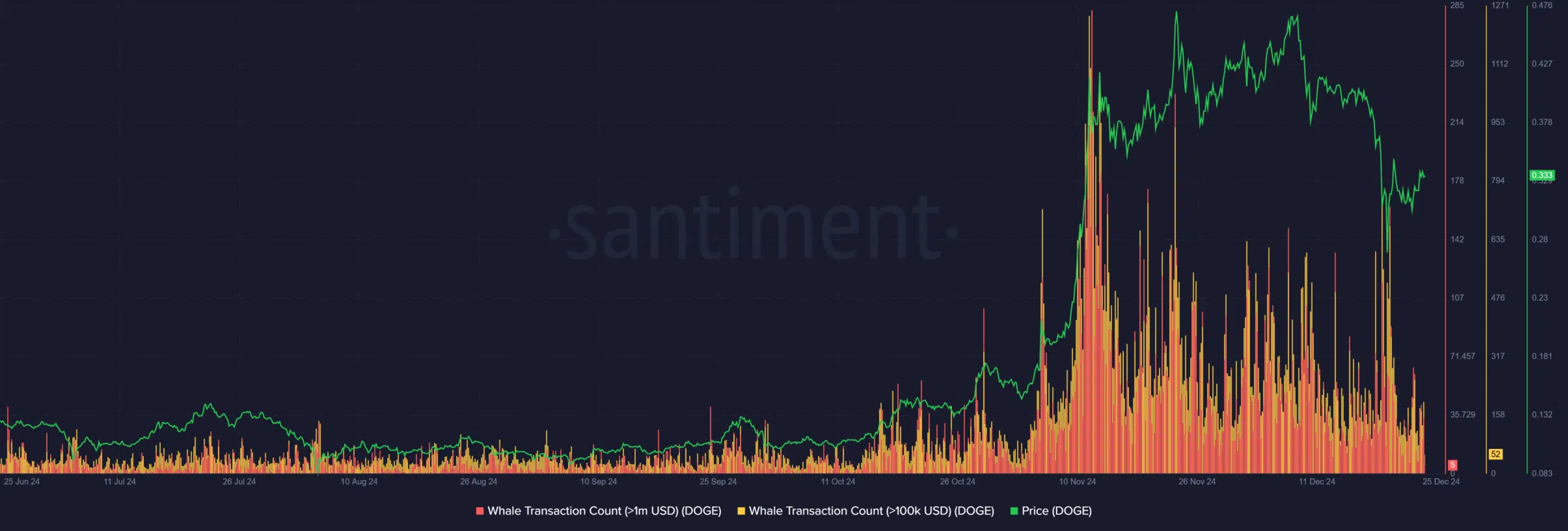

Dogecoin’s recent price movements are supported by a sharp rise in whale activity. Whale transactions exceeding $1 million have spiked dramatically, coinciding with the token’s price rally toward $0.33.

Notably, these transactions surged during periods of high price volatility, suggesting strategic accumulation and distribution phases by major holders.

The increase in $100,000+ transactions further highlights robust mid-tier whale involvement, contributing to sustained buy pressure.

This behavior aligns with an influx of capital from high-value wallets, as DOGE whales leveraged lower prices during prior consolidation phases.

The data underscores a critical catalyst: whales are driving liquidity and amplifying momentum in Dogecoin’s market structure. If this trend persists, Dogecoin could sustain its bullish trajectory, especially if whales continue to accumulate near key support levels.

What the wallet surge means for market sentiment

The all-time high in Dogecoin wallets holding 1 million or more DOGE is a clear indicator of rising long-term confidence among large holders. This surge reflects a strategic shift toward accumulation rather than short-term speculation, often signaling expectations of further price appreciation.

From a market sentiment perspective, it shows growing conviction in Dogecoin’s potential as whales consolidate their positions. Such wallet growth also boosts liquidity concentration, a critical factor in supporting sustained rallies.

However, it raises the stakes for volatility, as any significant sell-off from these wallets could create sharp reversals in market momentum.

Dogecoin: Potential scenarios

Dogecoin’s technical indicators reveal a mixed outlook. The RSI at 41.46 reflects a neutral-to-slightly bearish sentiment, indicating room for upward movement but requiring sustained momentum.

OBV continues to climb, signaling strong accumulation despite recent pullbacks, reinforcing a bullish narrative.

Source: TradingView

Read Dogecoin [DOGE] Price Prediction 2024-2025

DOGE faces key resistance at $0.35 and support at $0.30. A break above $0.35, backed by volume, could push prices toward $0.40, while a drop below $0.30 risks a retest of $0.25.

Record whale accumulation and active mid-tier participation suggest a market primed for a breakout. However, potential whale sell-offs remain a key risk, keeping volatility elevated and the outlook uncertain.