Phil Kwok, a guest lecturer at Cambridge University and co-founder of the crypto learning platform EasyA, recently discussed how far the XRP price could rise.

In a post on X, Kwok introduced a three-step framework to assess blockchain ecosystems and how sustainable they are. Notably, this framework focused on three factors: supply, demand, and supply shocks. Essentially, these factors are responsible for determining a token’s value.

XRP Supply Situation

In his commentary, Kwok stressed that it is important to understand the origin of an asset and token creation. With this, he pointed out that XRP has a fixed supply of 100 billion tokens, all created when the XRP Ledger launched.

Notably, unlike some other cryptocurrencies like Dogecoin with inflationary tendencies, XRP cannot produce additional tokens, making it deflationary in nature. However, Kwok noted an important caveat: the XRPL architects allocated 80 billion of these tokens to payments firm Ripple.

when the #xrp ledger first launched, 100 billion $xrp were created.

no more can ever be made.

so xrp has 0 inflation.

in fact, this makes it deflationary.

but that’s not exactly the full story… pic.twitter.com/P6D2KGJNj7

— Phil Kwok | EasyA (@kwok_phil) January 19, 2025

For context, Ripple holds most of these tokens in escrow and periodically releases them into the market on a monthly basis, creating additional selling pressure. At press time, the blockchain payments company still holds about 37.7 billion XRP in escrow, according to data from XRPScan.

How Demand Affects Prices

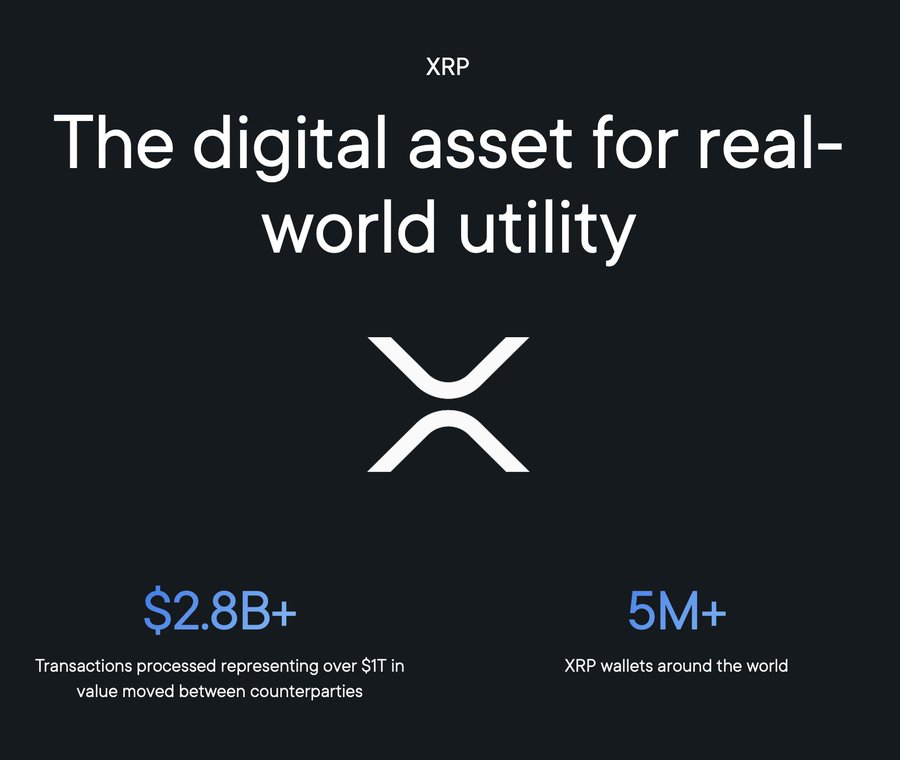

Further, Kwok stressed that demand is the cornerstone of a token’s value, identifying it as the second step in the framework. He highlighted the difference between utility tokens like XRP from meme coins such dogwifhat (WIF), pointing out that the latter rely solely on speculative buying.

