- Options traders are eyeing $120k and $150k price targets in Q1 2025

- Santiment cautioned that a move to $110k and other targets could happen when people least expect

Bitcoin [BTC] flirted with the $100k-level on Christmas Day, but dropped to $95k afterwards ahead of the $14B Options expiry on Friday, 27 December. However, Deribit has warned that the record year-end expiry had no clear market direction.

Despite the current whip-sawing, large players in the Options market are eyeing $110k, $120k, and $150k price targets in Q1 2025.

Options are derivative contracts that allow users to buy or sell the underlying asset (BTC) at a later date. Calls give the right to buy BTC (bullish sentiment) while puts confer the right to sell the asset (bearish signal).

BTC: Options traders eye $150K

Before the November U.S elections, Options traders nailed the breakout projection to $90k and $100k before everyone.

They are now positioning for Q1 2025, eyeing $110k, $120k, and $150k price targets as per Deribit data.

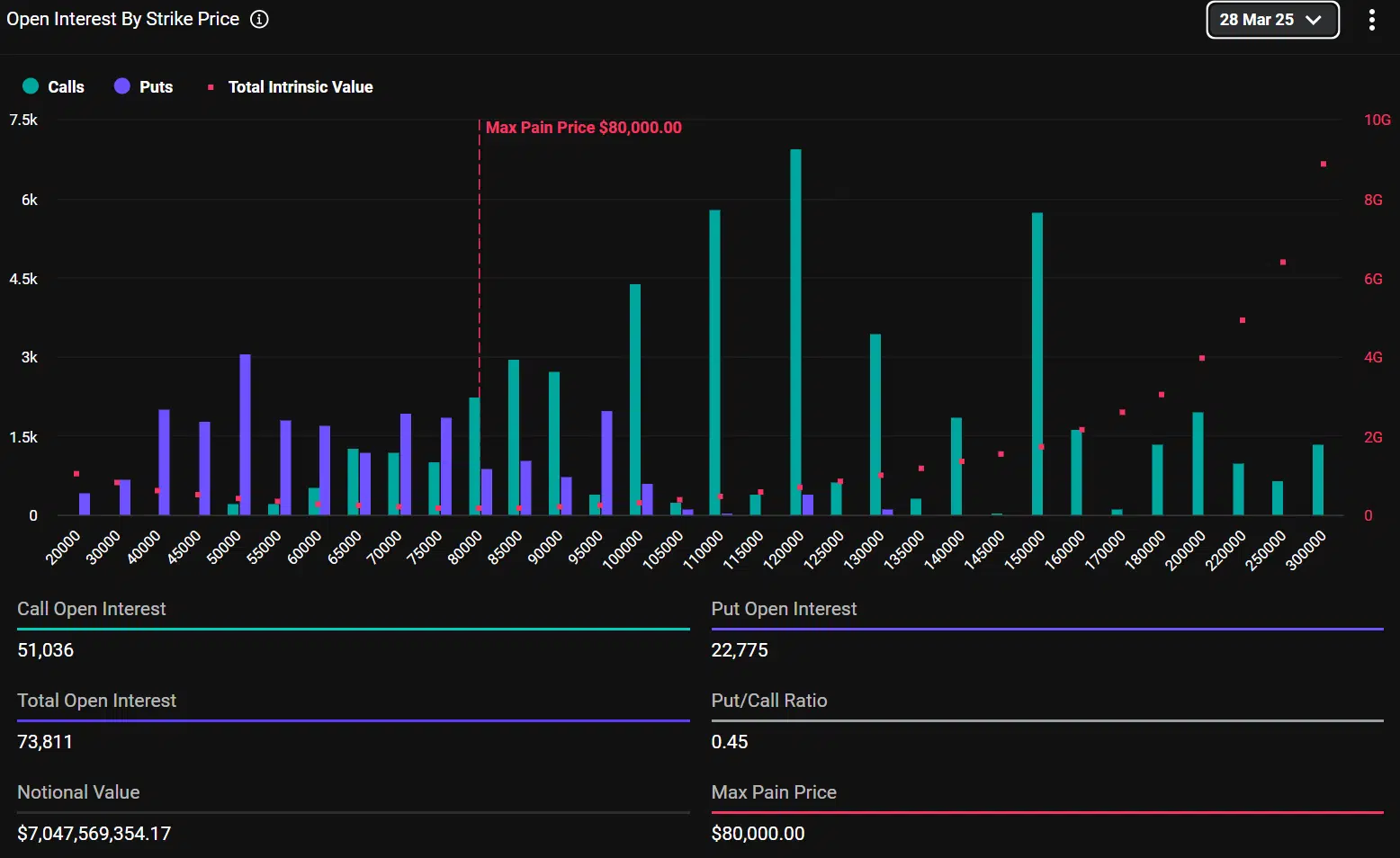

For the March expiry, the highest price target by Open interest (OI) was $120k, with calls dominating with nearly $700M in notional value.

