- Bitcoin is holding strong as global markets remain highly responsive to tariffs

- U.S government could buy Bitcoin using revenue from tariffs

Since the re-election of Donald Trump, crypto adoption has become one of the administration’s major agendas. In fact, President Trump has promised to make the United States the crypto capital of the world. Lately though, the question of how to raise revenue to accumulate crypto assets, especially Bitcoin [BTC], has taken center stage.

The Trump administration has now come out with a plan to raise revenue for Bitcoin acquisition. During an interview, Bo Hines, Executive Director of Digital Assets, said that the U.S government may buy Bitcoin using tariff revenue. Apart from tariff revenue, the government is also considering revaluing gold certificates at the U.S treasury and using the extra funding to buy more Bitcoin.

With higher tariffs, the Trump administration is aiming to raise more revenue from external governments. If such revenue is channeled into Bitcoin, the government could acquire a considerable amount. Worth pointing out, however, that financial markets and the wider crypto market have reacted quite differently to these tariff episodes.

How is Bitcoin reacting to tariffs?

According to Santiment, Bitcoin continues to show resilience as global financial markets remain highly reactive to shifting tariff announcements from the Trump administration.

Although volatility arising from tariffs is still affecting Bitcoin, on-chain data revealed that the cryptocurrency has been exhibiting relative strength.

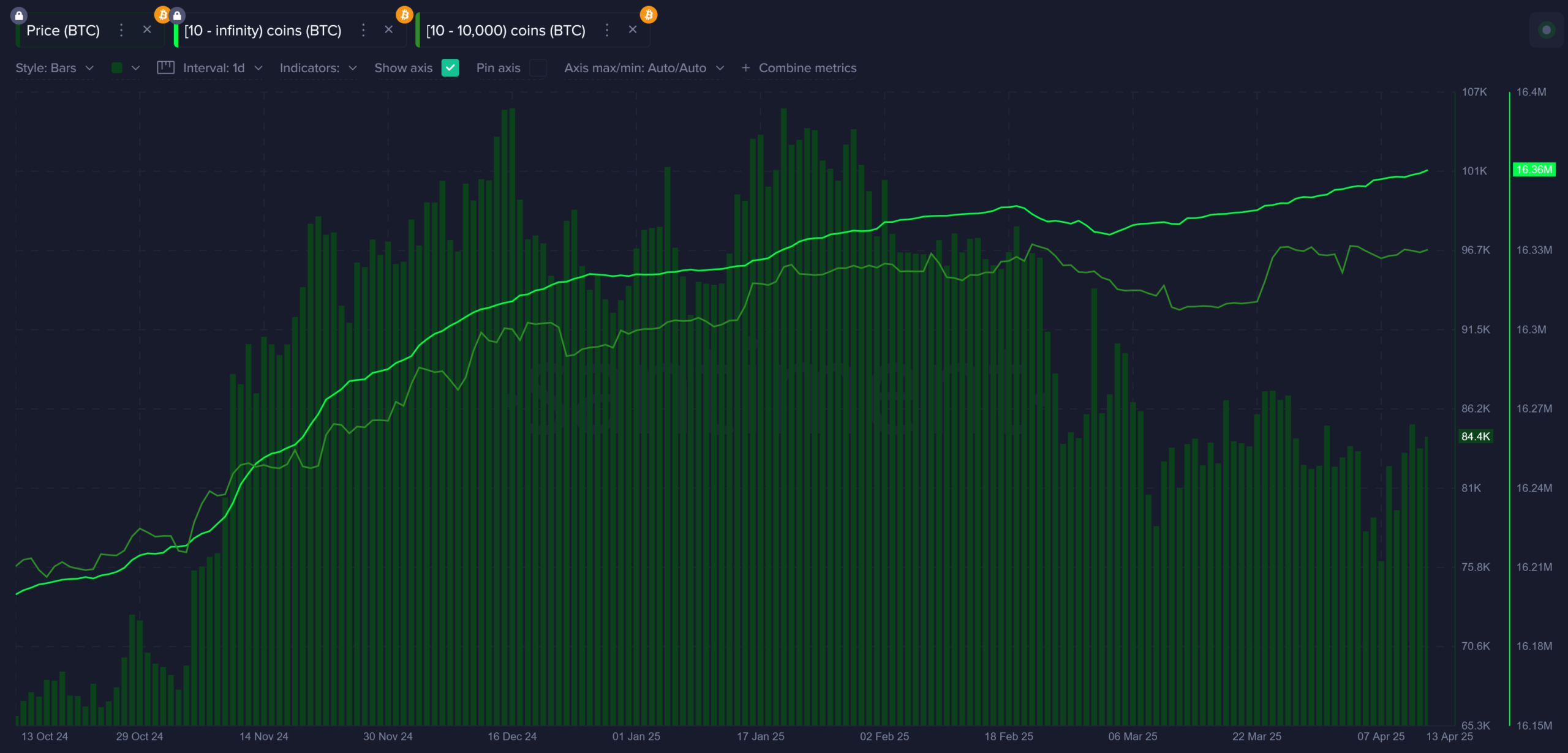

For example – Wallets with 10 or more BTC have continued to rise in holdings, climbing to an all-time high of 16.36M BTC held.