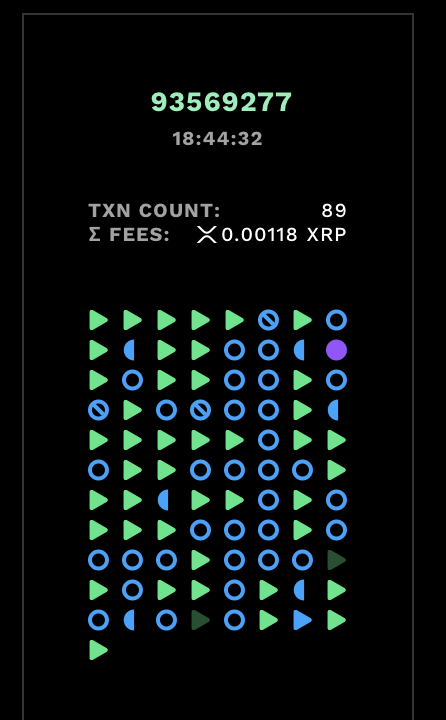

In contrast, besides speculative buying, XRP’s demand also comes from its utility within the XRP Ledger in areas like transaction fees. Every transaction requires XRP, including those initiated by major institutions. Additionally, the network burns these fees, reducing the token supply over time. So far, 13.4 million XRP have been burned.

The EasyA co-founder further explained XRP’s role as a bridge currency for cross-border payments. This use case allows seamless currency conversion, such as Japanese yen to euros, using XRP as an intermediary.

remember that the #xrp ledger’s built for payments.

cross-border payments.

so xrp’s also used as a bridge currency.

let’s say we wanna convert between japanese yen and euros.

ripple payments will do that for us with xrp.

yen => xrp => euro.

this is a massive market. pic.twitter.com/K3RiuCKOeX

— Phil Kwok | EasyA (@kwok_phil) January 19, 2025

Ripple Payments (formerly ODL), the company’s payment solution, accelerates transactions, cutting down processing times from days to mere seconds. This presents it as an attractive alternative to traditional cross-border payment rails.

Kwok highlighted the massive potential of this market, as cross-border payments account for trillions of dollars annually. XRP’s functionality also ensures low transaction costs, even during weekends and holidays, further boosting its utility-driven demand.

Supply Shocks

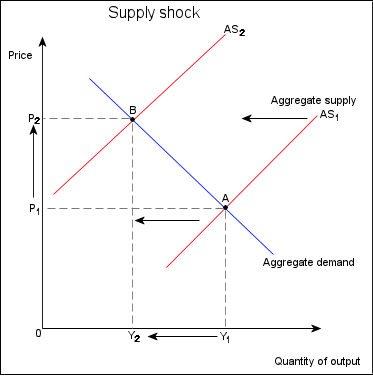

Kwok then called attention to supply shocks, where available tokens are suddenly restricted, as the third step in the framework. Notably, this phenomenon can significantly influence prices.

