By definition, bitcoin has crashed.

Although you don’t hear it, bitcoin (BTC) has crashed. A crash is classically a 25% fall in a sudden sharp move.

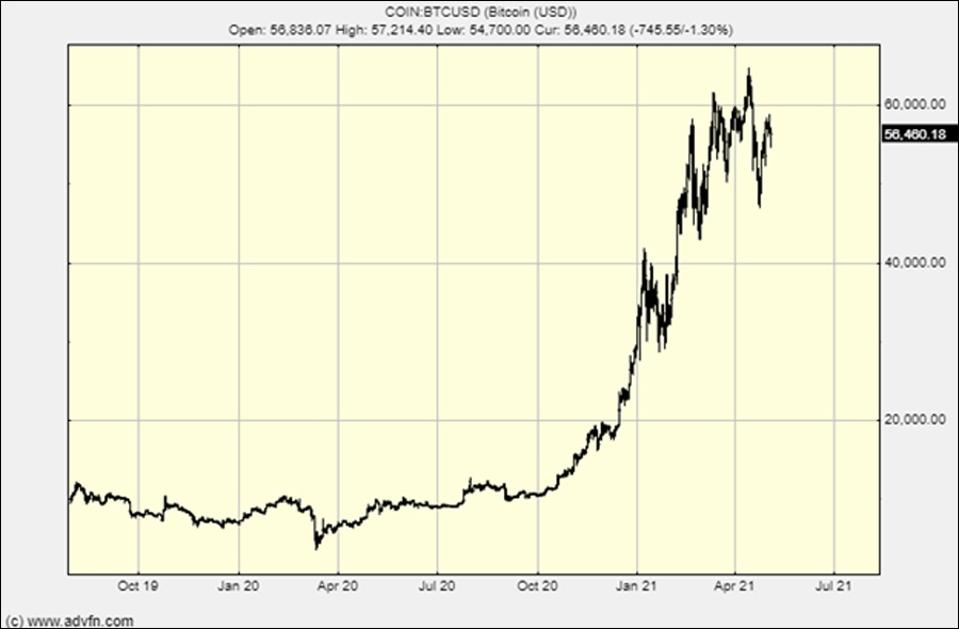

This is the only chart I’m interested in now. It shows that bitcoin crashed at the beginning of March and then again at the beginning of April. While it recovered both times it leaves the chart looking like this:

The bitcoin chart – there were two recent crashes

For the believers this is yet another short pause on the road to $1 million a bitcoin, but to others it’s a clear top.

First, here is some disclosure from me. I love crypto. I own bitcoin and ethereum, small positions but material to some people. I have a ton of crypto tokens of all sorts and will be in and may go out of any crypto you can find listed. My positioning is currently, I’m on the side-lines because I think BTC has reached/is at its peak and we are in for a bearish period before the next bull run around the next halvening.