This was followed by a $110k target, with calls commanding $554M in notional value. The $150k target had the third-largest money parked, with calls leading with $550M.

Overall, the put/call ratio was below 1 (0.45), indicating a bullish skew as calls outweighed puts. This underscored an overall bullish outlook for BTC in Q1 2025.

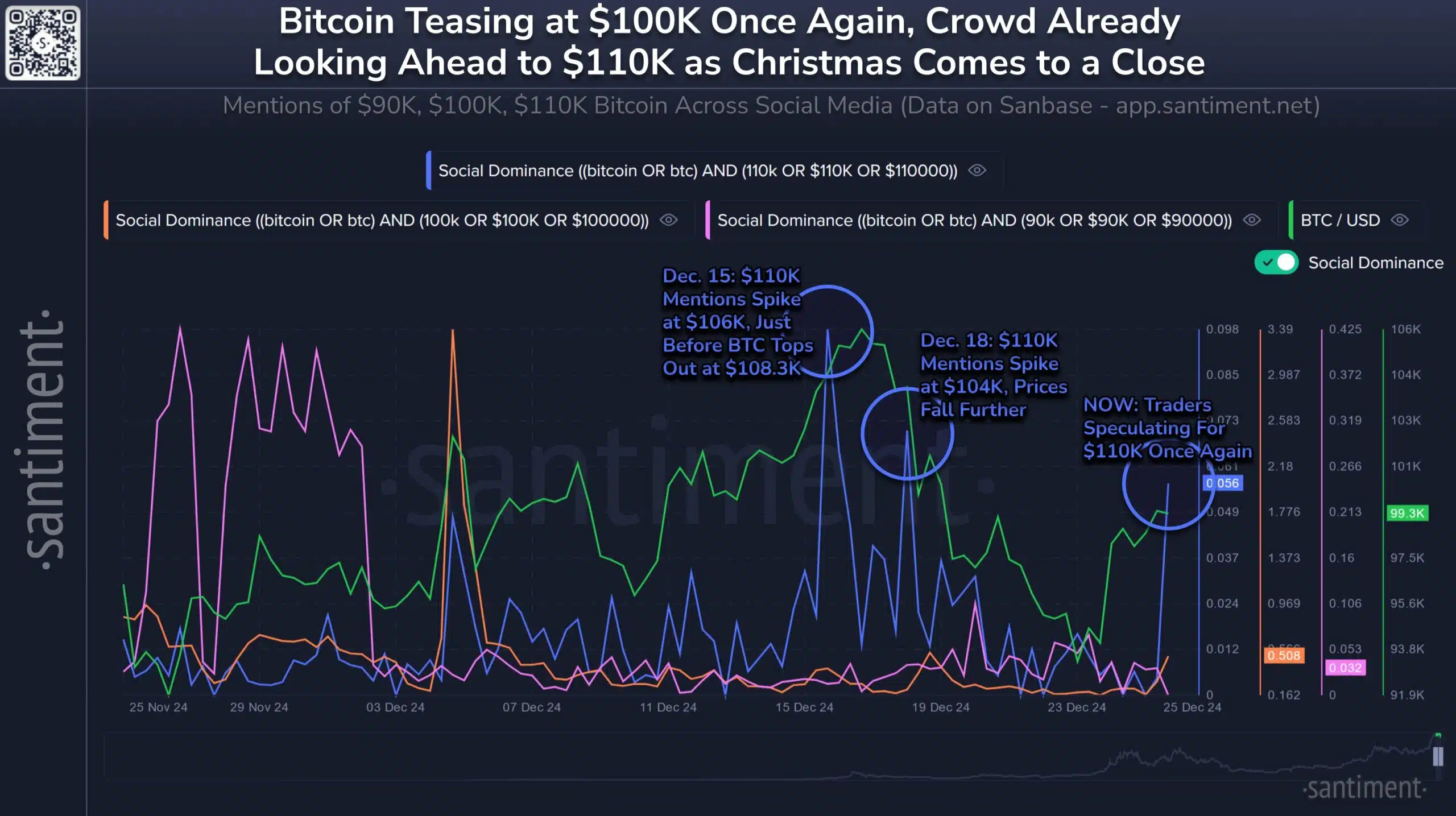

However, in the short term, BTC must top $110k before moving to the massive targets eyed by Options traders. According to Santiment, based on historical trends, the post-Christmas optimism among the crypto crowd could delay the $110k-level.

