Ripple XRP has overtaken Solana in spot trading volume, marking a significant shift in market dynamics.

Previously, Solana dominated with 70-80% of the trading volume, but XRP now commands more than 50%. The surge follows a 13% increase in XRP price after the U.S. Securities and Exchange Commission (SEC) dropped its lawsuit against Ripple Labs. This legal win has bolstered investor confidence, fueling speculation about the approval of an XRP exchange-traded fund (ETF).

According to Kaiko, a leading blockchain analytics firm, the increased trading activity in Ripple cryptocurrency is not a temporary anomaly. The firm reported that XRP’s liquidity has also improved, with its 1% market depth now surpassing that of Solana. The latest Solana news, in contrast, highlights the struggles of its futures ETF, which saw a lukewarm debut with just $12 million in trading volume.

XRP’s Market Performance vs. Solana

Despite facing challenges in the past due to the SEC lawsuit, XRP has emerged as one of the best-performing cryptocurrencies in 2025. Whereas Bitcoin, Ethereum, and other big assets have declined, XRP has gained more than 18% year-to-date. The market cap now positions XRP as the fourth-largest cryptocurrency at a value of $142 billion.

XRP was trading at around $2.44 at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

At the same time, bad luck continues to haunt Solana. The latest Solana news suggests its market capitalization has declined more than any other of the top 10 cryptocurrencies, aside from Ethereum and Dogecoin. Network congestion and the controversy surrounding Solana blockchain-based meme coins in early 2024 did not help and have affected the sentiment of investors.

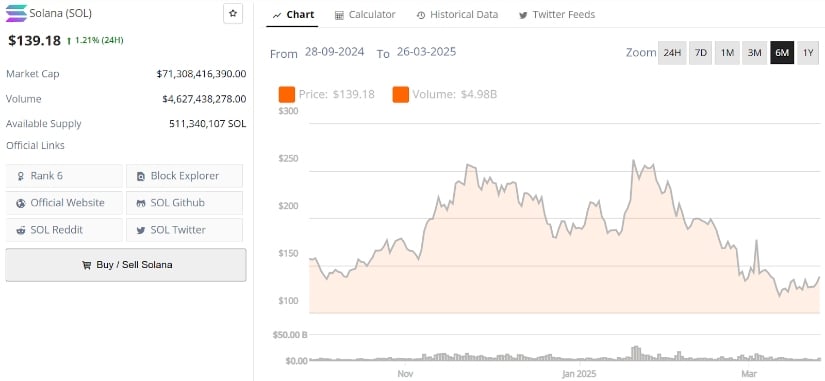

Solana (SOL) was trading at around $139.18, up 1.21% in the last 24 hours at press time. Source: Brave New Coin

Liquidity and Trading Volume: XRP Gains an Edge

The second major benefit XRP has over Solana is liquidity. According to Kaiko, XRP now enjoys deeper liquidity than Solana, meaning it can soak up larger trades with less price impact. It takes approximately $3.2 million of XRP trades to move its price by 1%, compared to Solana, where $2.8 million is required.

XRP and Solana saw major inflows of $6.71M and $6.44M, boosting weekly crypto investments to $644M. Source: Amatoshi via X

On the inflows front, XRP has been the clear victor among the altcoins. The latest Ripple XRP news highlights that the token saw $6.7 million in inflows last week, surpassing Solana’s $6.4 million inflows. Ethereum, however, saw an outflow of $86 million, which is indicative of ongoing concerns regarding its performance in the altcoin space.

Rising ETF Speculation and Institutional Interest

The SEC Ripple lawsuit resolution has significantly increased the odds of an XRP ETF approval. Data from the prediction market Polymarket shows that the likelihood of an XRP spot ETF being approved by the end of 2025 has surged to 83%. Ripple CEO Brad Garlinghouse recently hinted that multiple XRP ETF applications, including spot, leveraged, and inverse products, are awaiting regulatory approval.

