Coinbase is now the Ethereum network largest operator, and that has some people worried. On March 19, the company revealed it controls over 11% of staked ETH, more than any other Ethereum node operator. That’s a lot of power in one place, and some experts think it could be bad for the network.

According to Coinbase’s report, the company has 3.84 million ETH staked across 120,000 validators, which equals 11.42% of all staked ETH as of March 4.

Karan Sirdesai, CEO of Web3 startup Mira Network, isn’t thrilled bout this, he said, “We’re creating a system where a few big players control most of the network. That’s not what decentralization is about”.

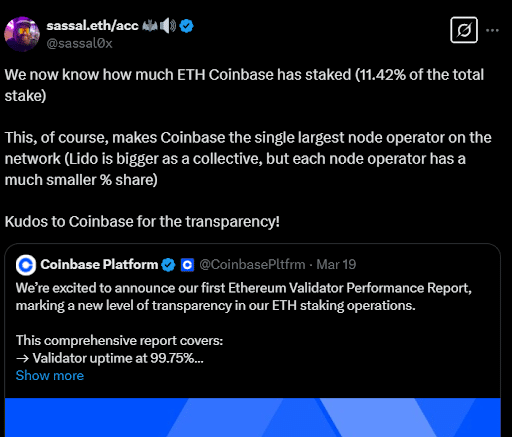

Liquid staking protocol Lido holds around 9.4 million ETH. But Lido spreads its stake across many independent node operators, making it less of a centralization risk. Anthony Sassano, host of The Daily Gwei, pointed this out in a March 19 post on X.

Coinbase, however, says it’s trying to keep things balanced. The company spreads its staking operations across five countries, uses multiple cloud providers and Ethereum clients, and monitors its network distribution regularly. “The health of the network is always a priority for us,” Coinbase stated in its report.

The issue could get even bigger if U.S. exchange-traded funds (ETFs) start staking ETH, something big asset managers like BlackRock want. Coinbase already holds ETH for eight of the nine U.S. spot Ether funds, which could push its influence even further.

Some experts think this could lead to censorship risks. Temujin Louie, CEO of Wanchain, warned that “If too much ETH is controlled by regulated companies like Coinbase, they might have to follow government rules instead of protecting Ethereum’s freedom”. Sirdesai agreed with this, he said big staking providers will likely prioritize legal compliance over network decentralization.

Meanwhile, U.S. regulators now allow banks to act as blockchain validators, meaning more big institutions could enter the staking game. Louie thinks this could make Ethereum feel more like traditional finance instead of the decentralized system it was meant to be.

But Coinbase might have competition. Robinhood could be a major challenger, according to Sirdesai. “They already have the tech, the users, and the ability to move into staking fast. They could actually compete with Coinbase better than any bank,” he said.

Also Read: Gelato Launches Blockchain-as-a-Service on Avalanche