- XRP’s value moved marginally in the last 24 hours.

- Metrics looked bearish on the token.

Ripple [XRP] was in a consolidation phase at press time, per AMBCrypto’s analysis. The token did not display much volatility, indicating that investors may have to wait for longer for things to turn bullish.

So, we planned to take a closer look at XRP to see whether its trend would change in April.

XRP is moving marginally

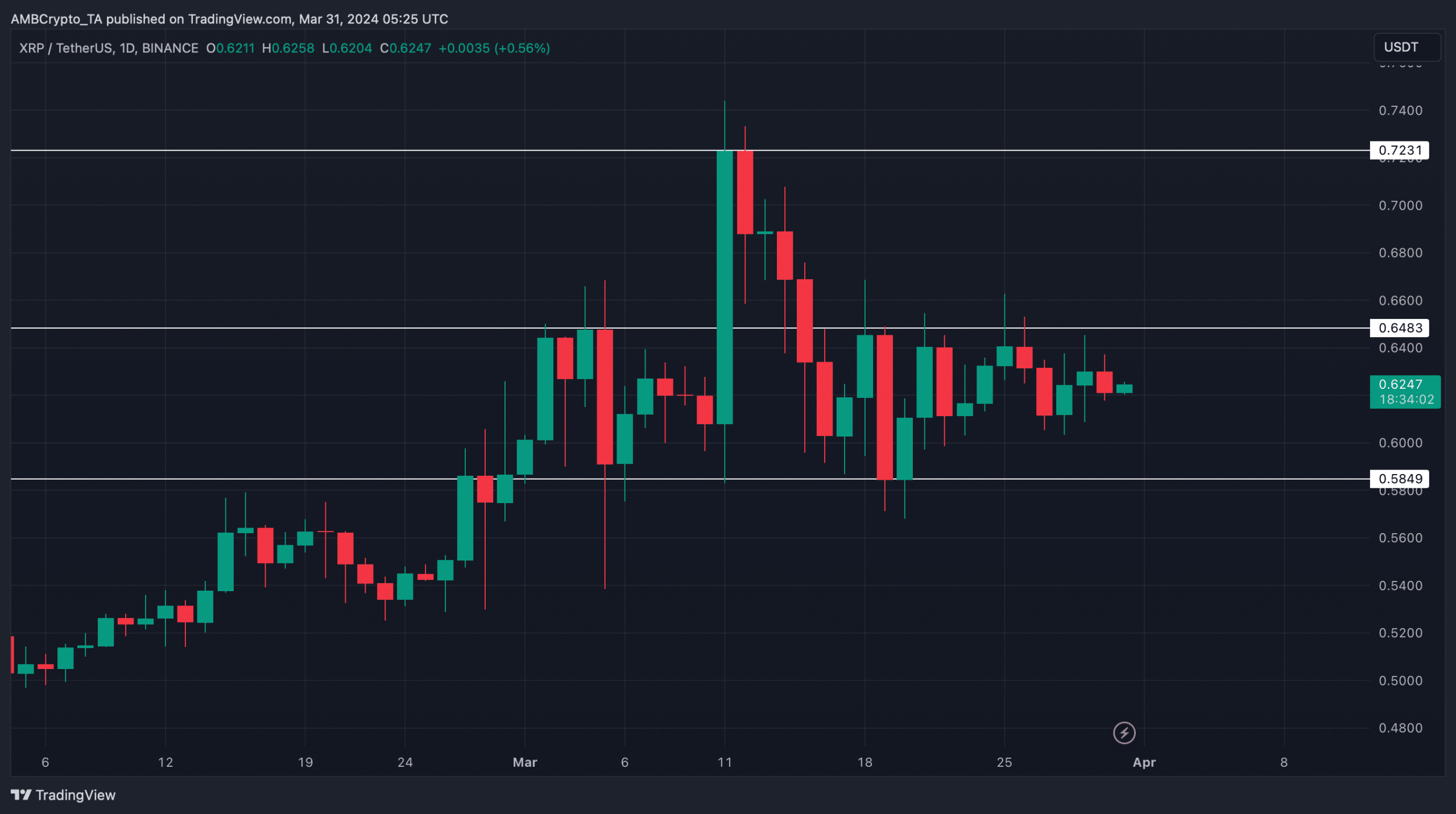

AMBCrypto’s analysis of XRP’s daily chart revealed that the token’s price was moving within a range for over two weeks after its value dropped on the 15th of March.

