- Leveraged trading and derivative use are tempting traders with the potential for huge gains

- However, high rewards come even higher risks

Over the last five years, the crypto market has been transformed by more than just ETFs, corporate holdings, and shrinking supply – Enter the rise of the derivatives market. In a record-breaking Q4, exchanges saw a surge in leveraged trades, as bold investors placed high-stakes bets.

However, in a market this volatile, is high leverage an opportunity or a ticking time bomb?

Big bets, bigger risks

One thing is clear – The derivatives market has completely changed the game. With high-leverage deals now on the table, retail traders can place big bets on top-tier assets without ever owning them outright.

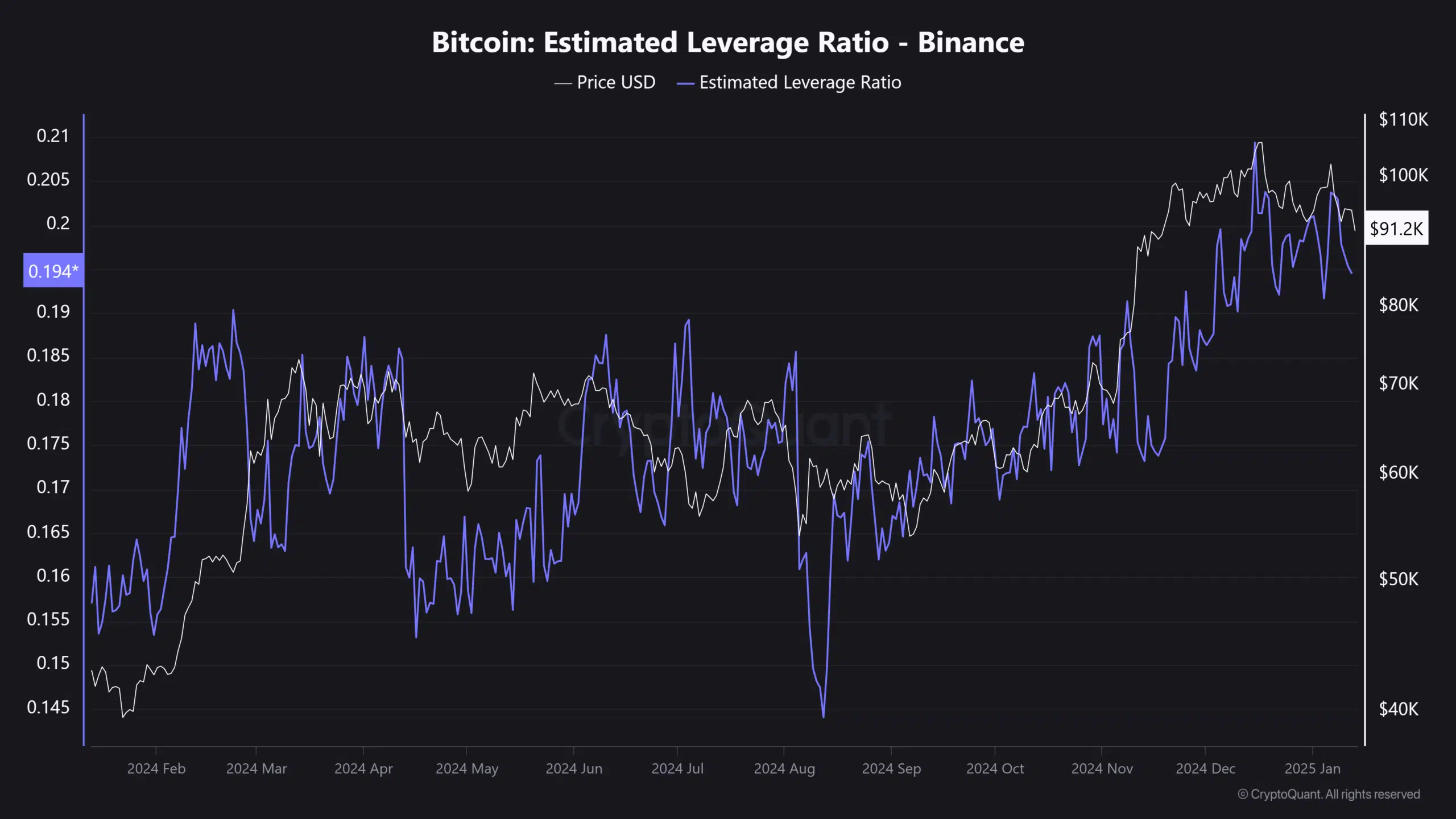

A key signal of this shift? The Estimated Leverage Ratio (ELR). This powerful indicator shows how much leverage traders are using on average. When the ELR spikes, it’s a clear sign that more traders are leaning into leverage.

Take Binance, for example. When BTC hit $106k in mid-December, the ELR hit a yearly high. Traders were eager to profit from the rally, pushing Open Interest (OI) to a record $68 billion – It’s highest level ever.

However, the action didn’t stop with Bitcoin. Even speculative assets like Dogecoin [DOGE] saw massive jumps. Starting the quarter below $1 billion, DOGE exploded to $2 billion, reaching a stunning $4.45 billion in OI – Mirroring Bitcoin’s explosive growth during the same period.

So, what does this tell us? Three things are clear – First, the “Trump trade” played a big role in driving leverage. Second, even the most unpredictable tokens aren’t being left behind. And third, Bitcoin still leads the derivatives market.

However, the fourth point is the most crucial. Every time the ELR has spiked, it’s been followed by a market top. As Open Interest hits new highs, it’s a warning sign that the market is overheating with leveraged positions. The result?

A market shakeup from leveraged bets

Coincidence or not, the current market is showing the risks of an overextended system. In just the last 24 hours, liquidations across all exchanges totalled a staggering $523.76 million, with a massive $456.09 million in long positions forcibly closed. And, the biggest players aren’t immune.

Binance alone saw a staggering $216 million in liquidations, while OKX wasn’t far behind, with $106.69 million wiped out.

It’s no surprise, though – Despite the recent BTC crash, Open Interest (OI) remains strong above $60 billion. With Bitcoin still far from a bull run, expect these leveraged positions to be squeezed out in the coming days.

The good news? Over the past week, the Estimated Leverage Ratio (ELR) has been consistently dropping across most exchanges. Clearly, risk is keeping investors from diving into high-leverage bets.

On the contrary, Bitfinex tells us a different story. While others remain cautious, the exchange has seen a surge in leverage, with its ELR hitting a two-year high. The appetite for risk is clearly resurfacing.

Read Bitcoin’s [BTC] Price Prediction 2025-26

The takeaway? High leverage and high OI can be a bullish signal, but in the volatile market of 2025, it could backfire in a big way. Traders are already losing millions in liquidations, and what we’ve seen so far is just the beginning.

Be careful – ‘high risk, high reward’ is becoming the new norm, but it’s a dangerous game to play.