The price of Bitcoin immediately dropped below the $60,000 level as the halving approaches.

According to CoinMarketCap data, Bitcoin (BTC) is down more than 3% in price over the past 24 hours, trading at $59,800 when writing. Cryptocurrency trading volumes decreased by almost 12% to $40 billion.

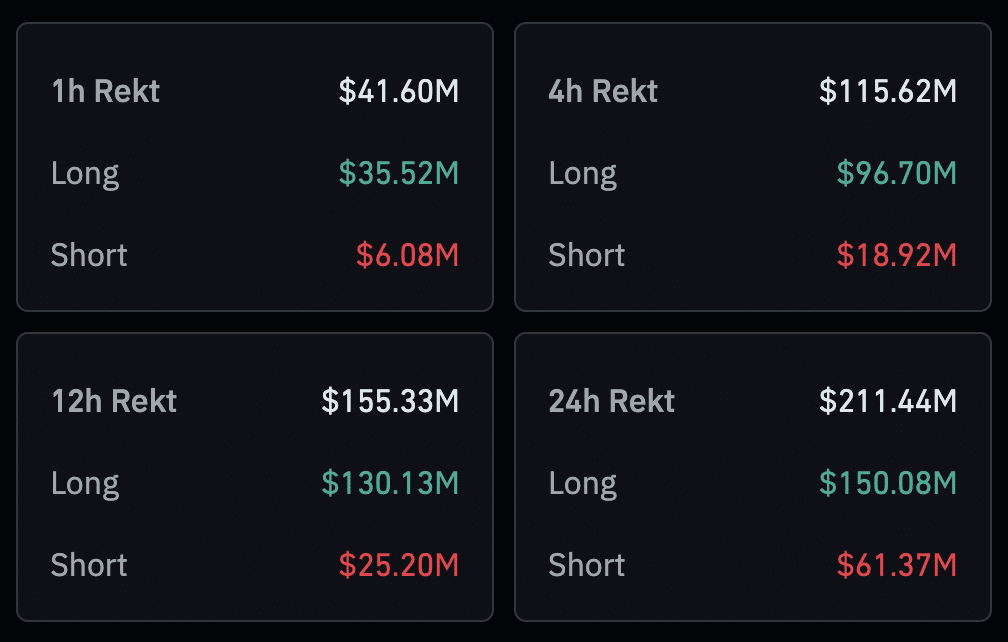

CoinGlass data shows that traders are actively liquidating positions. In the last four hours, traders have offloaded over $115 million worth of assets, $96.70 million of which were long positions and the rest short. The largest share of liquidations occurred on the OKX crypto exchange, totaling $43.81 million.

In a few days, the impending BTC halving will occur, with traders potentially exiting positions due to the seismic event. The halving will reduce miner rewards by 50%, stifling the number of coins uploaded to the market — a feature that some Bitcoin supporters consider optimistic.

In the run-up to the halving, the coin has experienced increased volatility, not only because of the halving. The sell-off also comes as investors continue to withdraw funds from popular Bitcoin ETFs after U.S. Federal Reserve Chairman Jerome Powell said the central bank needs to see more progress on the inflation front before cutting rates.

Markus Thielen, head of research at 10x Research, notes that crypto miners began accumulating Bitcoins in January 2024 to increase the imbalance between supply and demand. As a result, BTC’s price rose sharply and reached its historical maximum in March.

On the other side, digital asset mining companies will gradually eliminate accumulated coins after halving, putting pressure on the price of cryptocurrencies.