As the global financial markets reel from escalating trade tensions between the U.S. and China, Ripple’s XRP is showing signs of emerging as a safe haven asset.

With U.S. equities losing trillions in market value, investors are increasingly turning to digital currencies—and XRP is riding that wave with impressive momentum.

In recent days, the XRP price surged over 12%, reclaiming the $2.12 level and flashing bullish signals that hint at a potential breakout toward $2.58.

Trade Tensions Spark Capital Rotation into Crypto

The catalyst for XRP’s recent rally has been the global reaction to China’s retaliatory tariffs, a response to the United States’ earlier 10% trade levies. Beijing’s move, which includes 34% duties on U.S. exports, has deepened fears of a prolonged trade war and triggered a broad selloff in the stock market. The Dow and Nasdaq saw dramatic drops, erasing over $4 trillion in market capitalization.

China Imposes 34% Tariff on U.S. Imports. Source: CryptoBudhha via X

In contrast, XRP and the broader crypto market appear to be benefitting from this uncertainty. “Investors are rotating capital out of traditional assets into digital currencies as a hedge against macroeconomic instability,” noted a market strategist at XForceGlobal. This risk-off sentiment has bolstered XRP’s position as a leading alternative, with XRP news turning decisively bullish.

Technical Indicators Reinforce Bullish Outlook

From a technical perspective, XRP price prediction metrics are leaning heavily in favor of further gains. The token rebounded from a recent low of $1.98 and is presently well above the $2 level, a vital psychological and technical support level.

XRP shows a bullish setup, with support at $2.00 and a breakout above $2.50 likely opening the path to $3.00 and beyond. Source: ImmortalAXS on TradingView

Indicators such as the MACD (Moving Average Convergence Divergence) are showing early bullish crossovers, a sign that usually appears when trends are about to reverse. Meanwhile, the Bollinger Bands, which gauge market volatility, have tightened, signaling that something explosive is cooking. If XRP can break through the $2.28 resistance on the VWAP (Volume Weighted Average Price), pundits expect a rapid dash into the $2.58 zone, which is in alignment with the upper Bollinger Band.

“This setup is reminiscent of earlier breakouts,” said one technical analyst. “If momentum holds, XRP could chart a course toward higher highs.”

XRP’s $10–$20 Forecast: Hope or Hype?

