- BTC has managed to stay above its short-moving average.

- Institutions have continued to buy despite the decline.

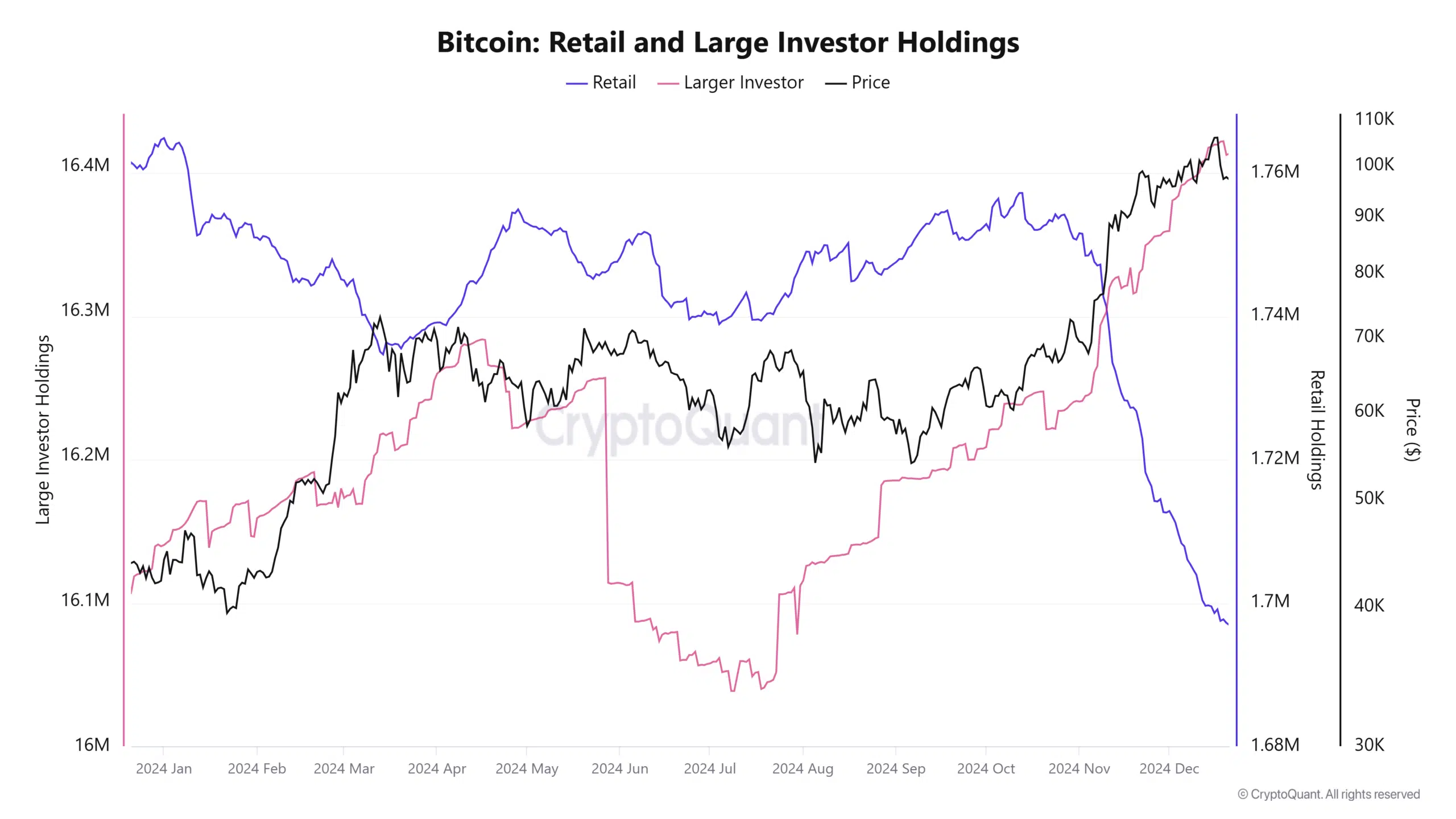

As Bitcoin [BTC] hovers around the $100,000 level, its market dynamics reveal a pivotal shift. Retail investors, once the backbone of Bitcoin’s growth, are retreating, while institutions are stepping in to fill the void.

This transition underscores a maturing asset class, with corporate treasuries and investment firms reshaping the cryptocurrency’s trajectory.

The latest data on retail and institutional holdings highlights the growing dominance of large investors. This trend aligns with the strategic acquisitions of companies like MicroStrategy, Marathon Digital, and Riot Platforms.

A transition in Bitcoin ownership: Retail vs large investors

Analysis of data from CryptoQuant highlights a stark divergence between retail and institutional activity. Retail holdings have plummeted to 1.68 million BTC, marking their lowest levels in years.

This trend reflects waning confidence among smaller investors, potentially driven by profit-taking or market uncertainty.

On the other hand, large investors have expanded their holdings to 16.4 million BTC, showcasing their confidence in Bitcoin’s long-term potential.

This shift signals a critical transition in Bitcoin’s market dynamics. Retail investors, while influential, are no longer the primary drivers of price movements. Instead, institutional players are stepping in, providing stability and driving a more consistent growth trajectory.

The decline in retail activity has not dampened Bitcoin’s momentum, as large investors continue accumulating, mitigating the effects of retail sell-offs.

Institutional holdings increases

Recent data from CryptoQuant showing acquisitions exemplify the growing role of institutions in Bitcoin’s market. MicroStrategy remains a leader in corporate Bitcoin adoption, with over 158,000 BTC in its portfolio, solidifying its position as the largest corporate holder.

Marathon Digital Holdings has also made a significant impact, combining mining operations and direct purchases to amass 40,435 BTC.

Riot Platforms, another key player, has strategically bolstered its holdings to 16,728 BTC, balancing mining operations with targeted acquisitions.

Semler Scientific has entered the Bitcoin market with 2,084 BTC acquired at an average price of $80,916, reflecting a broader trend of companies diversifying their treasury strategies.

Metaplanet, a Tokyo-listed investment firm, has followed suit, accumulating 1,142 BTC at a realized price of $65,650. In comparison, Tesla’s 11,509 BTC remains a testament to its early adoption of Bitcoin as a treasury asset.

These acquisitions underscore Bitcoin’s appeal as a hedge against traditional market risks.

Institutional support bolsters Bitcoin’s bullish momentum

Bitcoin’s recent price action reflects the impact of institutional activity on its market stability. After approaching $100,000, Bitcoin has retraced slightly to $95,329.90, consolidating gains from its earlier rally.

The price chart reveals key support at the 50-day moving average of $92,940.19, with the 200-day moving average at $70,322.99, offering additional long-term support.

The Accumulation/Distribution indicator, currently at 5.01M, highlights steady buying pressure, predominantly driven by institutional investors.

This accumulation has prevented sharper corrections, even as retail activity declines. For Bitcoin to resume its upward trajectory, reclaiming $97,230 as resistance will be critical.

Institutional buying activity remains a key factor in supporting these levels and mitigating the effects of short-term volatility.

Read Bitcoin (BTC) Price Prediction 2024-25

The growing divide between retail and institutional holdings signifies a fundamental shift in Bitcoin’s market dynamics.

As Bitcoin consolidates near critical support levels, institutional confidence could catalyze its next major rally, potentially pushing it beyond the $100,000 milestone.