- About 64M SUI tokens (2.13% of total supply) will be unlocked on the 1st of February.

- SUI has dropped to an inflection point, which could trigger a reversal or extended plunge.

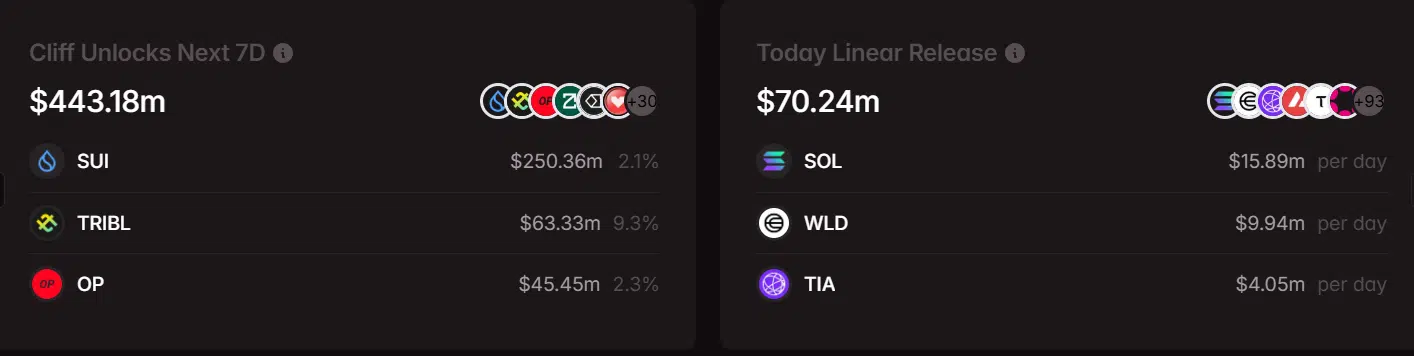

The layer 1 contender Sui [SUI] leads the list of token unlocks scheduled in the next seven days.

About 64M tokens (worth over $250M) or 2.1% of the circulating supply will hit the market on the 1st of February, just days after the Fed’s first interest rate decision in 2025.

Source: Tokenomist.ai

Depending on the broader market sentiment post-Fed guidance on the 29th of January, SUI could tank or rally after the token unlock.

SUI lags behind SOL

That said, since last August, SUI has eclipsed SOL in price performance by 550%. However, the run peaked in early January and has shed nearly 40% against SOL in the past two weeks.

While SUI has retreated to a potential inflection point, the unlock event and post-Fed sentiment might determine whether it will regain ground against SOL.

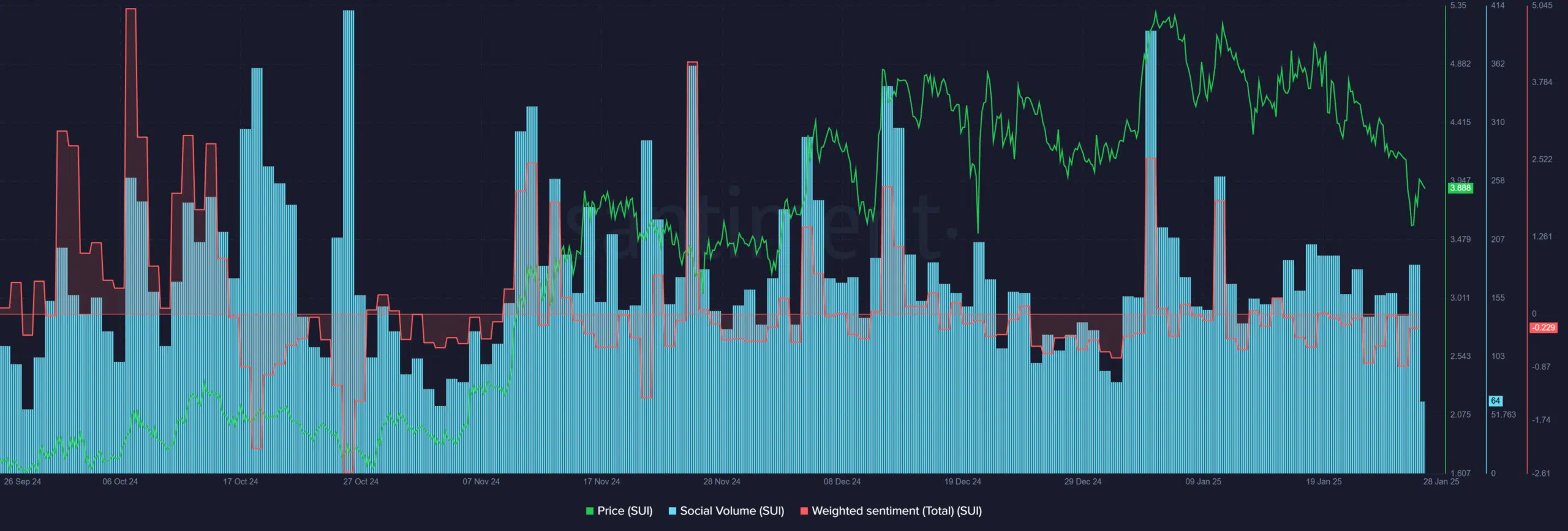

Additionally, sentiment and market interest were below par, at least as of this writing. The drop in social volume and negative weighted sentiment illustrated this.

For context, a recent positive spike in social volume and sentiment saw SUI top an all-time of $5.3.

Simply put, the current muted social volume and weak sentiment could cap SUI’s upside potential ahead of its unlock.

That said, the co-founder of the Sui network, Abiodun Adeniyi, teased an SMS transaction feature that could allow even those with non-smartphones to send money and crypto over the blockchain.

This could be disruptive and drive mass adoption.

Adeniyi said,

“Coming soon: #Sui will enable transactions through SMS, bringing payments, DeFi, rewards, and more to everyone, everywhere.”

In the meantime, SUI’s pullback was back to the $3.5 support, a key demand zone since last December.

Should the short-term support hold, SUI could reverse recent losses, with the immediate target of $4.5. However, a crack below it could extend the plunge to $3.0.