The analytics firm stated,

“Traders are now swinging bullish once again, with speculation of $110K getting rampant. Historically, we will see $110K Bitcoin only after the crowd doesn’t expect it, as this image shows.”

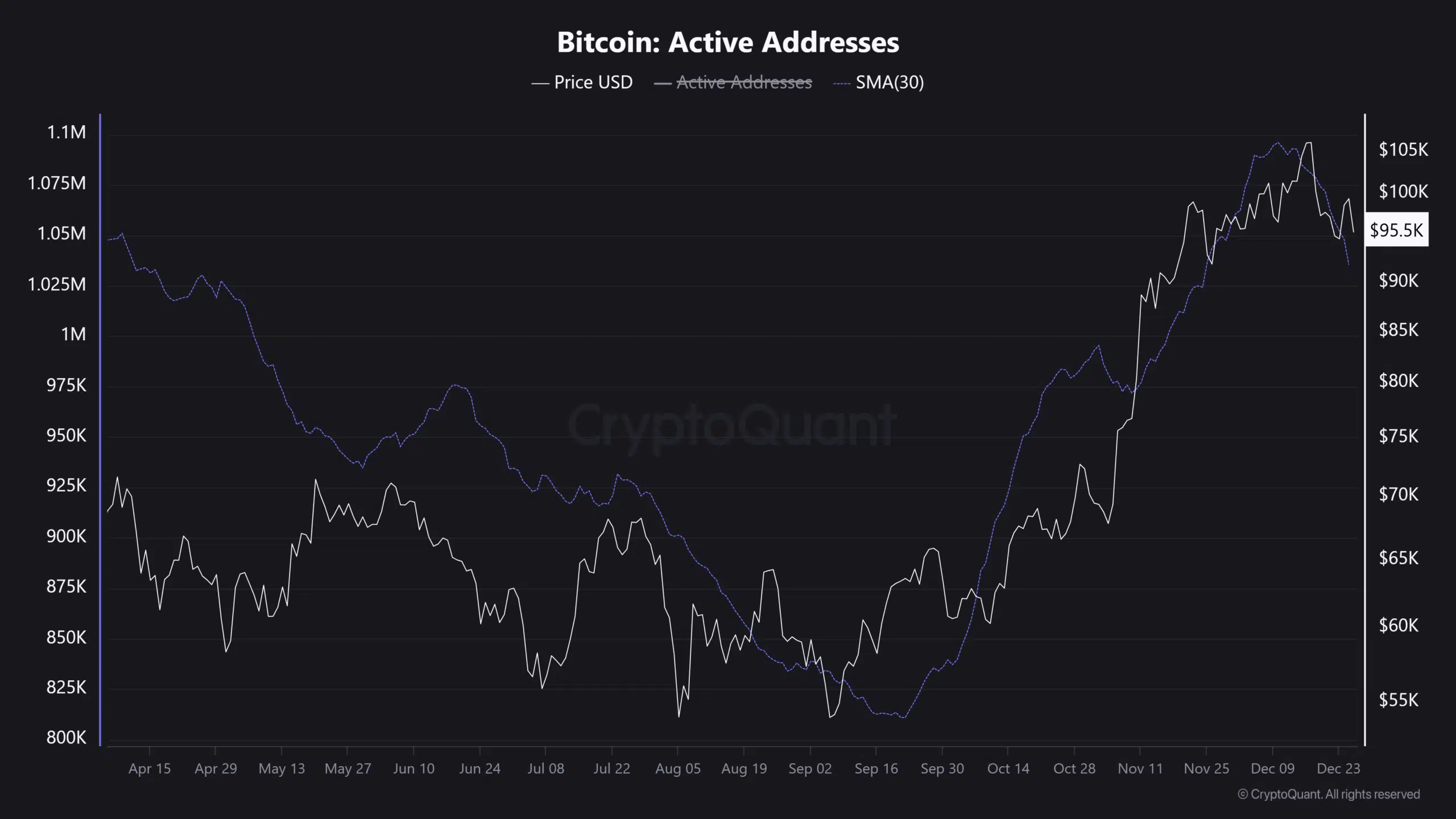

That being said, Bitcoin network’s growth is still strong. Since September, their active addresses have surged from 800k to 1M on average.

This illustrated strong market interest in the world’s largest cryptocurrency as it soared from $53k to $108k over the same period.

Read Bitcoin [BTC] Price Prediction 2025-2026

The likely key catalyst for the wild $150k target market could be the U.S BTC reserve.

Following speculations that President Donald Trump might use executive orders on day one to form the reserve, all focus will shift to his inauguration.