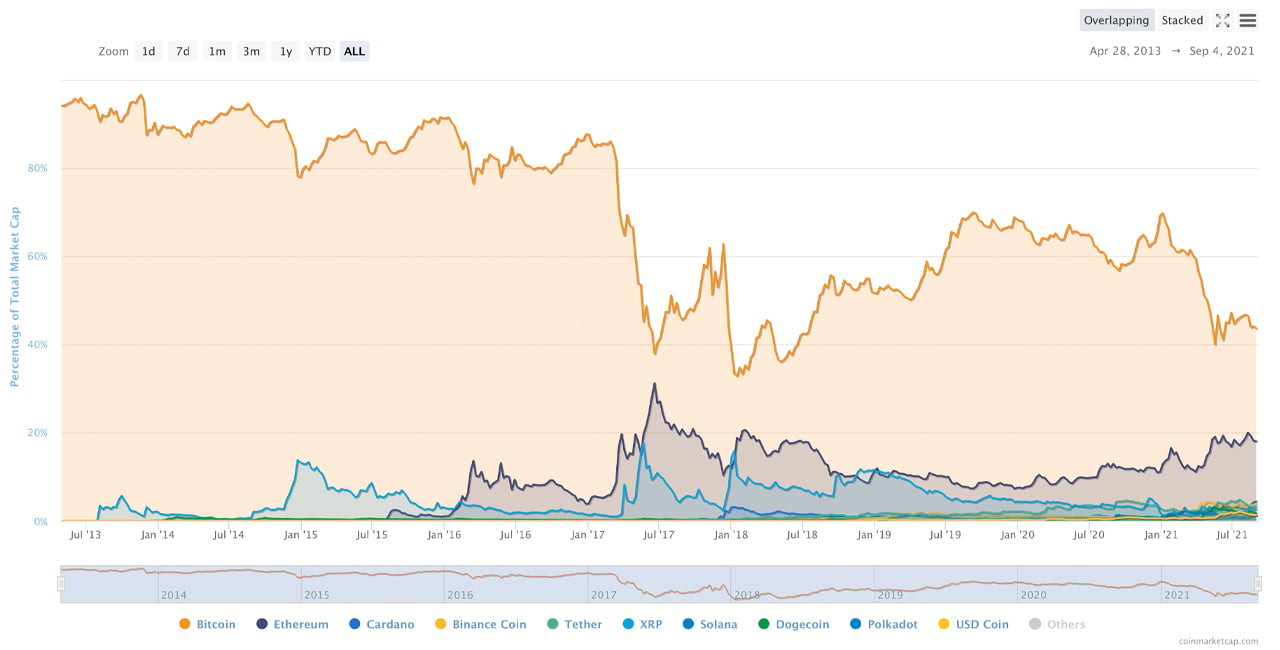

While bitcoin prices have risen in value during the last two weeks, bitcoin dominance levels have slipped to lows not seen since the June 6 low of 41%, and the dip to 39.97% on May 16, 2021. Depending on the crypto market price aggregator leveraged, bitcoin’s dominance has been between 39.99% to 41.52%. Meanwhile, as bitcoin’s dominance has dropped significantly, crypto-asset markets like ethereum, cardano, binance coin, and tether have seen market dominance, in terms of overall valuation, steadily increase among the 10,000+ coins in existence today.

As Bitcoin Slides to the 40% Range, Ethereum Climbs to 20% of the Crypto Economy

It is well known that between the first time bitcoin (BTC) prices were calculated by market capitalization, and all the way up until February 2017, BTC had more than an 80% market dominance among all the other coins, for a majority of the time.

There was an instance in 2014, where BTC dropped to 77.9% in December and again in March 2016 to 76.42%. After the March 2016 dip, there were a few quick instances of dominance levels dipping under 80%, but nothing like what happened in February 2017.

On February 19, 2017, BTC’s dominance levels slid from 85.4% to a low of 37.84% in June 2017. From here bitcoin has never managed to move above the 80% handle since then and in September 2019, it rose above the 70% handle but for only a few days.

