Bitcoin (BTC) has shattered previous records, climbing to an all-time high and reigniting enthusiasm across the crypto market.

This milestone has triggered a ripple effect, lifting the prospects of other prominent cryptocurrencies like Litecoin (LTC) and Monero (XMR). With Bitcoin leading the charge, investors are keen to explore whether LTC and XMR can ride this bullish wave to new heights. In particular, Monero’s privacy-focused innovations and resilient community make it a standout contender in this dynamic rally. Could Monero capitalize on this momentum to redefine its position in the market? Let’s delve into the potential trajectories of BTC, LTC, and XMR in this electrifying phase of crypto resurgence.

Bitcoin Shows Potential as Bulls Eye $111,730 Resistance Level

Source: ChangeNOW

Bitcoin is trading between $97,296 and $107,956, showing signs of potential growth. The nearest resistance level is at $111,730, and breaking through could lead to the next target of $122,389. In the past month, Bitcoin’s price has increased by over 12%, and by nearly 59% over six months. The Relative Strength Index (RSI) stands at 45.33, indicating neutral momentum. The 10-day Simple Moving Average is $101,054, slightly below the 100-day SMA of $104,316, which may signal an upward trend.

With these market indicators, some investors are watching Bitcoin closely. Bitcoin can be bought or exchanged on platforms like ChangeNOW without registration and hidden fees.

>>> ChangeNOW – Swap Crypto Simple, Fast, Free of Custody

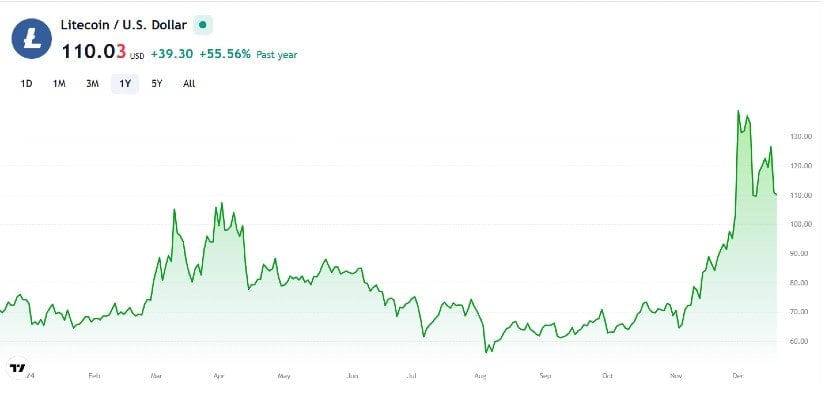

Litecoin Shows Potential Amid Bearish Signals and Near Support Levels

Source: ChangeNOW

Litecoin has recently dipped, with a one-week price change of around -7%. The Relative Strength Index is below 40, showing bearish momentum. However, over the past month, Litecoin’s price has grown by more than 20%, and in six months, it has risen by almost 50%. The current price is approaching the nearest support level at $85. If it rebounds, it could target the resistance level at $150, which would be a significant increase from current levels.

This potential trajectory underscores the importance of staying informed about Litecoin’s market dynamics, especially for those considering platforms like ChangeNOW, which provides seamless access without registration or hidden fees.

>>> ChangeNOW – Swap Crypto Simple, Fast, Free of Custody

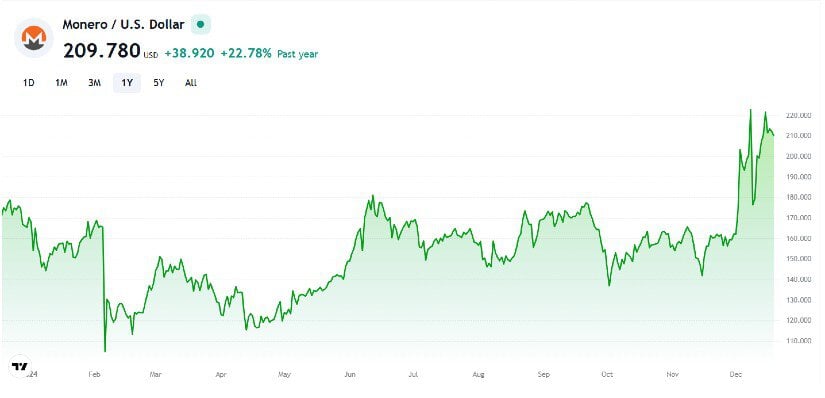

Monero Gains 34% in a Month as Bulls Target Next Resistance at $278

Source: ChangeNOW

Monero (XMR) has surged 34% in the past month, trading between $172 and $250. The nearest resistance is at $278, with support at $121. The 10-day moving average is $212, slightly below the 100-day average of $216. The RSI at 41 suggests room for growth without overbought conditions. Despite a negative MACD of -1.68, recent price increases indicate bullish momentum. A break above $278 could lead to the next resistance at $356, potentially increasing the price by over 70% from current levels.

For those tracking Monero’s trajectory, platforms like ChangeNOW offer easy access without registration or hidden fees.

>>> ChangeNOW – Swap Crypto Simple, Fast, Free of Custody

Conclusion

As Bitcoin, Litecoin, and Monero anticipate a potential rally, investors and traders have unique opportunities with each coin. Bitcoin continues to draw attention with its possible all-time high climb. Litecoin offers quick transaction times and lower fees, appealing for everyday use. Monero provides enhanced privacy features, attracting those who value confidential transactions. For those considering exchanging, buying, or selling these cryptocurrencies, ChangeNOW offers a seamless platform. It enables users to transact without hidden fees or the need for registration, enhancing security by not storing user funds. With support for over 900 cryptocurrencies, no limits on transaction volumes, and the option to purchase crypto using a bank card, ChangeNOW simplifies the crypto experience.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.