SCRYPT CEO Norman Wooding told crypto.news several factors point to higher Ethereum prices if the SEC approves spot Ether ETFs.

Wooding predicted that spot Ethereum (ETH) ETFs will follow the pattern of spot Bitcoin (BTC) funds and push ETH prices above $4,000. According to the expert, approval for spot ETH ETFs will eliminate “lingering anxieties” surrounding the second-largest cryptocurrency and boost market demand.

Wooding opined that Ether could retest its $4,800 peak if spot ETH ETFs capture 10-20% of Bitcoin ETF flows.

“This opens doors to a previously untapped audience, thus increasing demand, generating an upward price trajectory in the days, weeks, and months following approval.” the SCRYPT’s CEO told crypto.news.

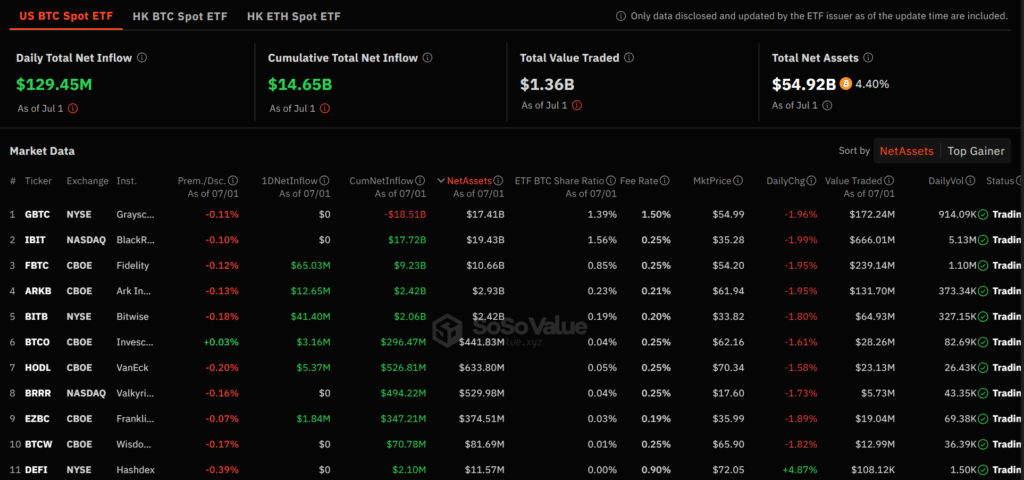

Exclusive Grayscale spot Bitcoin ETFs garnered over $35 billion in assets under management (AUM) within six months of trading. Wooding’s estimations echo a report from the Gemini crypto exchange, which said spot ETH funds could see $5 billion in net inflows over the same six months.

No staking, higher yield

Just as observers have regarded spot ETH ETFs a matter of when and not if, skeptics have also debated why Ethereum should have an instutitonal wrapper that tracks spot Ether prices.

Bitcoin is primarily treated as digital gold and a store of value, while Ethereum operates as a smart contract-powered ecosystem for decentralized applications. This market relies heavily on Ether as a liquid asset and an economic vehicle.

However, ETFs hold assets and wait for higher prices, which could lead to large amounts of dormant Ether. The issue is further exacerbated by the absence of staking activity in proposed spot ETH funds. Flipside Crypto data scientist Carlos Mercado said it’s not the best use case for Ether, but Wooding insists the outcome may be a net positive for ETH proponents.

Per Wooding, reduced liquidity and dormant ETH could incentivize more directly Ether staking, resulting in higher on-chain yield as spot ETFs capture significant supply.

“While dormant ETH from ETFs might reduce DeFi liquidity, the broader market exposure and increased participation could eventually drive more direct engagement in staking and DeFi, balancing out the initial impact,” Wooding discussed with crypto.news via email.

When will we see spot Ethereum ETF?

After the U.S. Securities and Exchange Commission (SEC) issued initial approval for spot ETH ETFs last month, issuers and experts expect final greenlights to arrive before the end of Q3 2024. Bloomberg analyst James Seyffart suggested the regulatory nod could occur this month, and SEC chair Gary Gensler told Congress to expect an outcome by the end of summer.

Although speculation exists that the SEC could spurn issuers, especially after the agency sued Consenys over its MetaMask wallet and staking offerings, Wooding is confident the regulator will approve spot ETH ETFs this month.

Per Wooding, rejecting Ethereum funds could dampen the SEC’s credibility and competency. SCRYPT’s CEO added that a denial might also prompt further regulatory discussions and result in better, refined future proposals.

Furthermore, Ether prices may slide downward if the SEC denies spot Ether ETFs. However, Woodings surmised that such an outcome is unlikely and a market downswing would be short-lived in any case. “The fundamental value and utility of Ethereum remain strong, and the market would likely stabilize as investors refocus on its technological developments and applications.” per Wooding.