Ripple has taken another significant step in expanding its footprint in Africa by partnering with Chipper Cash, a leading fintech firm on the continent.

This collaboration aims to streamline cross-border remittances, offering faster and more cost-effective transactions using blockchain technology.

Ripple Expands African Presence with Chipper Cash Partnership

Chipper Cash will integrate Ripple Payments into its platform, leveraging the efficiency of blockchain to facilitate seamless international money transfers. Reece Merrick, Ripple’s managing director for the Middle East and Africa, emphasized the importance of this partnership, stating, “By integrating our technology into Chipper Cash’s platform, we’re enabling faster, more affordable cross-border payments while driving economic growth and innovation.”

Africa’s payments landscape is evolving, and Ripple Payments is helping enable faster, cost-effective, cross-border transactions. Source: Chipper Cash via X

Chipper Cash’s co-founder and CEO, Ham Serunjogi, also highlighted the impact of the collaboration, explaining that crypto-enabled payments could enhance financial inclusion and grant businesses and individuals greater access to global markets. He noted, “This integration will allow our users to send and receive funds faster and at significantly lower costs.”

Blockchain Adoption Transforming Africa’s Remittance Industry

Africa has seen a rapid rise in crypto adoption, particularly in the remittance sector, where traditional banking methods often come with high fees and slow processing times. Ripple’s blockchain solutions aim to address these inefficiencies by providing 24/7 accessibility to payments, making it easier for individuals and businesses to transact internationally.

Ripple and Chipper Cash join forces to drive fast, low-cost crypto payments across Africa, boosting financial inclusion. Source: Ripple_X via X

For example, a Nigerian business person who imports goods from China can now pay for the goods in real-time, avoiding the inefficiencies and costs normally associated with cross-border transactions. The partnership with Chipper Cash will enhance such financial services, eliminating intermediaries and reducing operating costs.

This growth is a sequel to Ripple’s previous collaboration with Onafriq (formerly MFS Africa) in 2023 that facilitated payments in 27 African countries and key global markets such as the UK, Australia, and Gulf states. The latest venture in Africa is part of its larger strategy to put Ripple XRP news at the forefront of blockchain-based finance.

Ripple Strengthens Global Presence Despite Legal Hurdles

Ripple’s continued expansion happens against the backdrop of its prolonged court battle with the U.S. Securities and Exchange Commission (SEC). The prolonged XRP lawsuit has long been a pressing issue among investors, but new developments suggest the conflict could be near an end. Ripple CEO Brad Garlinghouse expressed he is positive on the company’s legal situation, declaring that settling the lawsuit would introduce badly needed regulatory clarity.

The SEC v. Ripple case could be fully resolved within 60 days, pending an SEC Commission vote and a final court sign-off. Source: Fred Rispoli via X

Ripple’s recent regulatory approvals, including getting a crypto payments license in Dubai, are indications that the company is determined to go global at a time of legal uncertainty within the U.S. The company now has over 60 regulatory licenses and registrations across the globe, further bolstering its position as a big player in the world of global payments.

XRP Price Poised for a Breakout?

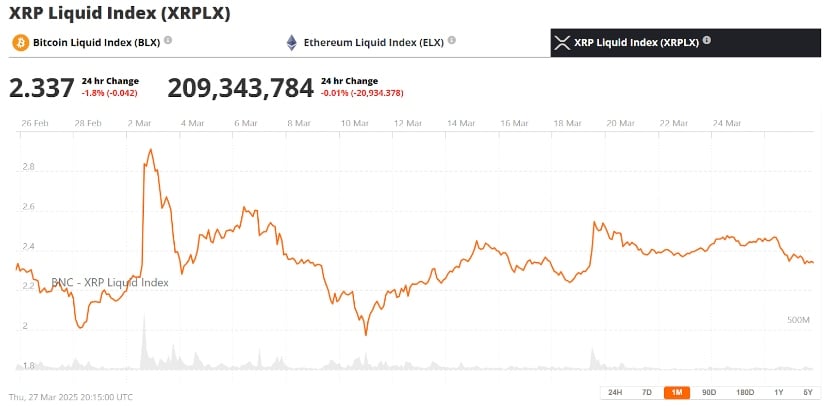

While Ripple strengthens its market presence, XRP price movements have also drawn attention. The cryptocurrency has maintained a strong position above the $2 mark for nearly three months, signaling stability ahead of a potential breakout.

A breakout above the $3 resistance could be pivotal for XRP’s bullish outlook. Source: Mochoa777 on TradingView

Technical analysts have identified a consolidation pattern suggesting that XRP could surge between March 30 and April 25. If bullish momentum builds, resistance levels at $2.70, $3.08, and $3.40 may be tested, with some experts predicting an eventual challenge of XRP’s all-time high of $3.40.

Crypto fund manager Bitwise has projected an optimistic long-term scenario in which XRP could reach $29.32 by 2030, assuming continued adoption in cross-border payments and tokenization markets. However, in a less favorable environment, they also outlined a bearish scenario where the cryptocurrency might drop to $0.13 if institutional support wanes.

Market Outlook: What’s Next for XRP?

The next few weeks could be decisive for XRP price, with technicals and sentiment both indicating rising volatility. If XRP is able to break through key resistance levels, it could trigger a rally similar to the previous bull runs. Traders are, however, vigilant, monitoring support levels of $2.24 to $2.30 for signs of a potential pullback.

Ripple (XRP) was trading at around $2.33 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

While Ripple XRP news keeps unfolding, its growing use in Africa and elsewhere in the world highlights its real-world use in altering the finance industry. With its recent agreement with Chipper Cash and its growing global influence, Ripple is cementing its place as the authority on blockchain-powered finance.