves. The collective reserves of stablecoins have shrunk by 52%, amounting to 16.93 billion. Read More about top stablecoins…

BTC-ETH Price Action

Ki Young Ju, CEO of Crypto Quant, highlights that even though stablecoin reserves have diminished, there has been a recent uptick in buy-side liquidity. He suggests that when the ratio of stablecoin market capitalization or exchange holdings is high, there is a relatively high probability of market bottoming out.

Ju further notes that the current market capitalization of stablecoins, in relation to Bitcoin and Ethereum, remains relatively low. Another Twitter user said- stablecoin transition period due to $BUSD, and it doesn’t necessarily link to the buy-side liquidity declining. For instance, $USDT exchange reserve is increasing.

Bitcoin, the leading digital asset, kicked off the Tuesday business day in Asia with a strong surge past the $31,000 mark. Starting at $31,153, Bitcoin’s rally follows a wave of optimism fueled by several prospective issuers re-filing their applications for Bitcoin exchange-traded funds (ETFs). Bitcoin’s price has surged to $31,045.69, at the press time, marking a 1.25% increase, while Ethereum has reached $1,959.29.

Also Read: DeFi Rockets, NFTs Plummet as Ethereum Bulls Set Sight on $2,000

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.