To be precise, after touching $0.72, the token’s value plummeted to $0.58. Since then, it has been moving between $0.58 and $0.68.

CoinMarketCap’s data revealed a similar scenario. As per the data, the token’s price only moved by 0.33% and 0.4% during the last seven days and 24 hours, respectively.

At press time, it was trading at $0.627 with a market capitalization of over $34.4 billion.

If XRP manages to break above the $0.648 resistance level in the coming days, then we might expect its value to touch its March 2024’s high in April once again.

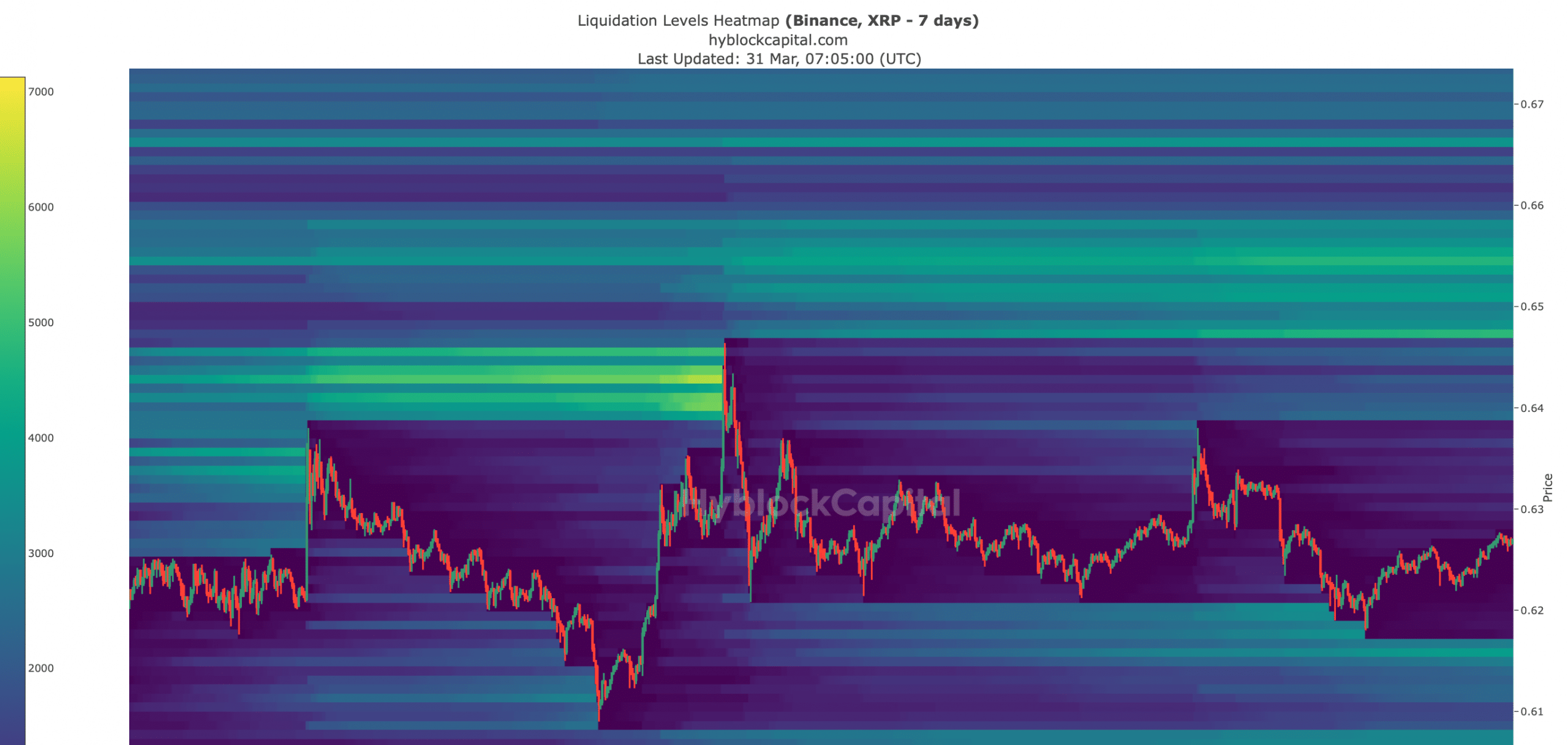

Therefore, to see whether that’s possible, AMBCrypto took a look at its liquidation levels. Our analysis revealed that XRP’s liquidation will increase near that resistance zone.

