- Bitcoin’s Spot ETF segment is heating up, with Bitwise’s latest application the most recent example

- Post-festive season flows look to be adopting a positive shift after recent ETF outflows

2024 has arguably been one of the most interesting years for Bitcoin in its entire history. Could 2025 be just as good? ETFs were the biggest liquidity drivers since their approval and the latest Bitwise development could signal more excitement in the next 12 months.

Bitwise has reportedly filed for a Bitcoin standard corporation or company ETF. Details revealed that the newly filed ETF will mainly focus on investing in companies that own a substantial amount of Bitcoin. In fact, preliminary details of the filing revealed that companies in the ETF must hold at least 1,000 BTC.

Other details of the filing include a marketcap of not less than $100 million and over $1 million in daily liquidity. Private stock holdings should also not exceed 10%.

How could such a development affect the overall market and perception of Bitcoin though?

The new Bitwise ETF filing underscores the rapid embrace of Bitcoin by the institutional class. Companies holding Bitcoin could end up appearing more appealing and this could aid in attracting more liquidity to such firms. This could potentially encourage more institutional liquidity to flow in that direction.

Bitcoin ETFs push back into positive after the festive season

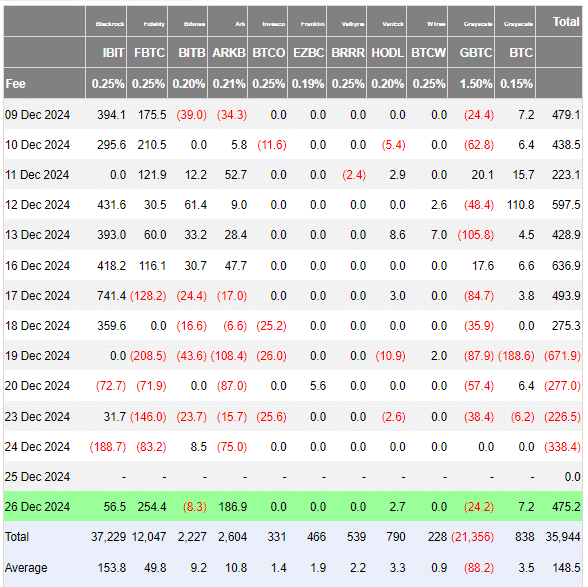

Bitcoin ETFs had a healthy bullish start earlier in the month, but leaned into the negative side as the holidays drew closer. In fact, daily flows remained in the green up to 18 December, after which the Bitcoin ETF flows shifted to sustained outflows until 24 December.

Bitcoin ETFs assumed positive flows after the festive season on 26 December. $475.2 million in inflows were seen during that timeframe, potentially signaling the return of demand. Fidelity and Ark Invest had contributed to the lion’s share of that demand.

Are the ETF inflows on Boxing day a reflection of the demand in the market though? Well, a holiday sell-off was highly probable and expected given that BTC had been enjoying a robust rally. Holiday spending dictated that some profit-taking was bound to take place.

