Justin Sullivan

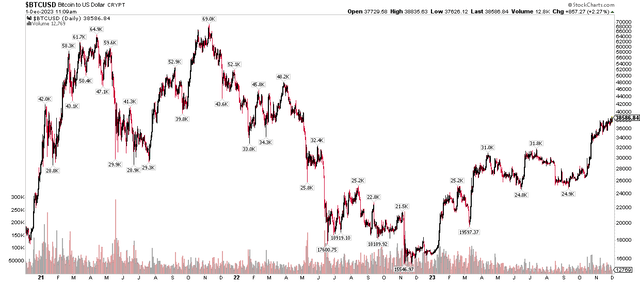

Bitcoin is back. The most popular (infamous with some investors who bought in at the top two years ago) cryptocurrency is approaching $40,000 as the reality is that a slew of spot Bitcoin and other cryptocurrency ETFs are poised to hit the market sometime in 2024. Increased token trading is thought, by some, to be bullish for Coinbase (COIN) as interest renews in this historically volatile space. A new ETF, focused on generating income, is on the market, though.

I have a hold rating on the YieldMax COIN Option Income Strategy ETF (NYSEARCA:CONY).

Bitcoin: Fresh Multi-Month Highs As Crypto Interest Grows Again

StockCharts.com

According to the issuer, CONY is an actively managed fund that seeks to generate monthly income by selling/writing call options on COIN. CONY pursues a strategy that aims to harvest compelling yields while retaining capped participation in the price gains of COIN.

CONY can be thought of as a covered call strategy within the efficiency of the ETF wrapper. The primary risk with owning CONY as opposed to COIN is if shares of Coinbase rise significantly in a short period of time – that would be a situation whereby investors would be called away with their COIN shares had they owned the stock outright. With the ETF, potential gains are capped as the Coinbase stock increases toward certain strike prices. What’s more, low implied volatility can result in less income collected and paid out to COIN shareholders. Furthermore, declines in COIN can result in losses for CONY shares, too.

CONY does not invest directly in Coinbase stock. Rather, it uses FLEX options to replicate exposure to a COIN covered call strategy (long stock, short upside calls). Treasuries are used as collateral within the portfolio. In practice, the issuer buys COIN at-the-money call options while selling COIN at-the-money put options to replicate the performance of COIN stock. These options usually expire within six months to a year.

To generate income, YieldMax sells out-of-the-money call options expiring in one month or less with strike prices typically within 5% to 15% of COIN’s stock price, capping potential gains. A short put option exposes holders of the ETF to downside risk.

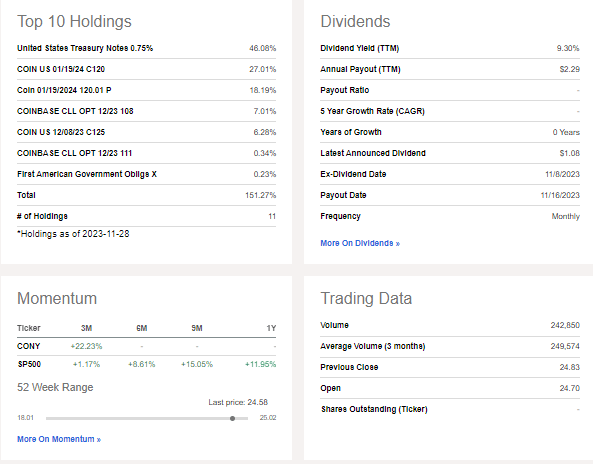

The ETF’s yield as of November 30, 2023, is 52.0% (annualized distribution rate) and 4.16% (30-day SEC yield). It’s important for investors to consider that this yield is the result of the fund selling call options. YieldMax notes that the distribution rate is the annual yield an investor would receive if the most recently declared distribution, which includes option income, remained the same going forward. On the other hand, the 30-day SEC yield represents net investment income (which excludes option income) earned by CONY over the most recent 30-day period, expressed as an annual percentage rate based on such ETF’s share price at the end of the most recent 30-day period. Finally, both of these yield measures should not be considered guarantees of future income return.

Thus, it’s essentially a trade-off between high income and capping upside potential relative to being long COIN outright. Of course, a high income yield would help CONY to outperform a long COIN position outright during pullbacks in the stock.

Currently, the fund has $104 million in assets under management and its annual expense ratio is high at 0.99% while volume is moderate at roughly 250k shares daily, so using limit orders when trading CONY is prudent.

CONY: Portfolio Positions & Dividend Information

Seeking Alpha

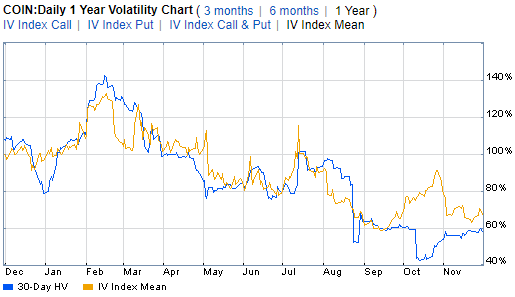

Is now a good time to own CONY over COIN? I don’t think so. Let’s detail why. Notice in the chart below that COIN’s implied volatility percentage is historically low at 67%. In general, you would want to own CONY when implied volatility is abnormally high so that you collect more option premium via selling calls. With low IV today, there is not as much to sell, simply put.

