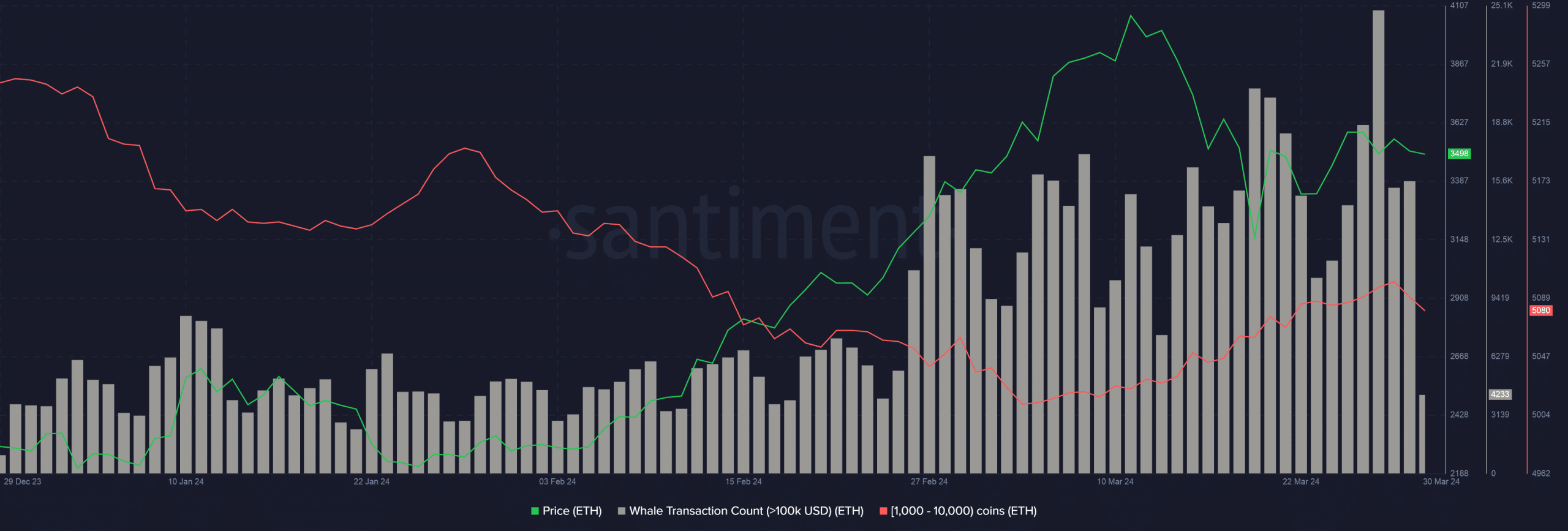

- Whale transactions worth over $100,000 rose significantly in March.

- The optimism could be flowing from CFTC labelling ETH as a commodity.

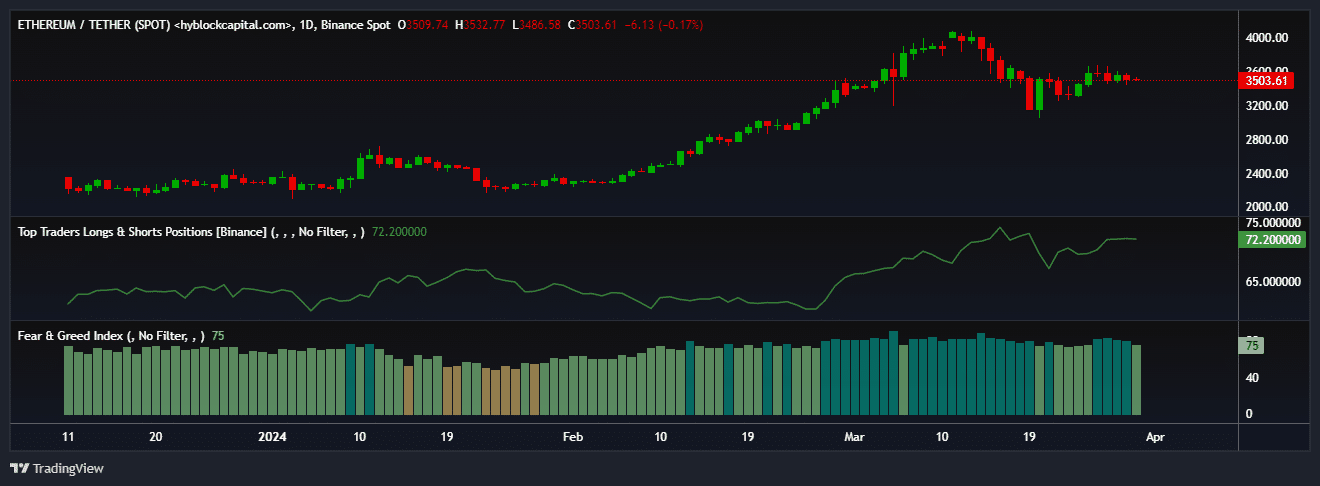

Despite critical events like the Dencun Upgrade, Ethereum [ETH] underperformed in March, with just a marginal increase of 0.79% over the 30-day period. The second-largest cryptocurrency faced strong resistance at the $4,000 mark, dropping to $3.500 as of this writing.

But the slump didn’t deter large investors of the coin, who continued to add Ethereum exposure to their portfolios.

Whales trust ETH to go big

According to AMBCrypto’s analysis of Santiment’s data, whale transactions worth over $100,000 rose significantly throughout the month. These transactions resulted in a sharp increase in small whale wallets which typically hold between 1,000 – 10,000 coins.

This nature of accumulation is known as “buy the dip.” The strategy involves buying assets during temporary price drops to benefit from potential future price increases.

Driven by research and business acumen, this plan is usually adopted for fundamentally-strong assets with long-term growth potential.

The level of bullishness was also reflected in the increasing long exposure in the derivatives markets. As per AMBCrypto’s analysis of Hyblock Capital’s data, about 72% of total whale positions on crypto exchange Binance were betting on ETH to rise.

Whales’ bullish strategy seemed to have been picked up by the broader market. The general mood was one of “Greed” as per the Fear and Greed Index. Typically, such sentiments lead to FOMO, drawing in more investors and adding to the buying pressure.

But what was motivating whales to be bullish on ETH?

Chances of spot ETF approval improving?

In recent weeks, a lot of pessimism had set in surrounding the approval of Ether spot ETFs. The odds were getting lowered due to increasing possibility of the U.S. Securities and Exchange Commission (SEC) deeming Ether as a security.

Is your portfolio green? Check out the ETH Profit Calculator

However, U.S. derivatives market regulator, Commodities Futures Trading Commission (CFTC) referred ETH as a commodity in the recent KuCoin lawsuit.

This could have rekindled investors’ hopes that an Ether spot ETF would eventually see the light of day. If approved, spot ETFs have the potential to do for ETH what Bitcoin has been witnessing since mid-January.