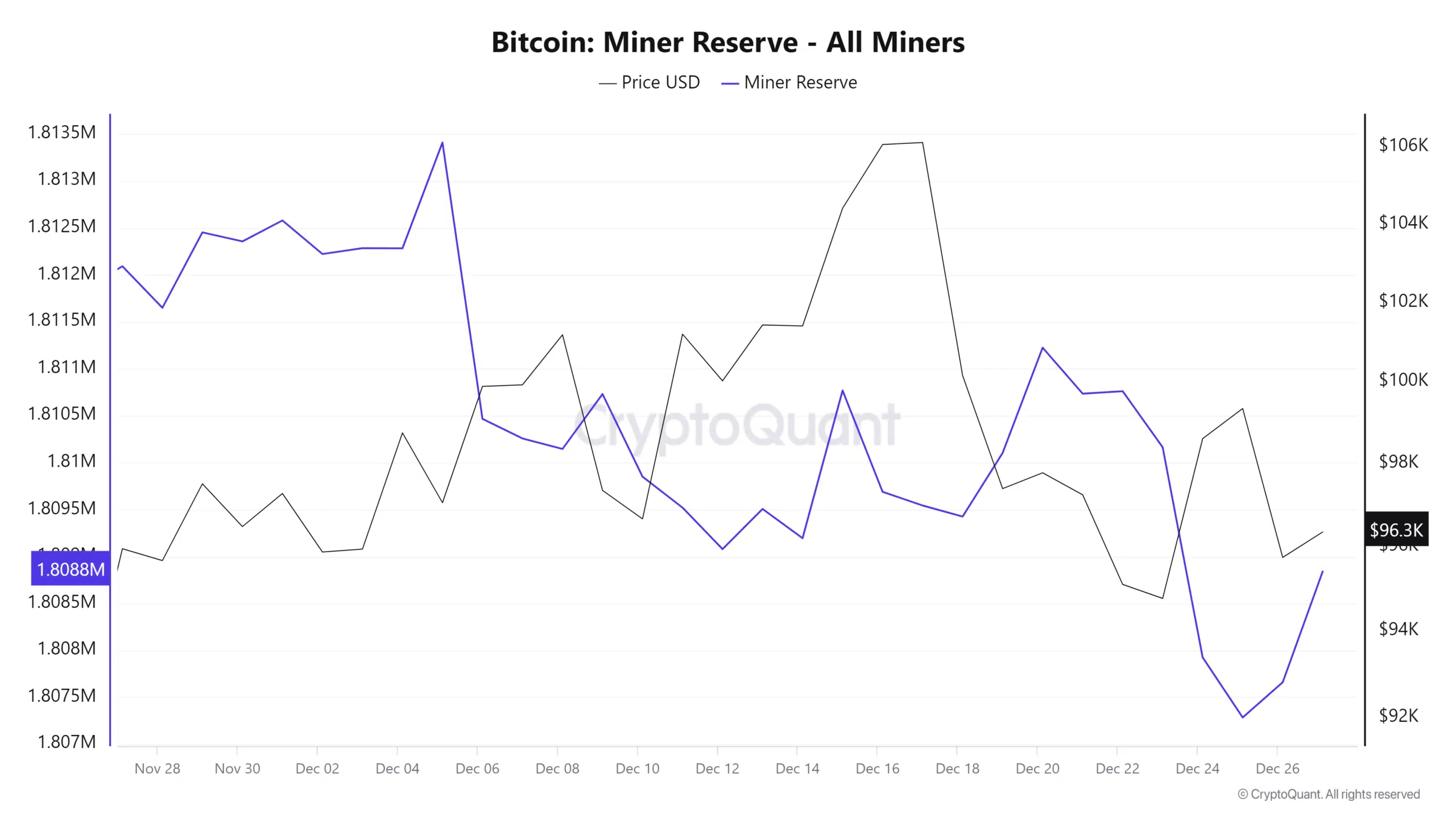

Miners play a vital role in the Bitcoin ecosystem and BTC miner reserves offer some insights into the state of demand. Miner reserves have been negative for the last 6 days, in line with ETF outflows.

Miner outflows turned positive on 25 December, jumping from 1.897 million BTC to 1.808 million BTC, as of the last 24 hours.

