We’ll discuss market trends, analysts’ predictions, and XRP’s chances of hitting the ambitious mark.

Also, we’ll talk about PlutoChain ($PLUTO), a new Layer-2 solution that might push the boundaries in scalability and blockchain compatibility.

Here are all the deets.

Can XRP Surge to $20 if Ripple Wins the SEC Appeal?

As of January 21, 2025, XRP is trading at $3.17 – a 2.74% increase in the last 24 hours.

Over the past week, it has climbed by 19.6%, and its year-on-year growth is an impressive 459%. The 24-hour trading volume has reached $14.92 billion, reflecting strong market activity.

XRP’s market capitalization currently stands at $178.44 billion, with a circulating supply of 57.56 billion tokens.

When considering the total supply of nearly 100 billion tokens, the fully diluted valuation (FDV) is approximately $309.94 billion.

This gives XRP a market cap to FDV ratio of 0.58, which indicates that a significant portion of its total supply is already in circulation.

Historically, XRP hit its all-time high of $3.40 on January 7, 2018, leaving it just 8.8% below that peak.

On the other hand, its all-time low was $0.002686 on May 22, 2014, marking an extraordinary rise in value over the years.

The RSI is at 48 right now, which puts XRP in the neutral zone.

The legal battle between the SEC and Ripple Labs revolves around whether XRP, Ripple’s cryptocurrency, qualifies as a security.

Back in December 2020, the SEC accused Ripple of raising over $1.3 billion through unregistered securities sales.

In July 2023, Judge Analisa Torres ruled that Ripple’s XRP sales to institutional investors violated securities laws.

However, she decided that retail sales through exchanges did not count as securities transactions. This partial win for Ripple marked a key moment, as it separated institutional and retail sales under the law.

The SEC disagreed and filed an appeal. They argue that all XRP sales should fall under securities laws.

Ripple, on the other hand, insists that XRP is a digital currency, not a security. This back-and-forth has created uncertainty about how cryptocurrencies are regulated.

Many believe the case could drag on until late 2025. The outcome could carry massive implications for the crypto industry.

A win for the SEC might lead to stricter regulations for digital assets, while a Ripple victory could encourage a more flexible approach.

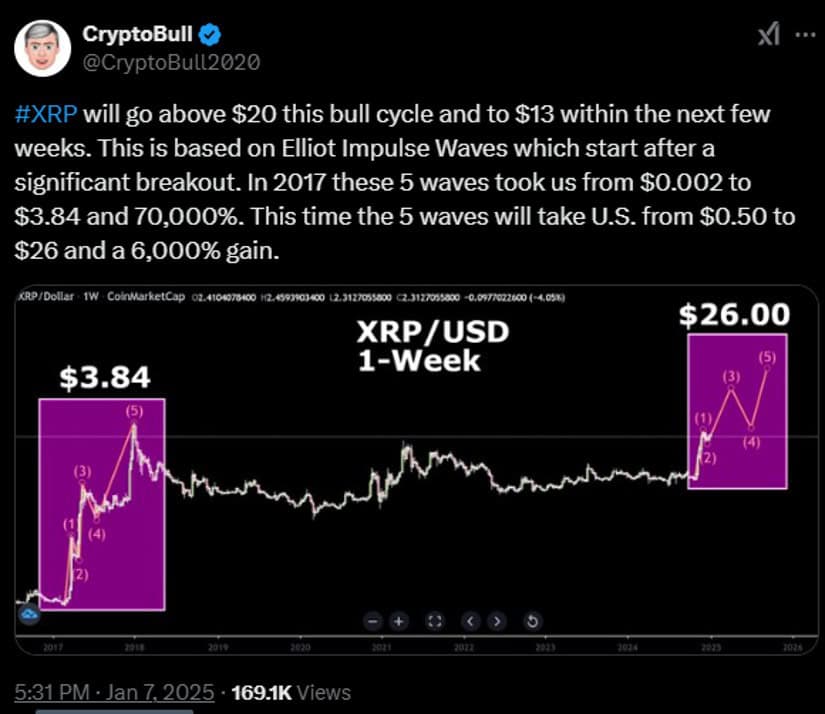

CryptoBall, an analyst on X, predicts that XRP will rise to $13 in the coming weeks and surpass $20 during this bull cycle, based on Elliott Wave Theory, which suggests significant price surges after a breakout.