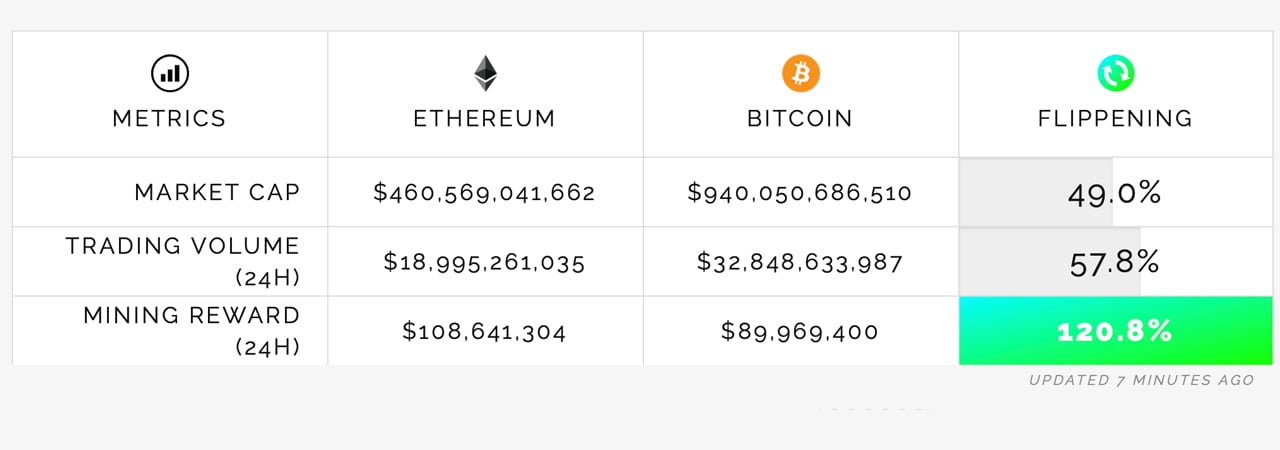

On March 1, 2021, BTC again tapped the 70% handle, but has since lost the market dominance again. One of the biggest markets eating into BTC’s cap is ethereum (ETH), which holds a 19.4% market dominance according to Coingecko stats.

Messari.io says ETH’s cap is 19.99% and coinmarketcap.com says the dominance level is 20.1%. Ethereum’s market valuation is around $460 billion on Sunday, September 5, 2021. During the last 24 hours, these three aggregators show BTC’s dominance has fluctuated between 39.99% to 41.52%.

Bitcoin’s market valuation at the time of writing on Sunday, September 5, is an aggregate total of around $940 billion. Other coin market caps have seen massive gains and this has furthered their dominance levels, and more specifically the top ten digital currencies by market capitalization. Today, all ten coins in the top ten list command 80% of the entire $2.36 trillion crypto market economy.

The top ten markets by market capitalization today include bitcoin (BTC), ethereum (ETH), cardano (ADA), binance coin (BNB), tether (USDT), XRP, solana (SOL), dogecoin (DOGE), polkadot (DOT), and usd coin (USDC).

While ADA has more than 4% of the entire crypto-economy in terms of market dominance, BNB has 3.71%. The stablecoin tether is nearing the three percentile mark with 2.98% of the whole crypto economy. XRP is a bit lower than tether at 2.21% and the new top ten contender solana (SOL) has 1.79%.

In terms of the remaining top ten coins and the rest of the cryptocurrency market caps below them ($472 billion) are also contributing to the swelling value of the overall $2.36 trillion crypto economy. Crypto coins like fantom (FTM), iota (MIOTA), kusama (KSM), and iost (IOST) all saw significantly-sized double-digit gains during the last seven days.

What do you think about bitcoin’s dominance levels dropping to new lows? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinmarketcap.com, buybitcoinworldwide.com/flippening/,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.