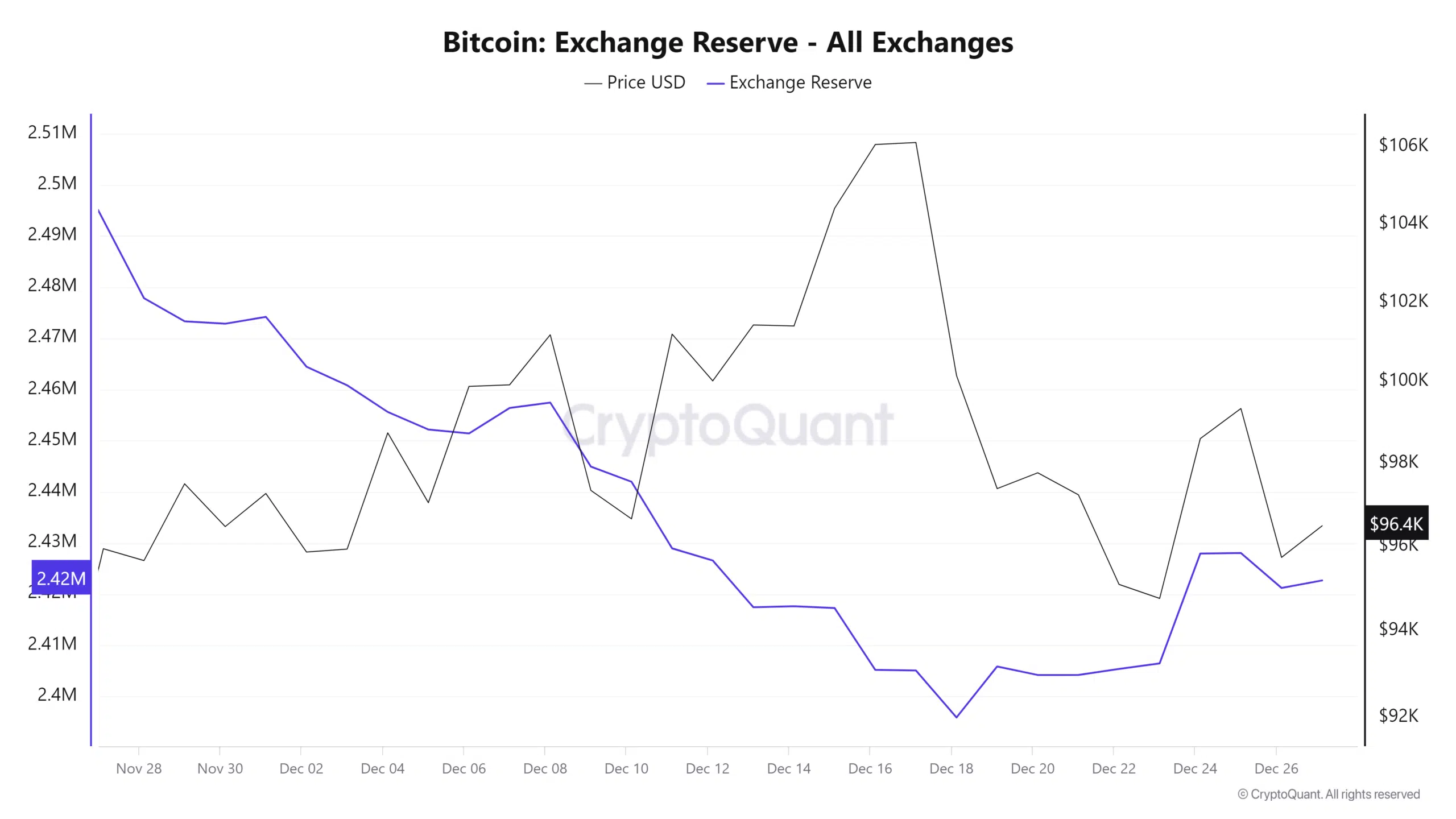

Bitcoin exchange reserves also painted a clearer picture of the demand and sell pressure that has prevailed over the last few months. For context, exchange reserves in the last 30 days dipped from 2.493 million BTC on 27 November to a monthly low of 2.395 million BTC on 18 December.

Finally, Bitcoin exchange reserves grew to 2.428 million on 25 December, before dipping to 2.422 million BTC two days later. This confirmed that the cryptocurrency has been experiencing sell pressure during the holidays. However, that sell pressure may have declined over the last 24 hours.

In short, holiday sell pressure may have already run its course and could potentially be paving the way for strong demand resurgence.