XBT Liquidators say that XRP will reach a price target of $27-$30, based on high time frame Gann fan analysis.

PlutoChain ($PLUTO) Could Bring Faster Transactions, Lower Fees, and EVM Compatibility to Bitcoin

Bitcoin has always struggled with slow transactions, high fees, and network congestion. PlutoChain ($PLUTO) could change that with its hybrid Layer-2 design.

PlutoChain creates a parallel network that could work alongside Bitcoin’s main blockchain. This setup could reduce traffic, lower fees, and boost scalability.

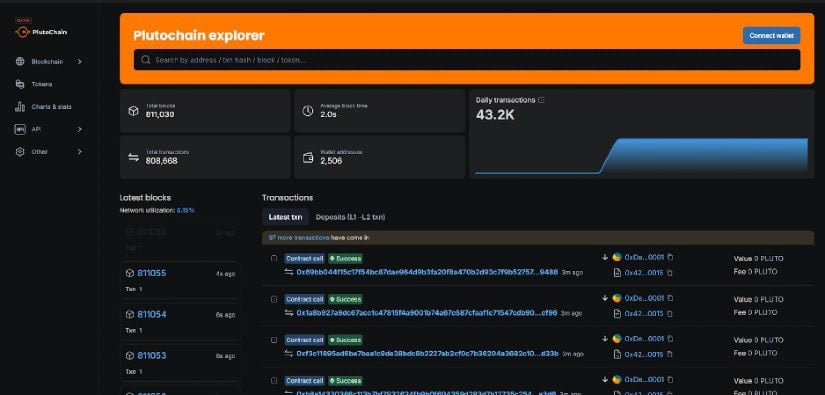

While Bitcoin’s 10-minute block times make it less competitive against faster blockchains like Ethereum and Solana, PlutoChain offers block times of just 2 seconds.

This could make way for smoother smart contract functionality, decentralized finance (DeFi), NFTs, and advanced blockchain applications.

EVM compatibility is another great feature. Developers could transfer Ethereum-based projects to Bitcoin’s secure infrastructure with ease.

This could make Bitcoin a more versatile platform and increase its real-world applications.

PlutoChain has already proven its potential. Its testnet processes 43,200 transactions daily without delays or congestion.

The project prioritizes security and it has passed audits from SolidProof, QuillAudits, and Assure DeFi. It also does regular code reviews and stress tests to further ensure safety and reliability.

Community involvement plays a big role in PlutoChain’s vision. Through a decentralized governance system, users can vote on key proposals, upgrades, and partnerships.

They submit ideas through the Discord community, which keeps the decision-making process open and collaborative.

Final Thoughts

While XRP’s future hinges on the outcome of the case, its growth and market activity demonstrate its resilience and appeal.

Meanwhile, PlutoChain might be a major robust solution for Bitcoin’s scalability challenges.

With its fast transactions, EVM compatibility, and strong community focus, PlutoChain could present a promising path for Bitcoin to evolve without compromising its core strengths.

This article is not financial advice. Past results are not indicative of future returns, and the crypto market is inherently unpredictable. Readers must conduct their own thorough research before purchasing any crypto coin or token. These forward-looking statements are subject to risks and may remain unchanged.

This article is sponsored content. All information is provided by the sponsor and Brave New Coin (BNC) does not endorse or assume responsibility for the content presented, which is not part of BNC’s editorial. Investing in crypto assets involves significant risk, including the potential loss of principal, and readers are strongly encouraged to conduct their own due diligence before engaging with any company or product mentioned. Brave New Coin disclaims any liability for any damages or losses arising from reliance on the content provided in this article.