- Coinbase Premium Index flips negative, marking a crucial moment for U.S.-based Bitcoin demand trends

- Macro factors and institutional shifts weigh on Bitcoin’s rally as it hovers near $95K

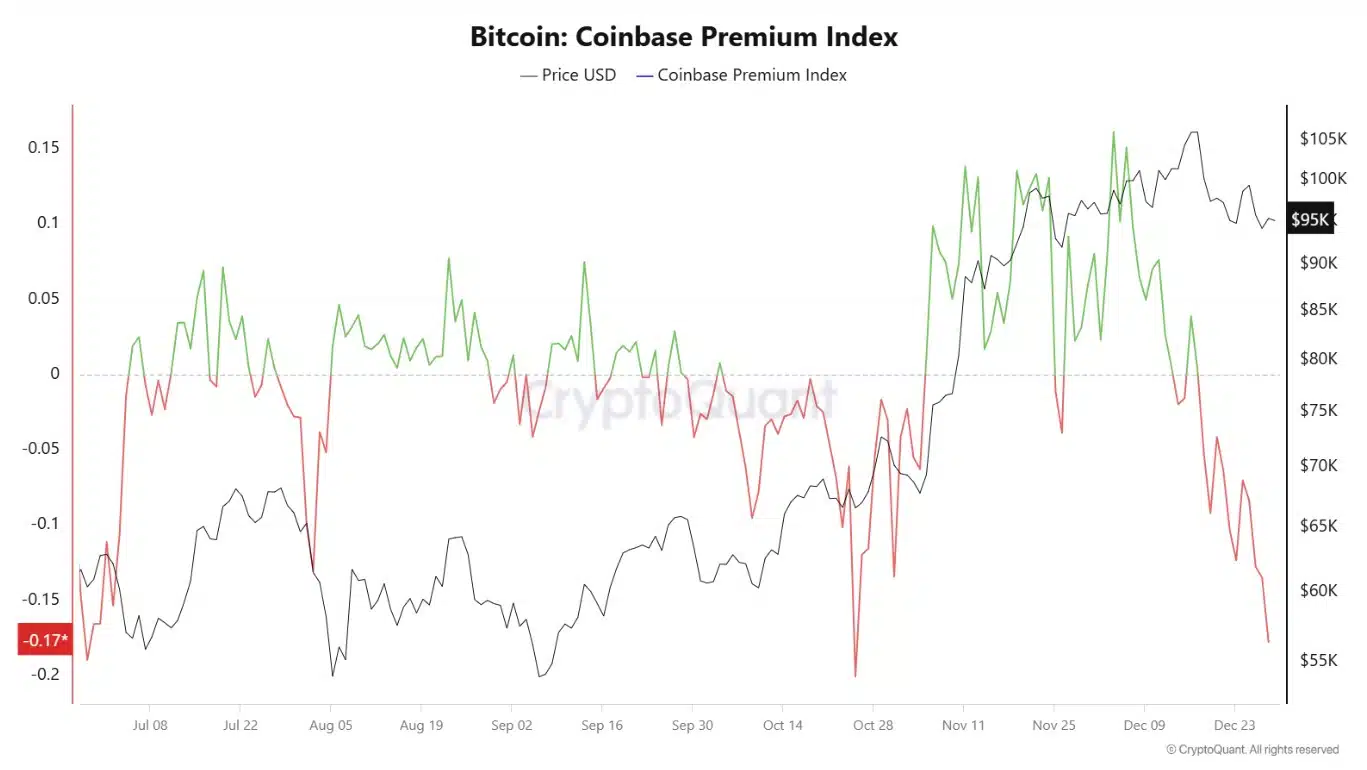

The Coinbase Premium Index has flipped negative, casting a shadow over Bitcoin’s [BTC] recent rally.

This metric, which measures the price difference between Bitcoin on Coinbase and other global exchanges, serves as a barometer for U.S.-based demand.

A negative reading suggests diminishing buying pressure from American retail and institutional investors — a worrying sign for the crypto market’s short-term outlook.

With institutional enthusiasm cooling and U.S. demand waning, Bitcoin’s ability to maintain its upward momentum faces a critical test.

The question now is whether this shift signals a temporary lull or a broader retracement for Bitcoin.

US institutional demand wavers

The Coinbase Premium Index has plummeted to -0.17 as of late December 2024, marking its steepest drop this year, per CryptoQuant data.

This sharp decline reflected weakening demand for Bitcoin among U.S. retail and institutional investors — a stark contrast to the optimism seen during Bitcoin’s earlier rally past $100,000 in November.

The negative premium signals a shift in market sentiment, as U.S. buyers are now offloading rather than accumulating Bitcoin, potentially due to rising treasury yields, macroeconomic uncertainty, and year-end portfolio rebalancing.

With Bitcoin currently hovering near $95,000, the lack of US-based buying pressure could act as a headwind for further growth.

This bearish divergence highlights US investors’ cooling enthusiasm as the market heads into 2025.

Bitcoin price consolidation: $95K in focus

Bitcoin was trading just below $95,000 at press time, with $95,170 acting as a formidable resistance. Multiple rejections at this level suggested an exhaustion of bullish momentum.

Support remains critical at $93,000, with a breach likely paving the way for a retest of the $90,000 psychological barrier.

The RSI at 45.60 confirms a bearish divergence, while the OBV at 1.65M shows a modest decline in buying volume over recent sessions.

This stagnation aligns with broader market hesitation as traders assess year-end macro trends and reduced institutional inflows.

For Bitcoin to regain its bullish footing, it must decisively close above $95,000 on high volume, targeting $100,000. Failing this, the risk of a breakdown below key supports increases as we approach 2025.

Catalysts for reversing the negative Coinbase premium

The negative Coinbase Premium Index could reverse with several key developments. Firstly, increased institutional adoption is pivotal.

BlackRock’s recent recommendation for institutional investors to allocate up to 2% of their portfolios to Bitcoin signals growing acceptance, potentially attracting more U.S. investors and positively impacting the premium.

Secondly, favorable regulatory developments could boost confidence among U.S. investors. The approval of Bitcoin ETFs earlier this year has already contributed to mainstream adoption.

Further regulatory clarity and supportive policies could enhance market sentiment, encouraging increased participation from both retail and institutional investors.

A potential shift in Federal Reserve policies, such as a pause or reduction in interest rates, could make risk assets like Bitcoin more attractive, prompting increased demand from U.S. investors.

Is your portfolio green? Check out the BTC Profit Calculator

Lastly, technological advancements and increased utility of Bitcoin could drive adoption.

Developments in payment systems and broader acceptance of Bitcoin as a medium of exchange may enhance its appeal, potentially influencing the Coinbase Premium Index positively.