- The volume of large transactions has increased in the last few days.

- ETH saw a slight rebound in the last 24 hours.

Ethereum[ETH] whales are making waves again, withdrawing massive amounts of ETH from Binance shortly after the market rebounded.

Analysis showed that four fresh wallets removed 8,440 ETH worth $28.43 million in the last trading session, and another ten fresh wallets followed suit, withdrawing 17,698 ETH worth $61.66 million in the current one.

These significant moves indicate possible whale accumulation, a behavior often linked to bullish price action. By analyzing recent price trends and on-chain metrics, we explore whether Ethereum’s supply dynamics are setting the stage for its next rally.

On-chain data confirms whale activity

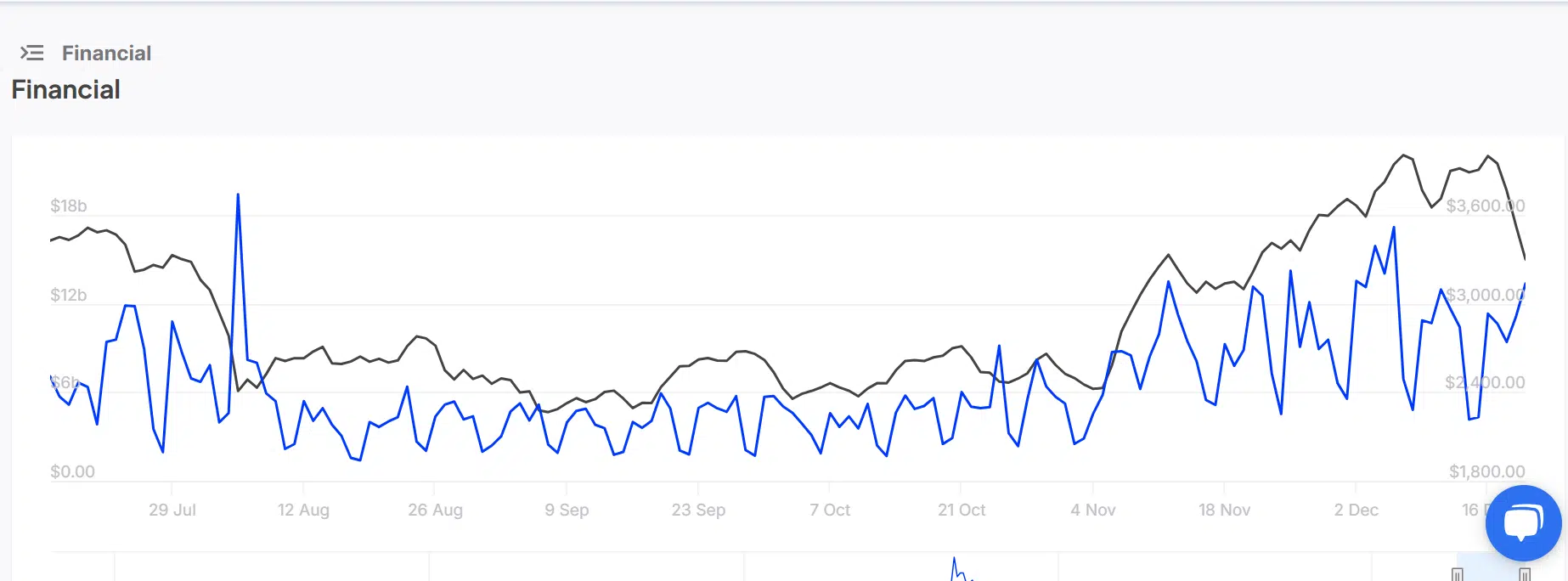

Analysis of the Ethereum Large Transactions chart from IntoTheBlock highlights a spike in high-value transfers. The spike coincided with the significant withdrawals from Binance, which Lookonchain highlighted.

The chart showed that between the 18th and 20th of December, large transactions increased by over $4 billion. At the end of the last trading session, the volume of large transactions was $13.35 billion.

Massive whale withdrawals signal accumulation

The withdrawal of over 26,000 ETH, totaling $90 million within hours, suggests strategic accumulation. Analysis of the Ethereum Exchange Netflow chart further supports these withdrawals.

The chart highlights a significant net outflow from exchanges, with more ETH leaving than entering. This trend reduces the available supply on exchanges, often signaling reduced selling pressure and growing confidence among large holders.

Such withdrawals into fresh wallets are typically associated with long-term holding strategies or staking. This behavior aligns with historical patterns where whale accumulation precedes significant price rallies.

Reduced supply on exchanges, combined with heightened whale movement, signals strong market participation, reinforcing the narrative of accumulation amid a recovering market.

Ethereum price stabilizes above key levels

The Ethereum price chart showed that ETH was stabilizing near $3,470 after a brief pullback. Despite recent corrections, the price remains above the 50-day Moving Average (MA), signaling continued bullish momentum.

Additionally, the Ichimoku Cloud indicator reveals that ETH is still trading within a bullish territory, with strong support of around $3,400.

The combination of whale accumulation and ETH’s technical strength suggests the asset is primed for a potential breakout, especially if demand continues to outpace supply.

– Is your portfolio green? Check out the Ethereum Profit Calculator

Ethereum’s recent whale activity and positive technical indicators suggest it is well-positioned for its next move. As exchange reserves dwindle and large holders accumulate ETH, the stage is set for a potential breakout.

While short-term consolidation remains possible, broader market dynamics indicate a bullish outlook for Ethereum.