- LINK has skyrocketed by 30%, fueled by major partnerships and heavy accumulation.

- Investors are betting big on the future of Chainlink.

Chainlink [LINK] is on fire, fueled by a surge in price and two key catalysts: World Liberty Financial’s (WLFI) acquisition and rumors of a partnership with Cardano [ADA].

With these moves, LINK is hitting new highs – Could this be just the start of something bigger?

LINK building on strategic partnerships

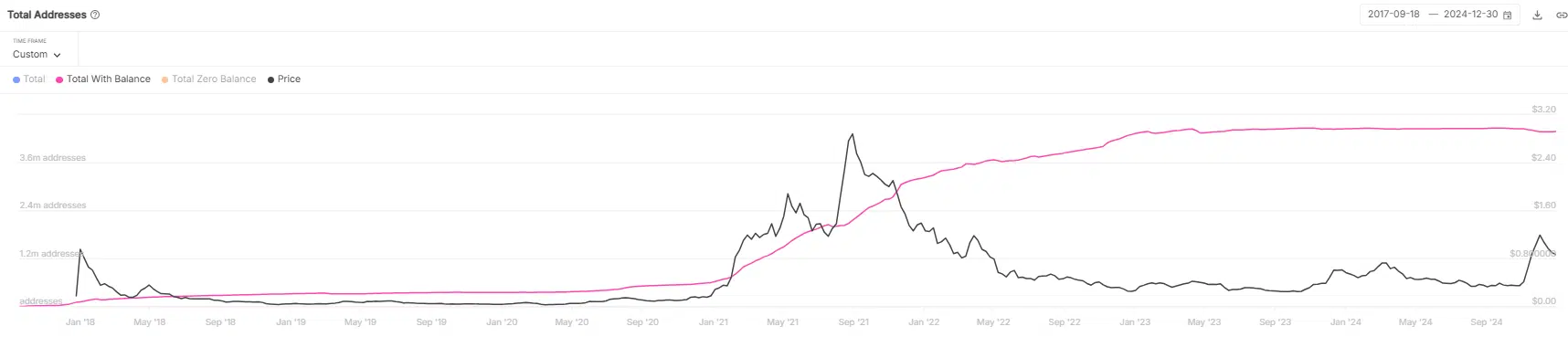

LINK may be 52% off its all-time high, but its impressive 205% surge since November last year is hard to ignore. While profit-taking has wiped out 39% of its post-election gains, 80% of holders are still in profit.

This shows strong demand is tightening the supply, keeping the momentum alive.

What’s driving this surge? A $4.7 million investment from Donald Trump’s World Liberty Financial (WLFI) has sparked a buying frenzy, pushing LINK’s market cap to an impressive $17.13 billion.

But that’s not all. Cardano’s co-founder, Charles Hoskinson, teased a potential partnership, signaling even bigger things ahead for Chainlink.

In the face of market volatility, these strategic moves have kept LINK strong. While LINK’s 24-hour growth has lagged rivals, with trading volume down 40%, its RSI shows no signs of overheating.

A rebound could be in place if FOMO returns.

Why Cardano?

Despite ADA failing to break the $1 mark, its network growth remains resilient. Daily active addresses have hit an impressive 50,828, setting new highs and proving that Cardano’s ecosystem is thriving.

Charles Hoskinson outlined three key goals for Cardano this year. First, bringing Bitcoin DeFi to Cardano, targeting a market bigger than Ethereum [ETH] and Solana [SOL] combined.

Second, improving scalability. And third, breaking barriers with integrations, starting with Chainlink.

A Cardano-LINK partnership could be a game changer.

Is your portfolio green? Check the Chainlink Profit Calculator

LINK stands to gain from Cardano’s strong community and market share, while Cardano taps into LINK’s cutting-edge tech and growing political influence—WLFI’s $4.7M investment being a prime example.

Together, they could redefine the blockchain landscape. These two are definitely ones to watch in 2025.