- Ethereum could reach $3,600 and $4,000 if market sentiment remains unchanged.

- Despite the massive ETH deposits to Binance, Ether remains bullish.

Amid the bullish market sentiment, a substantial Ethereum [ETH] transaction by a whale has gained widespread attention from the crypto community.

On-chain analytic firm Lookonchain made a post on X on 29th July stating that a giant whale has moved a notable 25,800 ETH worth $87 million to Binance.

Whale moves 25,800 ETH to Binance

According to the post on X, the whale bought 26,721 ETH from Binance at an average price of $3,457 between 31st May and 25th July of this year.

With the recent deposit, this whale has deposited a notable 26,660 ETH at an average price of $3,376 between 17th July and 29th July.

This move has raised concern among investors and traders. Meanwhile, the reason for this massive deposit remains unclear.

Whenever the market sees such notable deposits to exchanges, there is a high chance that the price may potentially decline or have an impact on the market.

However, data such as Total-Value Locked (TVL) and Open Interest (OI) suggest that this notable ETH deposit might not impact the ETH price.

According to an on-chain analytic firm Defillama and CoinGlass, Ethereum’s TVL and OI have risen by 3% and 6.2% respectively, in the last 24 hours.

Ether technical analysis and key levels

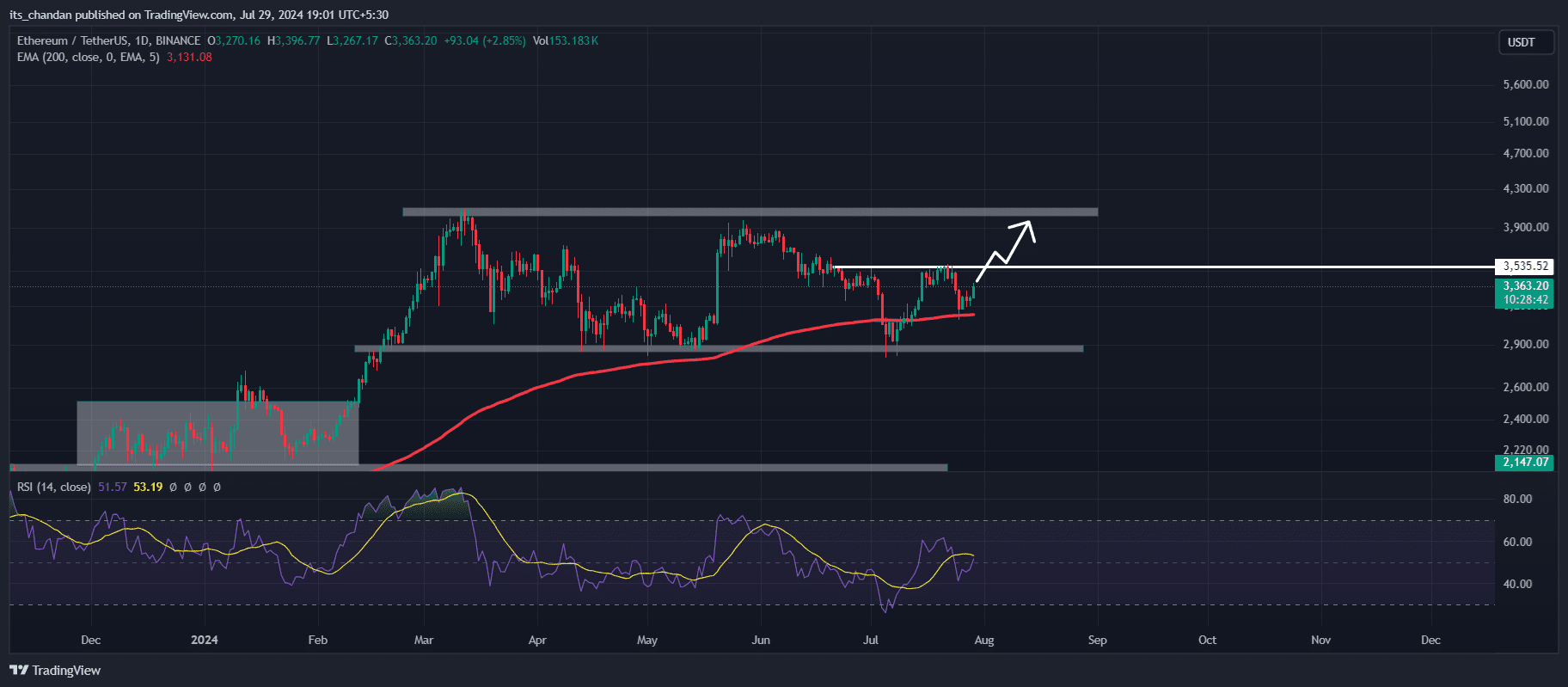

According to expert technical analysis, ETH looks bullish as it moves above the 200 Exponential Moving Average (EMA) on both the 4-hour and daily time frame.

