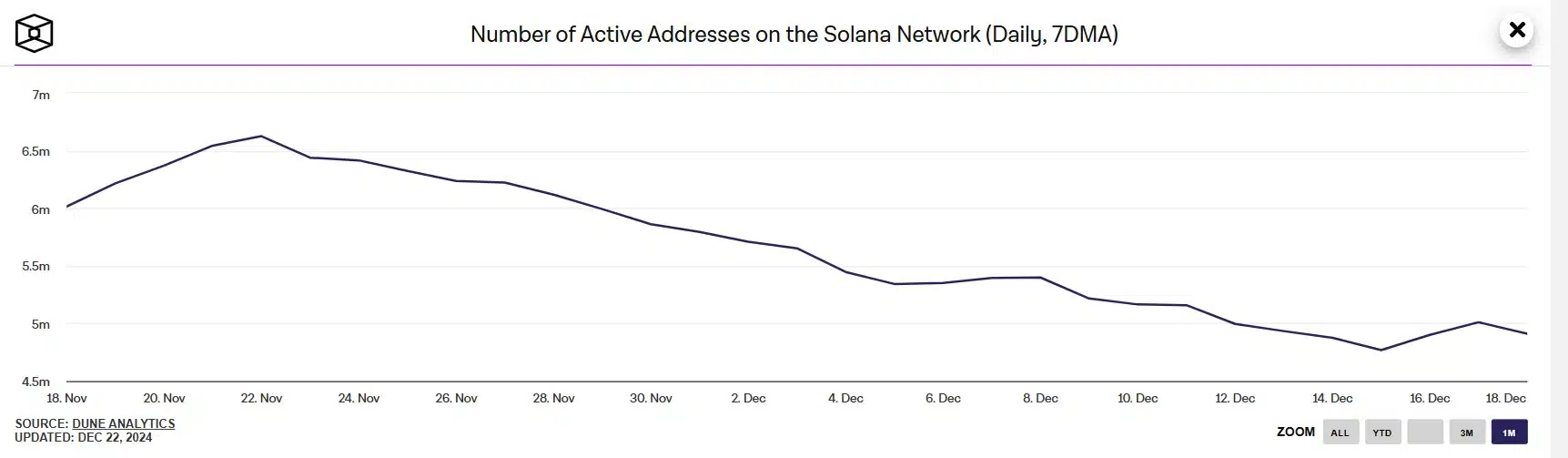

Solana’s decline in TVL is mirrored by a broader drop in user activity. User engagement has decreased since December 1, with 5.37 million unique addresses completing at least one transaction in the past 21 days – marking a 7% drop in activity.

This reduced usage has impacted Solana’s network revenue, which has fallen by 24% since the start of December.

Source: The Block

Additionally, Solana’s native token, SOL, has seen a significant 28% decrease in value over the past 30 days. These combined factors highlight ongoing challenges for Solana, with both user engagement and financial performance showing signs of continued strain.

Read Solana [SOL] Price Prediction 2024-2025

SOL price under pressure amid bearish momentum

SOL is trading at $182.08 at press time, reflecting a 2.11% decline in the past four hours. The RSI is at 40.65, hovering near oversold territory, suggesting weakened buying momentum.

OBV indicates diminishing accumulation, aligning with declining price activity. A breakdown below $180 could open the door to further losses, targeting $175 as the next key support.

Source: TradingView

Conversely, recovery requires a close above $190, aligning with the 21-day EMA. Macro sentiment remains bearish, with lower highs persisting on the chart.

Traders should watch for volume spikes as indicators of a potential reversal or continuation of the downtrend.