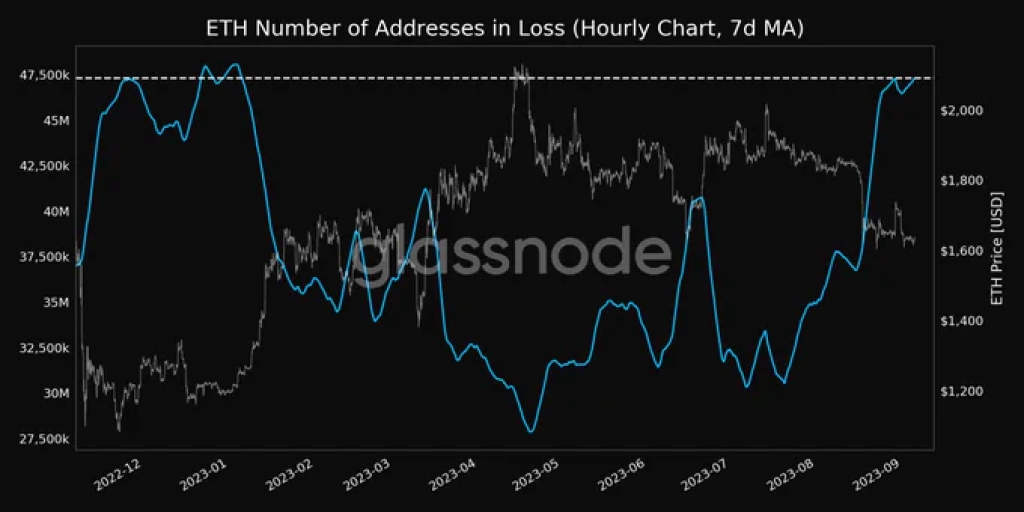

In a noteworthy development, the 7-day moving average (7d MA) of Ethereum addresses in a loss has surged to an 8-month high, standing at 47,304,857.667 according to data from on-chain analyst Glassnode.

This indicates a growing number of investors who are currently underwater on their Ethereum investments. The metric serves as a barometer for investor sentiment and could signal caution in the market.

Whales Make a Splash with $425 Million Purchase

Amidst this backdrop of increasing addresses in loss, Ethereum whales have made a significant move. Data reveals that approximately 260,000 $ETH tokens were acquired by large holders within the last 24 hours.

The value of this massive purchase is estimated to be nearly $425 million. This could be interpreted as a bullish sign, suggesting that big players are seeing current prices as a buying opportunity.

Exchange Deposits Reach 1-Month High

Adding another layer to the market’s complexity, the 7-day moving average of Ethereum’s exchange deposits has just hit a 1-month high of 2,145.685.

This comes close on the heels of the previous 1-month high of 2,145.327, which was recorded on September 4, 2023. Elevated levels of exchange deposits often imply that investors are moving their assets to exchanges, possibly in preparation for selling.

Trade on US-Banned Exchanges With No KYC 🤫

Tired of missing hot new listings because your favorite exchange is banned in the US? 🇺🇸

With RocketXchange you can finally trade on Kucoin, ByBit and more without registration or KYC! 🙌

Simply connect your wallet to access every coin. No VPN needed.

Seamlessly bridge between EVM, Solana, Cosmos and 100+ chains. Discover the next crypto gem with low fees.

Take your trading to the next level with:

- Instant access to banned CEXs 🚫

- No KYC required 🙅♂️

- Trade on your terms – no registration required

- Maintain full custody – tokens stay in your wallet

- Access liquidity across leading DEXs and CEXs

- Bridge assets quickly between any blockchain

Escape CEX limits today with RocketXchange!

Show more +The confluence of these metrics presents a mixed picture for Ethereum. On one hand, the rising number of addresses in loss may indicate a bearish sentiment among retail investors. On the other hand, the hefty purchases by whales and the uptick in exchange deposits could signify contrasting strategies or expectations among different market participants. As always, investors should exercise due diligence and consider multiple indicators before making any investment decisions.

Join us on Twitter and Facebook for the latest insights and discussions in the world of crypto.

Explore our news section and stay ahead of the curve with our expert price predictions.

CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com