Key Insights:

- XRP faces a 70% downside risk from bearish chart formation.

- South Korea demand props up XRP amid U.S. legal uncertainty.

- ETF momentum builds, but regulatory clarity remains elusive.

XRP price is trading on a tightrope as fresh legal twists, uncertain regulatory direction, and aggressive South Korean demand collide at a critical technical level. Analysts now debate whether Ripple’s token is gearing up for a breakout above $3.50—or facing a slide toward $0.65.

The price of XRP stood at $2.12 on April 5, nearly flat on the day, but 17% lower over the past 30 days. The price continues to face pressure despite bullish inflows from South Korean markets and growing ETF optimism in the United States.

Emergency Filing Reignites Ripple v. SEC Lawsuit Spotlight

Investor attention spiked after a surprise filing from Justin W. Keener, a former penny stock dealer previously fined $10 million by the U.S. Securities and Exchange Commission (SEC). In his latest motion, Keener claimed to possess “decisive evidence” relevant to Ripple’s legal battle with the SEC over XRP’s classification.

The emergency motion introduced proprietary data on investment contracts, which Keener says could influence Congress and reshape the SEC’s stance on XRP. The filing follows the SEC’s closed-door meeting on April 3, which stirred speculation over a possible withdrawal of the programmatic sales argument.

That speculation proved unfounded. No official comment came from the SEC. Ripple’s XRP has remained volatile as legal clarity remains elusive.

Coinbase and CFTC Filing Adds ETF Momentum

Coinbase submitted a filing to the U.S. Commodity Futures Trading Commission (CFTC) seeking approval for futures trading of XRP. The launch, expected on April 21, could provide a new source of institutional liquidity.

Meanwhile, 18 spot XRP exchange-traded fund (ETF) applications are pending before the SEC. BlackRock remains absent from the list, but according to AP Abacus, filings may be imminent. Analyst Andrew suggested BlackRock will eventually include XRP in crypto asset class products.

“If nothing else, both [SOL and XRP] will be included,” he said in a recent statement.

South Korea’s XRP Demand Remains a Lifeline

While legal and ETF speculation dominates U.S. headlines, South Korea continues to serve as a key demand driver for XRP.

According to crypto analyst XForceGlobal, the altcoin consistently leads trading volume on South Korean exchanges, even outpacing Bitcoin during slow periods. Upbit, the country’s largest exchange, reportedly holds 6 billion XRP—about 5% of the total supply.

The analyst noted that XRP’s role as a cross-border payment tool in South Korea helps sustain its utility. Millions of retail users reportedly hold XRP as part of their daily transactional ecosystem.

“South Korea’s regulatory isolation and retail support are holding XRP steady,” XForceGlobal wrote.

Chart Pattern Sparks Breakout or Breakdown Debate

On the technical front, XRP is stuck beneath its 20-day exponential moving average at $2.22. The Bollinger Bands are tightening, indicating a potential volatility spike.

A break above the middle band at $2.27 could trigger a retest of the upper band near $2.50. If support at $1.96 fails, however, a deeper slide could follow. The Relative Strength Index (RSI) remains weak at 42, showing little bullish momentum.

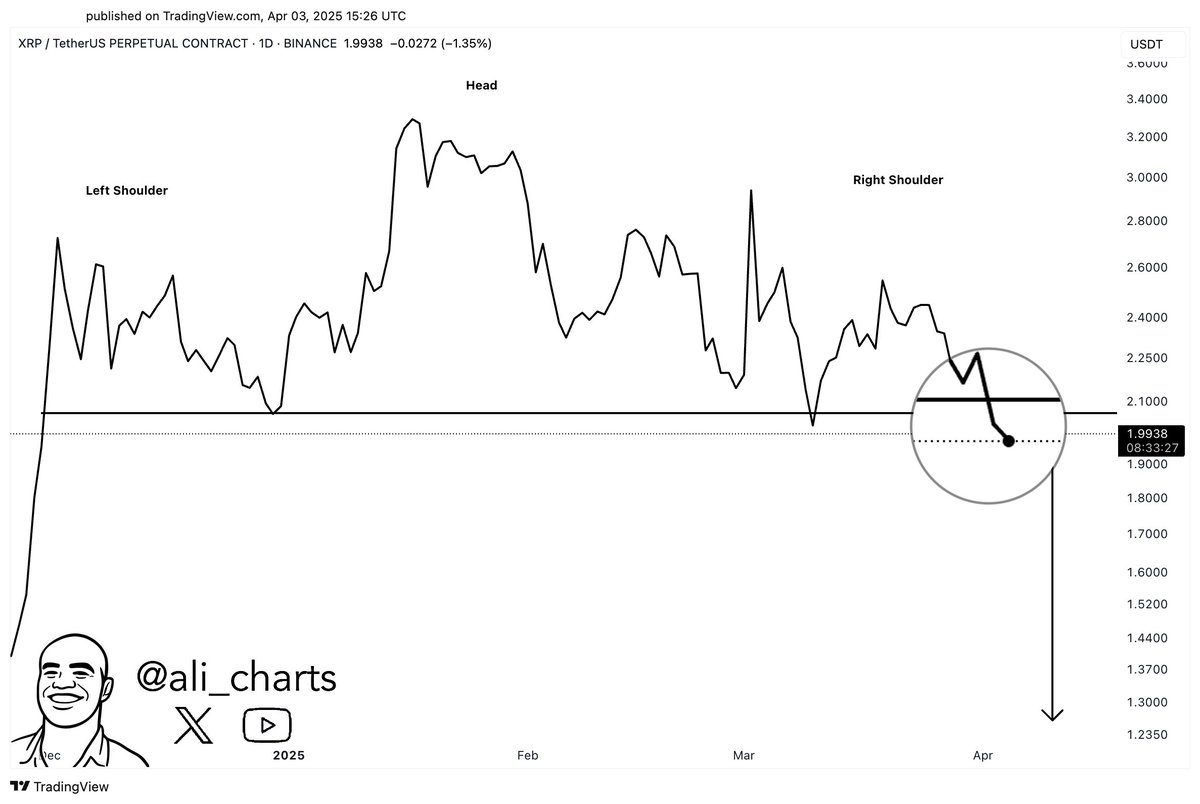

Ali Martinez, a widely followed analyst, identified a head-and-shoulders pattern with a neckline at $2.10. He warned that if confirmed, XRP could fall as low as $1.30 based on the measured move from its $3.20 peak.

In contrast, analyst Dark Defender believes XRP is still inside a bullish Elliott Wave structure. He set short-term targets of $2.22 and $2.55, arguing the ongoing correction is part of a B Wave phase.

XRP Price Wedge Formation Points to Extreme Outcomes

Adding fuel to the fire, another trader suggested XRP is forming an Ascending Broadening Wedge—known for wild breakouts and breakdowns. According to the pattern’s guidelines, XRP would need a strong close above $3.50 to confirm bullish momentum.

Failing that, rejection from the $5 range could push the token to retest $1.90 and then possibly break to $0.65.

“There’s a 70% chance it breaks to the downside,” the trader cautioned, “and just 30% for a bullish breakout.”

The pattern suggests a best-case target of $17.50, but that outcome remains unlikely unless XRP clears key resistance.

With XRP’s trapped between macro legal risk, localized bullish demand, and ETF uncertainty, April could decide the token’s next major move.

Disclaimer

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.