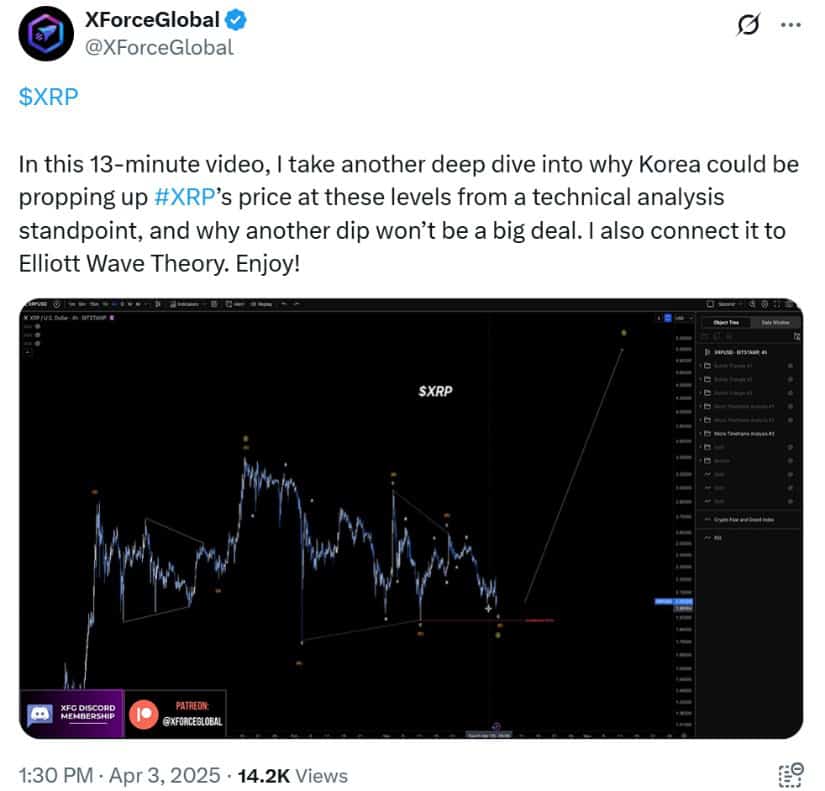

Beyond short-term gains, some analysts are setting their sights much higher. XForceGlobal’s latest Elliott Wave analysis has sparked intense debate by projecting a potential XRP rally to the $10–$20 range. According to the firm’s certified South Korean analyst, XRP is in the early stages of a wave pattern that historically precedes major bull runs.

A deep dive into how Korean trading activity and Elliott Wave Theory may be supporting XRP’s current price, suggesting any dip could be short-lived. Source: XForceGlobal via X

This bold XRP price prediction is grounded in the Elliott Wave Theory, which suggests that market movements are driven by collective investor psychology manifesting in repetitive cycles. “If the current wave count holds, XRP may be entering a third wave—a stage often associated with the most powerful gains,” the analyst explained.

Skeptics, however, caution against overly optimistic expectations, pointing to ongoing regulatory uncertainties. The XRP lawsuit brought by the U.S. Securities and Exchange Commission (SEC) continues to cast a shadow, though Ripple’s legal team remains confident.

A favorable resolution in the SEC Ripple lawsuit could be a game-changer. Ripple CEO Brad Garlinghouse has previously hinted at a major announcement in June, fueling speculation that Ripple XRP news could soon include a landmark legal victory—possibly opening the door for institutional adoption and Ripple Bank of America integrations.

Key Levels to Watch: Support and Resistance

Despite the optimism, XRP must first navigate critical levels. The immediate resistance lies at $2.28, with a successful breakout potentially clearing the path to $2.58. Failure to break through could send the token back to retest the $1.98 support. A drop below this could spell trouble, with some predicting a dip toward $1.70 if bearish pressure mounts.

XRP is forming an inverted head and shoulders pattern, with a potential move toward resistance after a pullback. Source: Paradigm_Shifter333 on TradingView

Still, the prevailing market mood suggests that XRP remains resilient. On the daily chart, XRP has consistently held above key support levels, including the 200-day EMA and the 0.5 Fibonacci retracement. These markers reinforce the current bullish sentiment, especially when coupled with rising trade volumes.

Macro Conditions Favor Crypto Adoption

Broader economic trends also support the growing appeal of XRP. When traditional financial systems are under stress, alternative assets like Ripple XRP are being contemplated as a valid store of value. The efficiency of the Ripple ledger in cross-border settlements and its usability in the Ripple exchange system only add to its use.

Ripple (XRP) was trading at around $2.13, up 0.32% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Moreover, the Ripple market is also in the limelight due to its unique ability to facilitate institutional-level transactions. If Ripple gets more partnerships or releases news regarding Ripple currency price movement, then this would also be a growth catalyst for XRP.

Looking Ahead: A Crossroads for XRP

XRP is currently navigating a confluence of bullish technical setups, positive macroeconomic shifts, and renewed investor demand—all spurred on by escalating global tensions. While a short-term retest to $2.58 appears feasible, longer-term hopes for $10–$20 will depend on a number of factors, including market sentiment, regulatory transparency, and the direction of Bitcoin.

Today, the Ripple cryptocurrency is at a crossroads. Investors are watching closely, and whether XRP goes on to fly or not will most likely depend on whether it can break through principal resistance levels—and the latest SEC Ripple lawsuit result.

Currently, the XRP price is among the most closely tracked in the cryptocurrency universe, mirroring the volatility and potential that digital currency holds in times of global uncertainty.