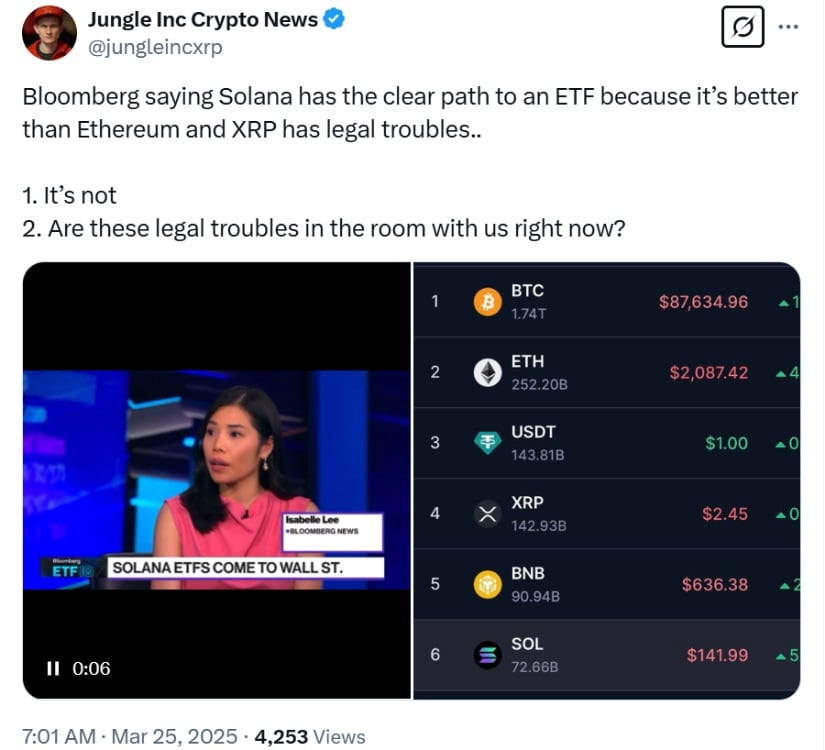

Bloomberg claims Solana has the strongest ETF prospects, arguing it outperforms Ethereum while XRP remains hindered by legal challenges. Source: Jungleinxrp via X

Meanwhile, institutional interest in Solana ETFs has been underwhelming. CME Group’s launch of Solana futures on March 18 failed to gain traction, with lower-than-expected institutional participation. The latest Solana news suggests that while retail traders are showing interest, the lack of institutional demand has dampened the enthusiasm surrounding Solana’s ETF prospects.

What’s Next for XRP and Solana?

With regulatory certainty now in place, XRP price prediction models show further upside as the market searches for an ETF rollout. With approval, an XRP ETF would enable even more institutional buying, as has been seen with Bitcoin and Ethereum ETFs. Additionally, Ripple’s partnerships, like its efforts with big financial institutions like Bank of America, all continue to support its dominance of cross-border payments.

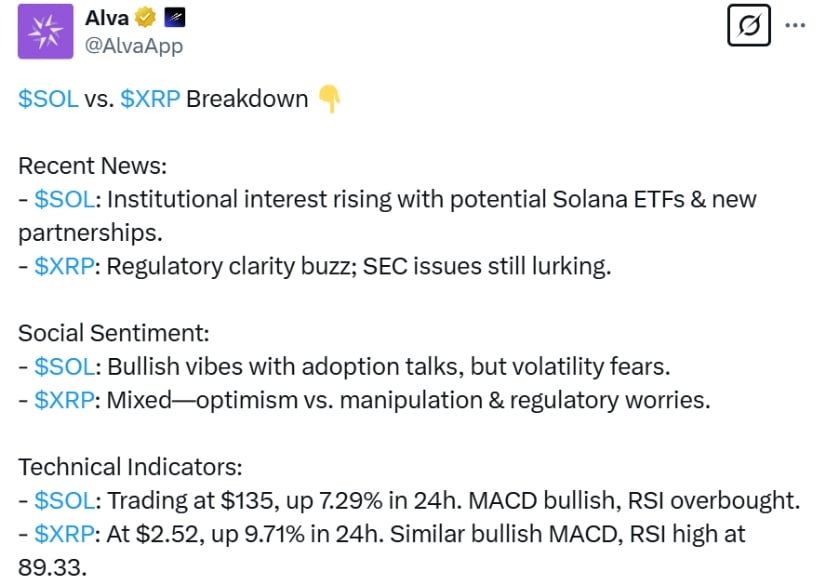

Solana gains institutional interest and ETF buzz, while XRP rides regulatory clarity hype; both show bullish momentum but face volatility and legal concerns. Source: Alva via X

On the part of Solana, investors are paying close attention to what happens with its proposed spot ETF. The newest Solana ETF news is that regulatory approval is in doubt, but if approved, it would be a welcome shot in the arm for Solana’s market position.

Both Solana and XRP remain strong players in the shifting cryptocurrency landscape. However, with a strong legal foundation, deeper liquidity, and growing institutional interest, Ripple currency price momentum appears to be outpacing that of Solana for now.