If the token manages to hold its ground despite high liquidation, then its path ahead to the March high looks pretty clear.

XRP will get volatile, but in which direction?

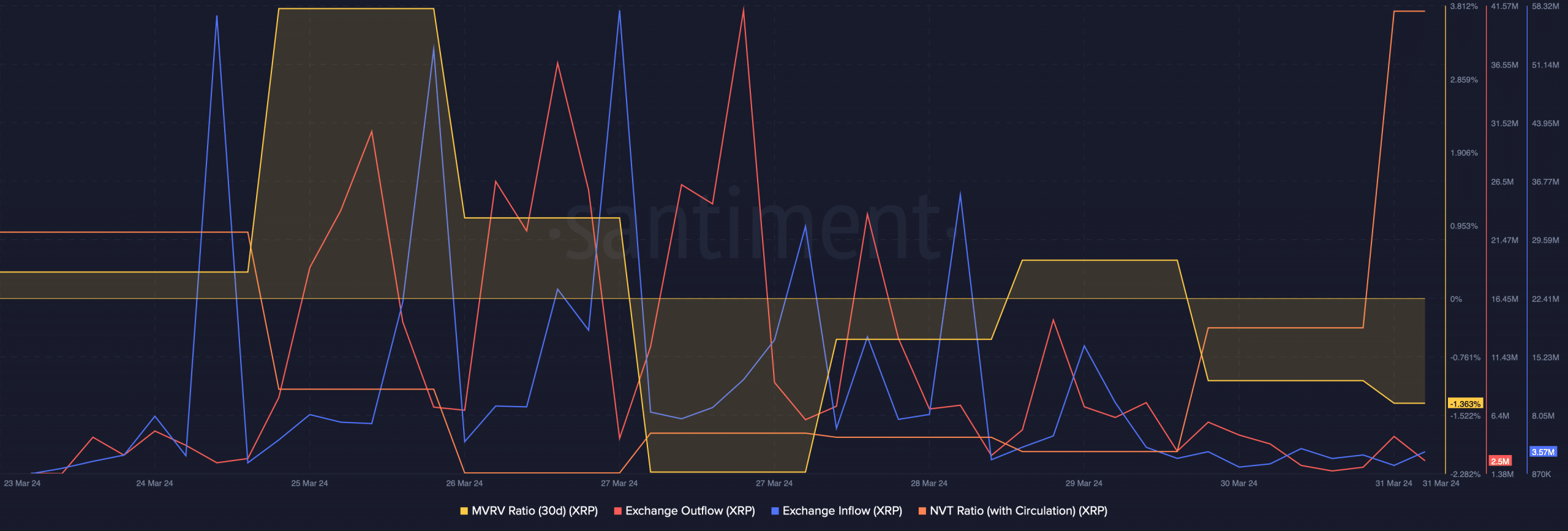

Though the liquidation level looked optimistic, the same can’t be said for XRP’s on-chain metrics.

AMBCrypto’s analysis of Santiment’s data revealed that its Exchange Outflow dropped after spiking on the 27th of March. A similar trend was noted in terms of the token’s Exchange Inflow.

Seemingly, investors were not actively trading the token at press time. The token’s MVRV ratio also dropped in the last few days, which too was a bearish sign.

Additionally, XRP’s NVT ratio registered a massive spike off late. Whenever the metric rises, it indicates that an asset is overvalued, hinting at a price decline in the coming days.