Such a spike in sharks and whales suggested that large holders are bullish and might be anticipating that Bitcoin will hold firm in this period of uncertainty.

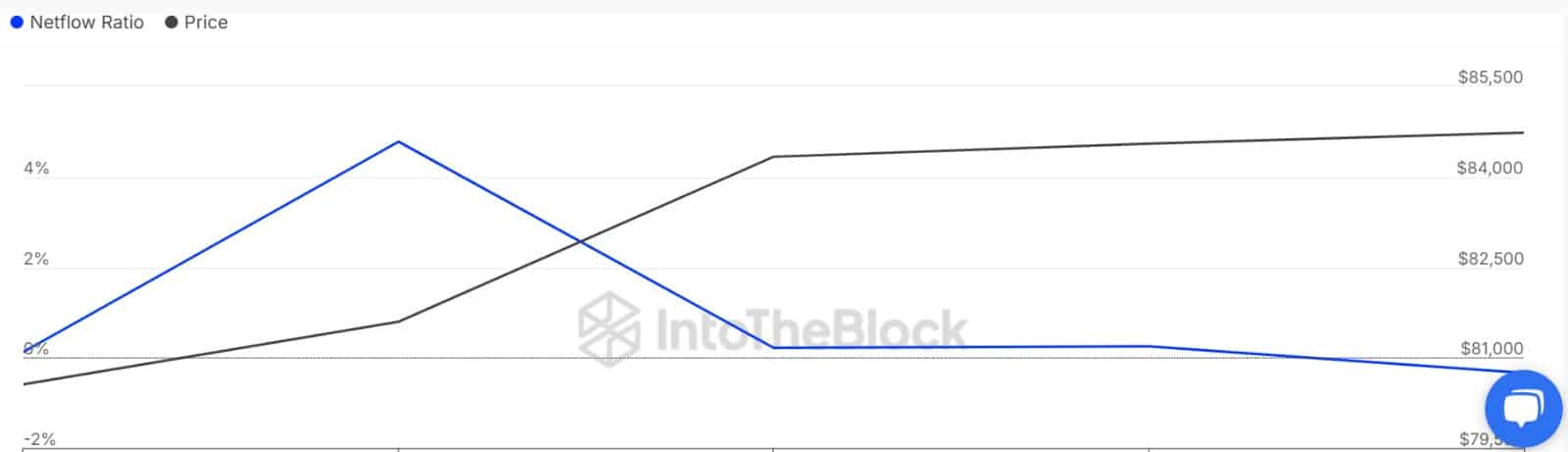

Looking at the large holders’ netflow to exchange netflow ratio, we can see that whales have not been selling. In fact, the whale flow ratio to exchanges dropped to a weekly low of -0.34% – A sign of bullish sentiments among whales.

Additionally, the amount of available BTC sitting on exchanges is still dipping, as there are more and more signs of traders holding on for the long run. This means that despite market fluctuations arising from tariffs, Bitcoin holders and investors have continued to hold firm.

This market behavior can be validated by the sustained decline in the sell-side risk ratio.

It fell throughout April to 0.001. It suggested that investors, especially long-term holders, are currently less incentivized to sell. Thus, these investors expect the price to rise higher in the near team.

Therefore, channeling tariff revenue into Bitcoin will restore confidence to retail traders and turn every market participant bullish.

This announcement is good news for BTC and could help drive the price higher. Especially as investor confidence in the administration returns.

What does it mean for BTC?

While tariffs have negatively affected the financial market, Bitcoin has held strong and rebounded strongly from a tariff-related dip.

Therefore, with BTC holding strong in a time of uncertainty such as now, policy clarity over tariffs is a good thing for the crypto. If the U.S government takes revenue from tariffs and starts to buy Bitcoin, investors and holders alike will start perceiving tariffs positively. Such a shift in sentiment will erode concerns within the market.

If such a scenario plays out, we could see major upsides. A shift in tariff-related sentiment will see Bitcoin reclaim pre-liberation day levels of around $88,500. However, if investors are not convinced fully about the policy, the crypto will continue to consolidate between $83k and $85k.