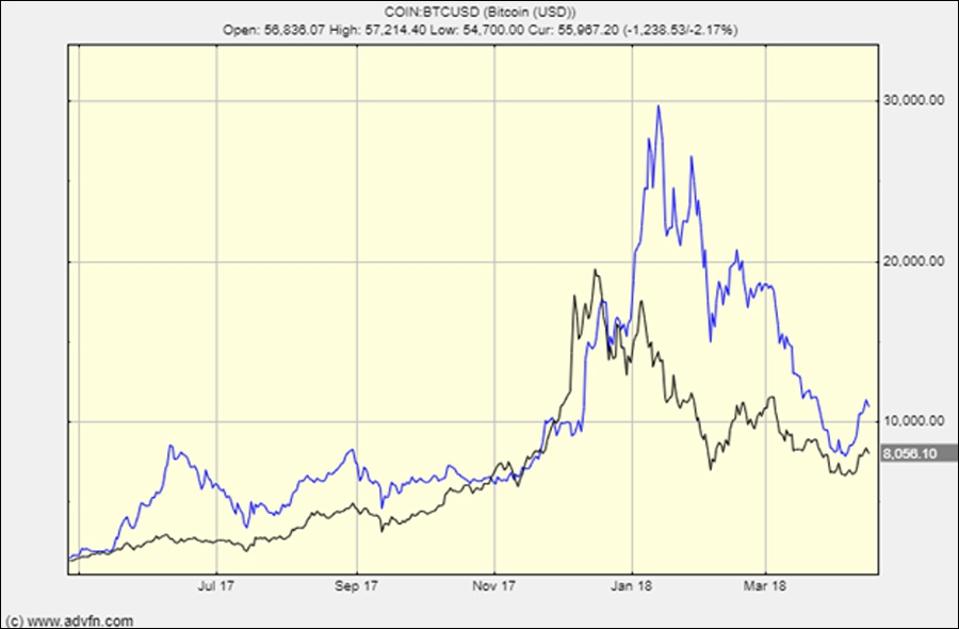

Now this is the chart for anyone less than 100% of a hodler:

The last bitcoin crash

This is the previous boom/bubble. Obviously bitcoin and ethereum came unstuck.

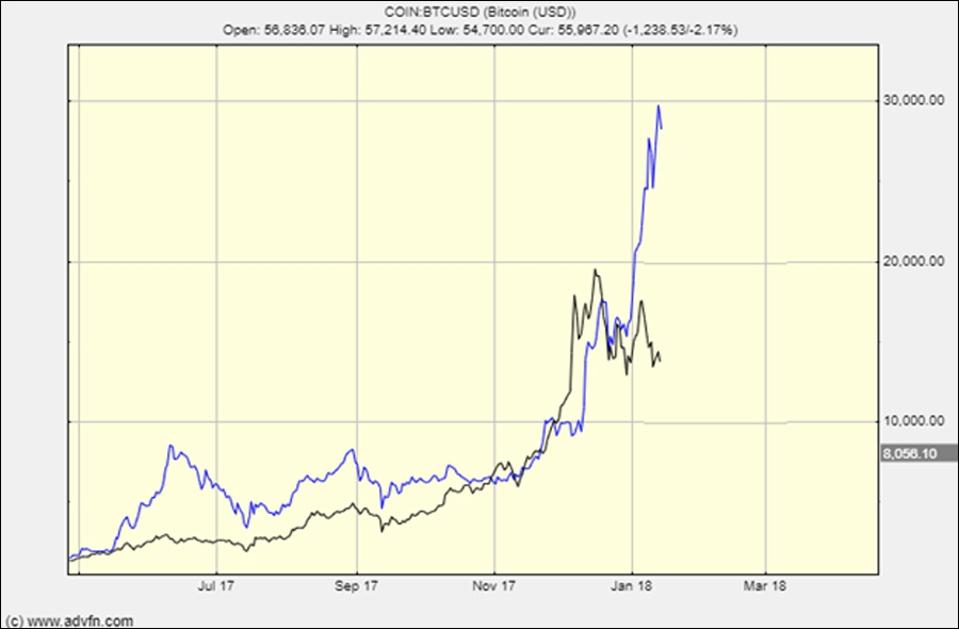

Unpacking this a little, this is what concerns us in that chart:

The chart of the last bitcoin crash should concern us

Why? Because this is where we are today:

Today’s bitcoin chart looks very familiar

If you have even a single technical analysis bone in your body, this is going to ring alarm bells, especially as for the initial rise of bitcoin, the 2017 pattern repeated itself.

