In a development that could mark the closing chapter of one of the most watched legal battles in crypto history, Ripple Labs and the U.S. Securities and Exchange Commission (SEC) have filed a joint motion to pause their appeals in the ongoing XRP lawsuit.

The April 10 motion, submitted to the Second Circuit Court of Appeals, indicates the two parties have reached an “agreement-in-principle” and are now seeking a negotiated resolution.

A Major Shift in the XRP Lawsuit

The XRP lawsuit, which began in December 2020, stems from the SEC’s accusation that Ripple sold XRP as an unregistered security. The case has since evolved into a broader debate about the classification of cryptocurrencies in the U.S., with Ripple defending XRP as a digital asset, not a security.

Ripple and the SEC have jointly moved to pause their XRP lawsuit appeals as they await the commission’s approval of a settlement. Source: James K. Filan via X

After more than four years of litigation, the SEC and Ripple have now jointly requested the court to hold their appeal and cross-appeal in abeyance, halting all legal activity for 60 days. According to the filing, this pause will “conserve judicial and party resources while the parties continue to pursue a negotiated resolution.”

The motion cancels the previously scheduled April 16 deadline for Ripple to respond to the SEC’s appeal brief. Ripple’s defense lawyer James Filan confirmed this in an X post, stating, “The settlement is awaiting Commission approval. No brief will be filed on April 16.”

Ripple’s Partial Legal Win and Path to Resolution

The legal turning point came in July 2023, when Judge Analisa Torres ruled that Ripple’s institutional sales of XRP violated securities laws, but its programmatic sales on public exchanges did not. This mixed ruling gave Ripple a partial victory and set the stage for potential settlement talks.

Source: Luciferisfalselight via X

Ripple CEO Brad Garlinghouse declared the “end of the case” last month, while Chief Legal Officer Stuart Alderoty signaled that Ripple would not pursue a cross-appeal. The latest motion, which covers all remaining litigation matters including claims against Garlinghouse and co-founder Chris Larsen, reinforces speculation that a final settlement is within reach.

One reason for the timing, according to observers, is the change in leadership at the SEC. Paul Atkins, a pro-crypto advocate, was confirmed as the new SEC Chair on April 9. His swearing-in could happen as soon as April 12, and insiders suggest that the SEC might be waiting for Atkins to take office before officially approving the settlement.

“SEC is ready to settle but is waiting for Atkins to take the helm… to start off with dropping the biggest case of their career and start with a huge win,” one X user noted in response to Filan’s update.

Market Reactions and XRP Price Forecast

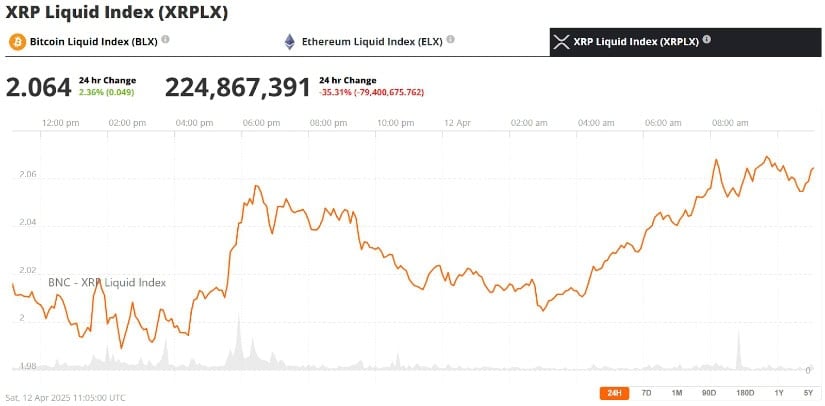

Despite the legal breakthrough, the XRP price saw a modest decline of 4.24% on April 10, dropping to $1.9649. This dip erased some of the 14.32% gain from the previous session. Experts believe that the market has largely priced in expectations for a good result.

XRP price has already broken the $2 resistance following the Ripple SEC lawsuit news. Source: Mindfullylost on TradingView

The price of XRP is currently at $2.01, with a 24-hour volume of $4.14 billion, as data from CoinMarketCap shows. Analyst Egrag Crypto has been optimistic about the XRP price prediction, taking the view that macroeconomic shifts and regulatory certainty can cause XRP to surge up to $27 in the future.

Meanwhile, the approval of the Teucrium 2X Long Daily XRP ETF by NYSE Arca has added further momentum, reflecting growing institutional interest and confidence in XRP as a compliant digital asset.

Implications for Ripple and the Crypto Industry

A final settlement would not only close the Ripple lawsuit but could also establish key precedents for U.S. crypto regulation. Ripple is expected to pay a reduced civil penalty—reportedly around $50 million, significantly down from the initial $125 million proposed by the SEC.

This outcome may allow Ripple to restore institutional relationships and expand its U.S. operations. It may also strengthen Ripple’s institution relationships such as with Bank of America and help in making the Ripple ledger a compliant cross-border payments blockchain network.

“SEC’s move to hold off on litigation and negotiate a settlement with Ripple—combined with pulling off lawsuits against Coinbase and Kraken—points to a broader regulatory rebalancing,” said a lawyer familiar with the matter.

XRP is trading at around $2.06, up 2.36% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

If approved, the Ripple settlement would redefine the SEC’s enforcement approach to cryptocurrencies, away from general crackdowns and towards negotiated regulatory clarity.

Looking Ahead

As both sides await official approval from SEC commissioners, the next 60 days could be decisive. If the settlement proceeds, Ripple may emerge as a model for future crypto compliance—ushering in a new era of cooperation between blockchain firms and U.S. regulators.

For XRP holders and the broader crypto community, this Ripple news offers a glimmer of resolution to a years-long dispute that has shaped the regulatory conversation around digital assets. Whether the Ripple currency price will soar on the back of final settlement news remains to be seen, but one thing is clear: the Ripple market is bracing for the next chapter.