Read Ripple’s [XRP] Price Prediction 2024-25

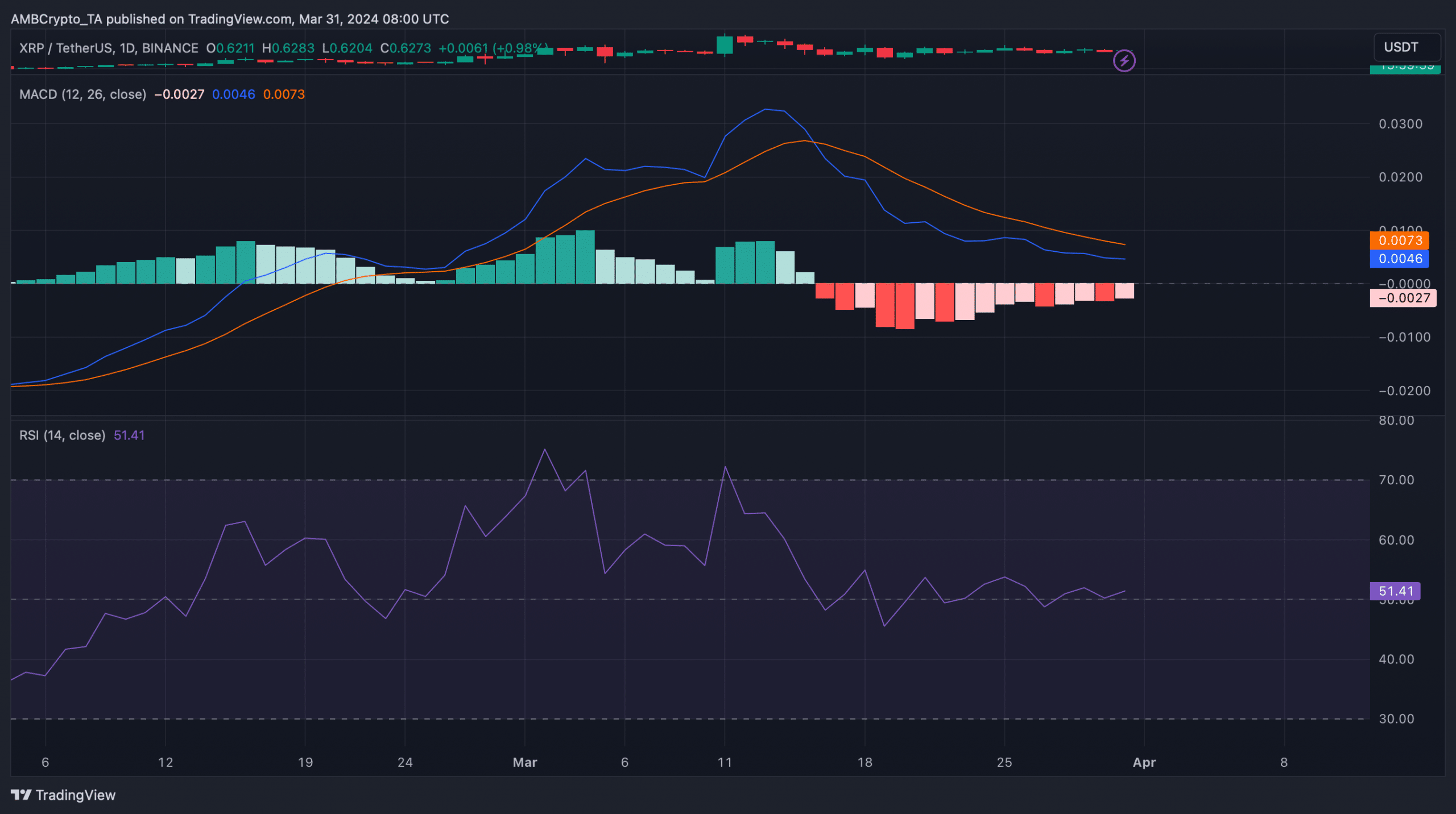

However, XRP’s MACD displayed a clear bullish advantage in the market.

Its Relative Strength Index (RSI) also registered a slight uptick from the neutral mark, which hinted that XRP’s value might move northwards in April.