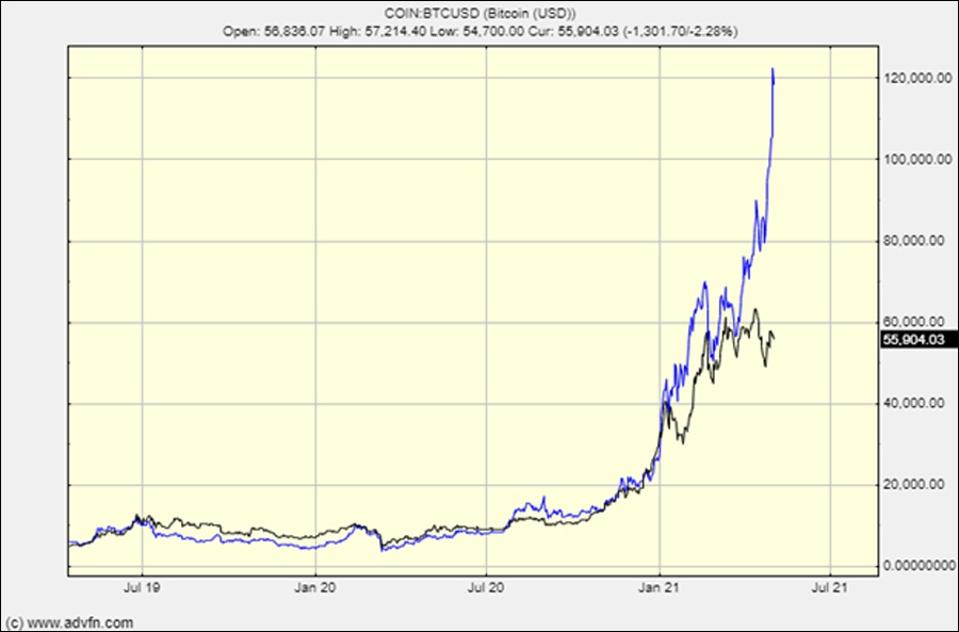

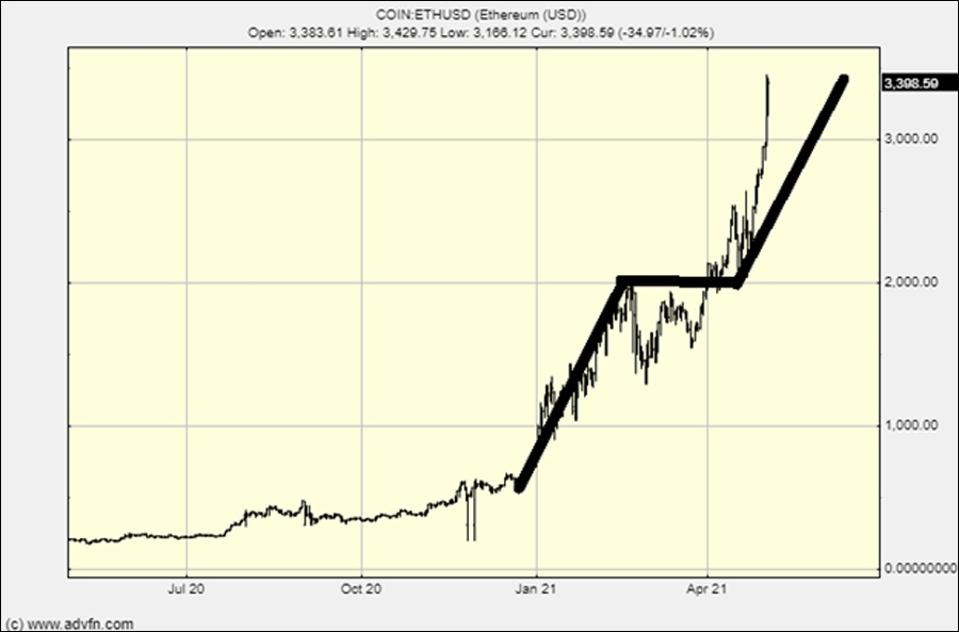

You might throw in this chart, too:

This 2-step even vertical is a useful indicator of the top

This two-step even vertical has always been a very useful indicator of the top for me, but you should always take charting voodoo with a copious pinch of salt.

To me there is a sense that crypto has gone from a coherent bull market to an uncoherent market where it’s impossible to see through the froth to the underlying trend.

DeFi (decentralized finance), where I played after I left ethereum and bitcoin to others, has gone from a 10x game to a volatile percentage game and NFTs (non-fungible tokens) have seen its week in the sun and experienced its first boom, bubble and bust cycle meanwhile.

My position—that cryptocurrencies, DeFi, NFT and all the other categories present or to be born are in for a generational bull—is unchanged but if bitcoin has seen its top then all that will suffer the bear part of the crypto cycle it has suffered more than once before.

If bitcoin breaks out again then the sky is the limit once more and if it does I suspect I’ll go play once again in DeFi where the upside would once again be multiples not percentages. While positioned to do so I would be extremely surprised to see it.

With acknowledgement to Mark Twain, I’m expecting the future to do a bit more than rhyme.

——

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.