COIN: Low Implied Volatility

Fidelity Investments

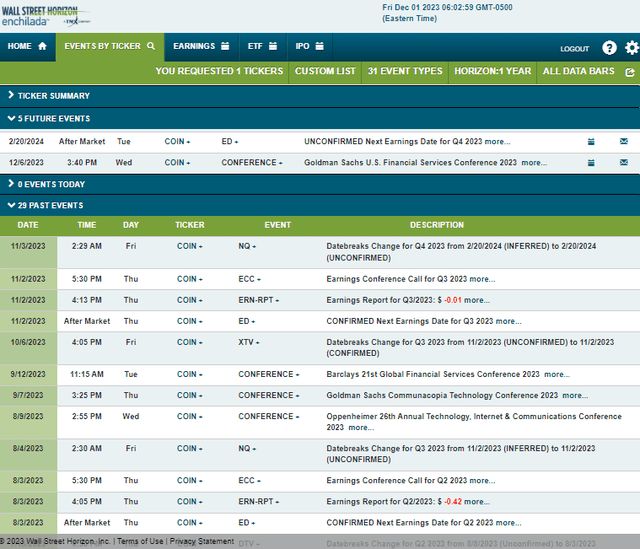

It’s also important to highlight any volatility-inducing catalysts in the offing. According to data from Wall Street Horizon, Coinbase’s CFO Alesia Haas is slated to present at the Goldman Sachs U.S. Financial Services Conference 2023 on December 5 and 6 before the company’s Q4 2023 earnings date of Tuesday, February 20, 2024.

Corporate Event Risk Calendar

Wall Street Horizon

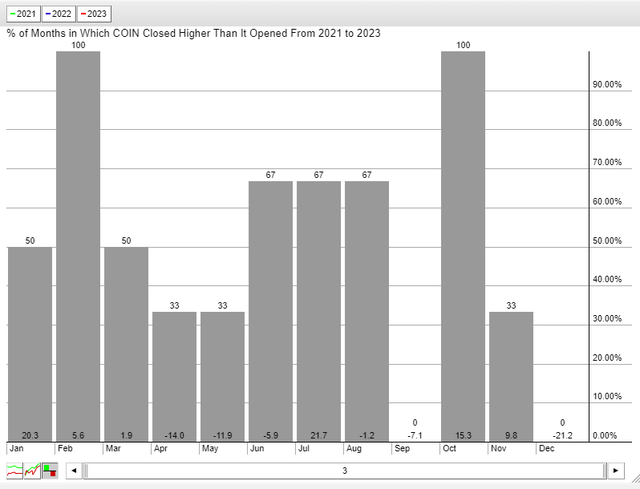

Unlike long-term investments, it’s key to pay very close attention to short-term catalysts, too. Seasonally, there is not much to go off of with respect to seasonal trends on Coinbase shares. Still, December has been by far the stock’s weakest month since its 2021 debut. It was down in both December 2021 and 2022, with an average loss of more than 20%.

COIN: 0-2 In Decembers So Far

StockCharts.com

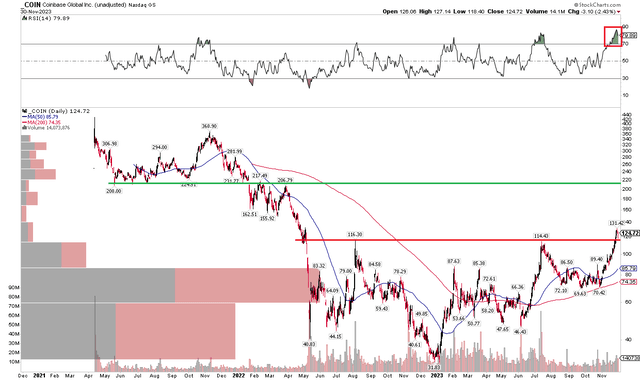

The Technical Take

While there’s bearish seasonality at play with COIN right now, price analysis comes before making decisions based on the calendar. Notice in the chart below that the stock broke out through key resistance in the mid-$110s. Shares touched above $130 recently, and I see a possible move up to a previous important resistance mark in the $207 to $217 range. The mid-$150s could also present some challenges for the bulls, but there is a solid air pocket of light volume up about 30% from today’s price compared to the high-volume congestion zone at $115 and below.

Also, take a look at the RSI momentum indicator at the top of the graph – it is firmly in overbought territory. I generally view that as positive – a sign of intense demand for shares. Moreover, with a rising long-term 200-day moving average, the bulls appear in control. So, being long COIN outright over owning the synthetic covered-call strategy ETF is the better play today, in my opinion.

COIN: Bullish Upside Breakout, Light Volume Up to $207

StockCharts.com

The Bottom Line

I see a better upside in COIN versus CONY today. Modest implied volatility on COIN shares, and its bullish chart, lead me to conclude that being more aggressive through COIN is the better play.