Additionally, the Relative Strength Index (RSI) also indicates bullishness for ETH as the RSI value remains below the overbought area.

By analyzing the ETH chart using price action and technical indicators, there is a high chance that ETH could reach $3,600 and $4,000 if the market sentiment remains unchanged.

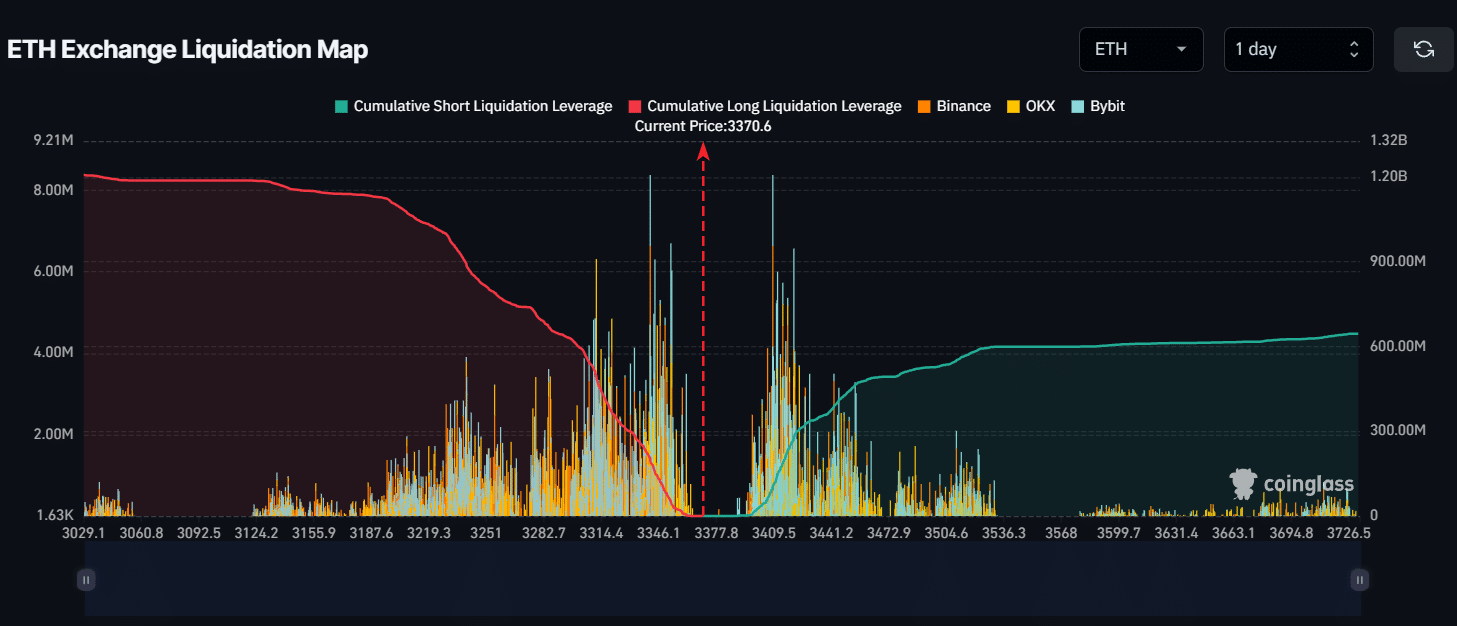

ETH’s major liquidation level

However, the major liquidation levels are $3,340 on the lower side and $3,410 on the higher side, according to CoinGlass data. If market sentiment changes and the ETH price falls to the $3,340 level, $188 million worth of long positions will be liquidated.

Conversely, if the ETH price rises to the $3,400 level, $87 million of short positions will be liquidated. This data from CoinGlass suggests that bulls currently have a stronger presence than bears in the market.

Read Ethereum (ETH) Price Prediction 2024-25

As of writing, ETH is trading near the $3,380 level and has experienced a price surge of over 3.5% in the last 24 hours.

However, trading volume has declined by 20% during the same period, suggesting lower participation from investors and traders.