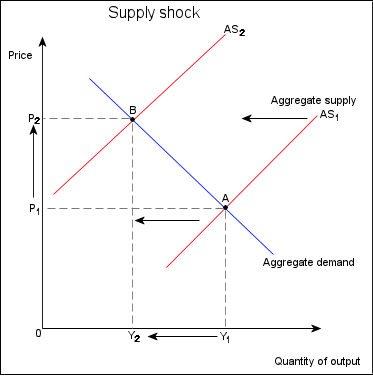

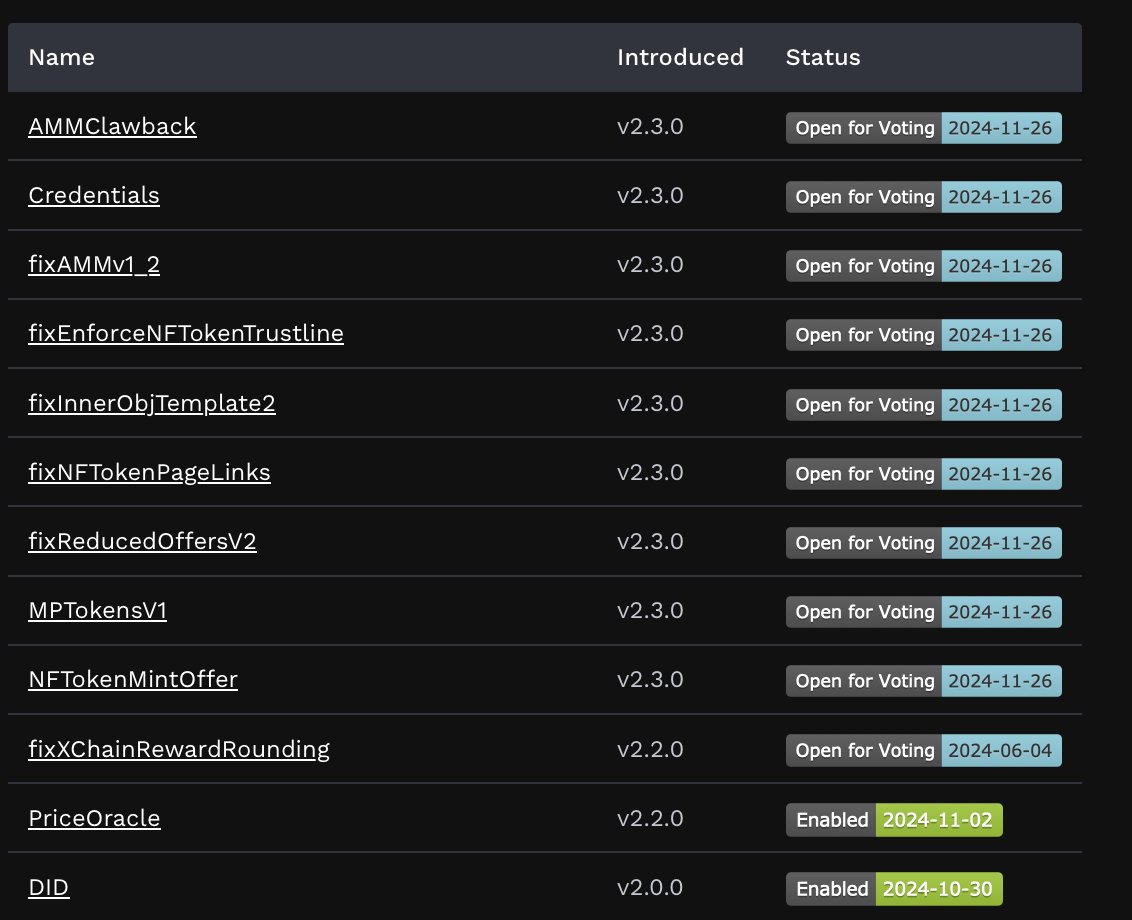

Mechanisms like staking help to introduce these supply shocks, but the XRP Ledger does not directly implement them. Despite this, Kwok noted recent amendments and new features that could start creating similar effects.

For instance, market participants can now use XRP in automated market makers (AMMs) and earn returns as liquidity providers following the launch of the AMM feature last October. Additionally, developments in decentralized identity systems could introduce more sources of demand.

Kwok identified other blockchains, such as Ethereum and Polkadot, to show how supply shocks can affect token value. He noted Polkadot’s parachains mechanism, which locks tokens for extended periods and demonstrates how limiting market supply can impact prices.

when gav founded polkadot.

he created something called parachains.

anways.

long story short.

they resulted in hundreds of millions of dollars of $dot tokens being locked up.

for years.

so even without demand increasing.

value goes… pic.twitter.com/pPRAITZcHt

— Phil Kwok | EasyA (@kwok_phil) January 19, 2025

XRP Price Could Surge Further

If the XRPL’s new features create similar supply shocks, the XRP price could rise further, especially if demand surges with greater institutional adoption. It bears mentioning that demand could also come from potential XRP ETF launches, a factor Kwok failed to mention

The lecturer stressed that his three-step framework is experimental and designed for simplicity. Essentially, builders and analysts can use this blueprint to assess whether a blockchain holds genuine potential or merely functions as speculative.

Despite presenting the comprehensive framework, Kwok avoided making direct price predictions for XRP. Notably, at press time, XRP changes hands at $3.18, having increased 39% over the past seven days.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.